The Australian Foreign Investment Review Board (FIRB) has given Maximus Resources Ltd (ASX:MXR, OTC:MXRRF) the go-ahead to proceed on a joint venture with the Korea Mine Rehabilitation and Mineral Resources Corporation (KOMIR).

Cash injection for exploration

KOMIR will invest US$3 million (around A$4.5 million) in exploration to earn a 30% interest in Maximus' Lefroy Lithium Project, in Western Australia's Eastern Goldfields lithium corridor.

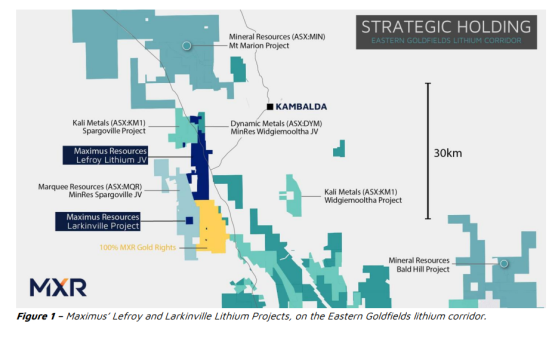

The Lefroy Lithium Project spans granted mining tenements in the Eastern Goldfields Lithium-Cesium-Tantalum (LCT) Province, near Mineral Resources’ Mt Marion and Bald Hill lithium mines.

Maximus holds a diversified portfolio of gold, lithium and nickel exploration projects in the Kambalda region, with over 335,000 ounces of gold resources.

"Important milestone"

Maximus managing director Tim Wither said: “Receiving FIRB approval is an important milestone for the strategic lithium partnership, allowing the company to progress the Lefroy Lithium Project, fully supported with KOMIR’s US$3 million investment.

“We have made some significant progress during the FIRB review process, utilising a US$200,000 non-refundable deposit to build our geological understanding and identifying some very promising prospective targets at Kandui, Yilmia and Landor through the first-phase soil geochemistry mapping and a successful initial 3,000 metres RC drill program.

“In November 2023, we successfully intersected several shallow high-grade spodumene-bearing pegmatites at our Kandui prospect, which will be the focus for the upcoming drill program, whilst drill testing the Yilmia and Landor prospects.”

Spodumene-bearing pegmatites

The first drilling program at Lefroy intersected multiple high-grade spodumene-bearing pegmatites, bearing out the company’s geological interpretation and confirming spodumene as the dominant lithium-bearing mineral, with results such as:

- 6 metres at 1.11% Li2O from 91 metres including 3 metres at 1.99% from 91 metres;

- 5 metres at 1.11% Li2O from 111 metres, including 3 metres at 1.72% from 111 metres;

- 5 metres at 0.77% Li2O from 59 metres, including 3 metres at 1.18% from 59 metres; and

- 12 metres at 0.39% Li2O from 78 metres, including 2 metres at 0.87% from 78 metres and 3 metres at 0.65% from 83 metres.

In parallel with the first-phase drill program, Maximus collected 3,300 soil samples across the entire Lefroy lithium tenement package.

The upcoming second phase drill program, set to commence shortly, will focus on the Kandui target.

Maximus retains a 70% interest in the Lefroy Lithium Project at the end of the farm-in period, maintaining significant upside potential.

A separate Memorandum of Understanding (MOU) with LG Energy Solution Ltd offers the option to acquire KOMIR's 30% interest and negotiate the purchase of up to 70% of the Lefroy Lithium Project’s future lithium product.

With FIRB approval secured and supported by KOMIR's substantial investment, Maximus is now primed to advance the Lefroy Lithium Project.

Read more on Proactive Investors AU