(Bloomberg) -- In a world calling for investors to load up on U.S. Treasuries, this money manager is going the other way.

Eaton (NYSE:ETN) Vance Management’s Andrew Szczurowski, whose government bond fund has outperformed 97 percent of peers in the past three years, is underweight duration as he isn’t buying into the widely prevalent market view that the Federal Reserve is done hiking interest rates for now. For him, factors supporting U.S. government bonds, such as trade wars and disappointing data, should start to fade in the second half of this year.

“In Treasuries, I just don’t think there’s any value,” said Boston-based Szczurowski, whose firm has $493 billion under management. “The market is misinterpreting the Fed a little bit and I personally don’t think the Fed’s done hiking.”

Speculators have been moving away from the record positions seen last year betting against Treasuries as the Fed shifted toward more dovish rhetoric. Market pricing has wiped out the prospect of any rate hikes this year and is now even signaling a cut in 2020, prompting BlackRock Inc (NYSE:BLK). and Goldman Sachs Group Inc (NYSE:GS). to recommend buying U.S. sovereign bonds.

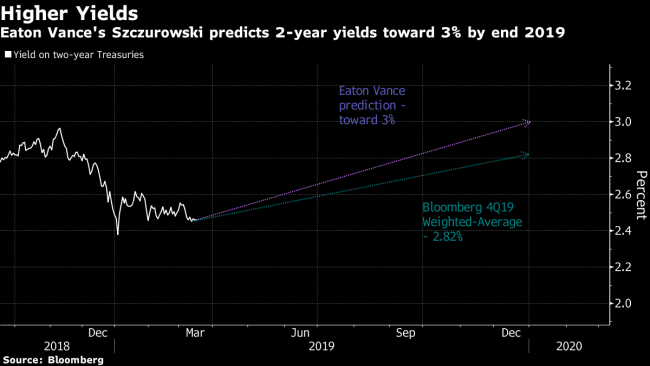

Szczurowski predicts the Fed could instead lift interest rates once or even twice this year and then “three more for the cycle itself,” adding that “it’s not unreasonable” for two-year Treasury yields to climb back toward 3 percent by the end of this year.

The yield was at 2.46 percent as of 8:00 a.m. in New York Friday. Only 12 of 49 forecasters in a Bloomberg bond yield survey see two-year Treasury yields climbing to or above 3 percent by the end of 2019. Szczurowski is investing in U.S. agency mortgage-backed securities, which he said can outperform Treasury Inflation-Protected Securities or TIPS.