Mako Gold Ltd (ASX:MKG) is doubling down on a large gold system at its Napié Gold Project in Côte d’Ivoire, where an initial round of auger drilling uncovered up to 56 g/t gold.

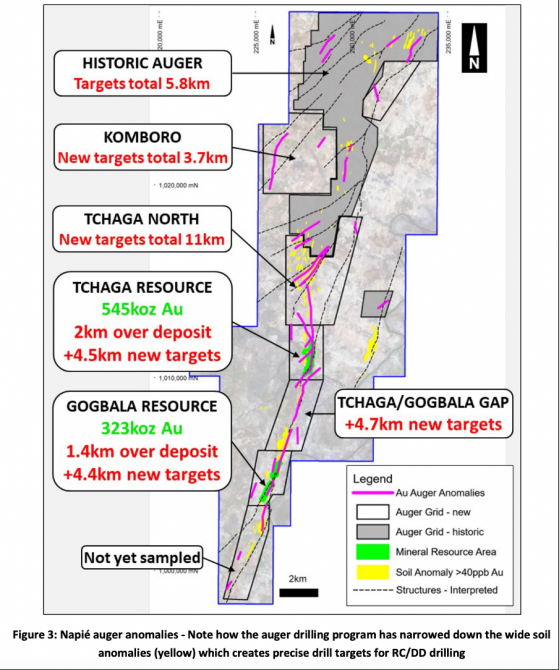

The first phase of the 25,000-metre auger program has pinpointed multiple multi-kilometre gold anomalies — equal to or several times larger than the nearby Tchaga and Gogbala prospects.

Several assays returned upwards of 1 g/t gold, while the 55.9 g/t hit came from a zone south of Gogbala where there’s been no previous drilling.

With a 4.7-kilometre auger anomaly between Tchaga and Gogbala, a +10-kilometre anomaly at Tchaga North and 2.3-kilometre anomalies south of the Gogbala resource, Mako believes there’s scope for substantial, near-term resource growth at Napié.

“Unlocking district-scale potential”

Mako managing director Peter Ledwidge said: “We are delighted with the results of phase one of the auger program, which has delineated multiple multi-kilometre drill targets.

“The auger drilling has narrowed down the wide soil anomalies at Napié and pinpointed specific long targets for resource expansion.

“We are particularly pleased with the extensive multi-kilometre mineralised trends highlighted at Tchaga North with more than 10 kilometres of anomalies, as well as the 5.6-kilometre trend between the Tchaga and Gogbala deposits.

“Also noteworthy is a 1.4-kilometre extension to the south of Gogbala at the southern tip of the Gogbala deposit, where there has been no previous drilling.

“We believe that the auger drilling has helped to unlock the district scale multi-million-ounce potential of the Napié Project by narrowing down the wide soil anomalies so that we can hit the ‘sweet spot’ in our upcoming RC/DD resource expansion drilling program in Q1.

Where to from here?

Mako expects to kick off phase two of the auger drilling program at Napié by the end of January, with results expected roughly a month after.

Reverse circulation (RC) and diamond drilling will follow hot on its heels — Mako hopes to hit the ground running as soon as the phase two auger assays hit the desk.

The highest priority targets for RC and diamond drilling include Tchaga North, where 11 kilometres of gold mineralisation was identified.

In the past, drilling in the region has uncovered hits like 8 metres at 8.53 g/t gold, 1-metre at 215 g/t and 4 metres at 101.31 g/t.

Another area of interest is the zone between Tchaga and Gogbala, where auger work identified a 5.6-kilometre gold trend.

Limited historical drilling returned 1-metre at 30.89 g/t, 17 metres at 1.68 g/t, 4 metres at 4.82 g/t and 5 metres at 3.28 g/t.

Finally, the 1.4-kilometre zone south of the Gogbala deposit — home to the 55.9 g/t and 1.79 g/t gold readings in an area with no previous RC/DD drilling — is also a priority target for future drilling.

Read more on Proactive Investors AU