Mako Gold Ltd (ASX:MKG) has received highly encouraging results from a structural diamond drill (DD) hole at the Tchaga Prospect, within its 90%-owned flagship Napié Project in Côte d’Ivoire.

Hole (NADD020) was drilled at Tchaga for structural studies to improve the geological model and test for mineralisation outside of the current 545,000-ounce resource and at depth.

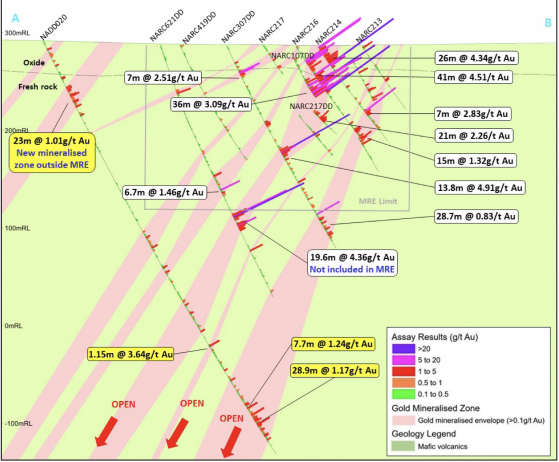

A highlight of the results was the discovery of a new shallow gold mineralised zone outside the current mineral resource returning 23 metres at 1.01 g/t gold from 53 metres.

Further to this, wide zones of gold mineralisation were also intersected at depth, including 7.7 metres at 1.24 g/t gold from 425 metres and 28.9 metres at 1.17 g/t from 436.1 metres.

Tchaga is on a +23-kilometre soil anomaly and coincident 30-kilometre-long Napié Fault with the resource at this deposit forming most of the Napié Project's 868,000-ounce resource.

Assay results from structural hole NADD020 - New assays shown in yellow - Note new mineralised zone discovered outside the Mineral Resource Estimate (MRE) limit 1.

With the diamond drill now complete, Mako has sent in structural consultants engaged to advance structural interpretation on Napié, with the work to start in March 2023.

The work aims to enhance the understanding of the plunge direction of mineralisation and other structural controls to vector into the high-grade zones.

Busy period

The next couple of months will be busy for Mako.

This week it is expected to start phase 2 of its auger drilling program, with five auger rigs on site. Once results are received RC drilling will start on targets with the highest potential for resource growth.

“The deep structural diamond drill hole accomplished several objectives for us. We needed a deep hole to cross stratigraphy and structure ahead of structural studies which are scheduled to begin in March," Mako managing director Peter Ledwidge said.

"These studies should enhance our understanding of the controls on gold mineralisation to expand the mineral resource.

“We were very pleased to discover a new, shallow, wide zone of mineralisation outside the mineral resource, which is worthy of follow-up shallow drilling to expand the Tchaga resource in the future.

“We were also pleased to encounter wide zones of mineralisation at depth and believe that following the results of the structural interpretation, we will have an increased understanding of the processes which control gold deposition and that we will be able to target higher grade zones on the Napié project.”

Objectives achieved

Mako had several objectives for its work at drill hole NADD020.

The company achieved all of these, including:

What’s next

Mako will now turn its attention to structural work and auger drilling.

Read more on Proactive Investors AU