Magnetite Mines Ltd (ASX:MGT) has completed a suite of high-value workstreams in preparation for a definitive feasibility study (DFS) for the Razorback Iron Ore Project, identifying “significant” cost savings and validating infrastructure options ahead of a final investment decision for the operation.

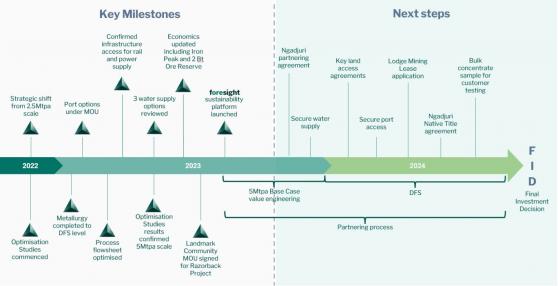

The company is targeting the DFS’s completion for 2024, currently advancing water supply options and permitting, power supply transmission and offtake, and lang access agreements including haul road, electricity transmission and water supply pipeline.

MGT expects to submit a formal Mining Lease Proposal in the first quarter of next calendar year, while also finalising a partnering agreement with the Ngadjuri Nation, the Traditional Owners on whose land Razorback is situated.

Identifying material cost reductions

“Since we announced the optimised 5 million tonnes per annum base case for development of our world-class, 100%-owned Razorback Iron Ore Project in March 2023, the MGT team has been refining all aspects of the Project with the objective of delivering a Definitive Feasibility Study suitable for a final investment decision,” Magnetite Mines CEO Tim Dobson said.

“Our attention has focused on de-risking key infrastructure elements and identifying material cost reductions via value engineering to further improve the project’s economics before we complete cost intensive, DFS-level engineering. We are also advancing permitting and Native Title agreement making.

“The optimisation of Razorback to a high-value, long-life, operation at an initial operational scale of 5 million tonnes per annum has been well received by potential strategic partners and customers.”

Razorback Iron Ore Project completed milestones and planned workstreams

MGT has identified several cost saving measures which it believes will deliver “significant cost reductions” prior to the completion of the DFS.

These include:

- Valve engineering: test viability of saline water, removing need for desalination plant.

- Power source optimisation: MGT is actively engaging with ElectraNet to support their application for the Mid North Expansion (Northern) project, which could provide a near-site grid connection, increased opportunity for a local, renewable energy source, and enhanced supply reliability.

Green steel future

“We are observing ever-increasing momentum towards a green steel future and have been working closely with the South Australian Government to establish a common vision for the establishment of ‘green iron’ production hubs in the State,” Dobson continued.

“Our objective is to time the delivery of Razorback to meet the emerging international investment opportunity and to supply the forecast demand for premium-grade iron ore products required by the decarbonising steel industry.

“I am pleased with the progress we are making for what will be a world-scale iron ore project. I look forward to updating shareholders as we diligently progress the completion of a DFS for Razorback.”

The company says it has received strong interest in Razorback from the global steel market.

The global green steel market was worth about US$83.4 million in 2021, predicted to grow at a compounding annual growth rate of an incredible 131.8% from 2022 to 2031, potentially reaching $386 million by that year.

As economies move to decarbonise, demand for green steel will only grow. Government investment is forecast to rise significantly over the next few years, providing lucrative opportunities for the market sector.

In response to market enquiries, MGT plans to produce bulk concentrate samples from both the Iron Peak and Razorback deposits for assessment by potential downstream customers.

The company has also lodged a submission with the Federal Government’s review of the national Critical Minerals List to advocate for the inclusion of magnetite (high grade iron ore) given its importance to the global decarbonisation push.

Native title negotiations

Magnetite Mines recognises the Ngadjuri People as the Native Title holders, Traditional Owners and cultural custodians of the Project area.

The company has begun formal negotiations for a Partnering Agreement expected to be completed in the coming weeks, after engaging with the Ngadjuri representative body, the Ngadjuri Nation Aboriginal Corporation (NNAC), in a community information session in mid-August.

Once the Partnering Agreement is finalised, MGT aims to formally begin negotiations for a Native Title agreement in September 2023.

Ngadjuri community information session with Magnetite Mines, August 2023

Read more on Proactive Investors AU