Lithium prices experienced a sharp correction in the December quarter of 2023, retracting from peak levels observed in the previous year.

The year marked a shift in the lithium market dynamics. Supply-side constraints eased slightly as new lithium production facilities came online, alleviating concerns over material shortages.

Yet, this influx of supply coincided with a moderation in demand growth, attributed in part to market saturation and economic uncertainties.

Long-term prospects remain robust

Despite this correction, long-term prospects for lithium remain robust.

The global net zero for 2050 commitment will see continued demand for critical minerals tied to the energy transition, including lithium. The adoption of lithium-ion batteries to power the transition to cleaner energy, in particular, is expected to underpin demand.

According to Statista, the global demand for lithium will surpass 2.4 million metric tons of lithium carbonate in 2030, doubling the demand forecast for 2025. Increases in battery demand for electric vehicles are expected to drive the demand, which is forecast to reach 3.8 million tonnes by 2035.

Respondents to a poll conducted by GlobalData, a leading data and analytics company, in January 2024 expected lithium prices to show the greatest improvement across a selection of commodities over this year.

Of the 446 poll respondents, 35% expect the price of lithium to have the greatest growth of those commodities listed, followed by both gold and copper with shares of 23% each.

Small caps making moves in December quarter

Lithium Australia

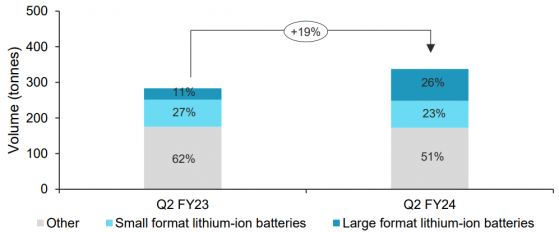

During the December quarter (Q2 FY24), the Envirostream battery recycling subsidiary of Lithium Australia Ltd collected a total of 338 tonnes of batteries for recycling, representing a 19% increase on Q2 FY23.

Recycling collection volumes (tonnes).

There has been significant growth in large-format LIB (lithium-ion battery) collections, driven by the strong partnerships the company has developed with tier-1 electric vehicle (EV) and energy storage system (ESS) manufacturers.

As a result, large-format LIB collections totalled 89 tonnes during the quarter, representing a 179% increase relative to Q2 FY23.

Large-format LIBs represent the most efficient battery type for recycling primarily due to the simpler logistics, and provide MMD (mixed metal dust), which generates downstream sales revenue.

Lithium Australia CEO and managing director Simon Linge said: “We are excited to see volumes of large-format LIBs grow during the quarter as we continue to execute our strategy to target this battery type via partnerships with EV and ESS manufacturers. Volume growth and process improvements in MMD yield are key to our goal of achieving cash flow breakeven within the recycling business.”

Lightning Minerals

Lightning Minerals Ltd (ASX:L1M) focused on further delineating the lithium in soil anomaly on its Dundas tenement E63/2000 in Western Australia during the quarter.

The campaign has successfully identified an extensive lithium in-soil anomaly with results up to 177ppm lithium supporting previous assays up to 218ppm lithium.

Lightning managing director Alex Biggs said: “The quarter has been another successful period of exploration and target identification for the company. We continue to further delineate high-priority lithium targets on our Dundas tenement E63/2000 which we will be drilling in January 2024.

“Plans are also underway for further target identification across our Dundas project areas. We also completed our first pass reconnaissance exploration program at our Canadian projects, Dalmas and Hiver in Quebec confirming multiple pegmatite occurrences across both projects.”

Ioneer

Ioneer Ltd (ASX:INR, OTC:GSCCF, NASDAQ:IONR) made progress toward a Final Investment Decision (FID) and commencement of construction at its Rhyolite Ridge Lithium-Boron Project in Nevada during the December quarter.

The company is financially well-positioned as it moves to being fully permitted with conditional debt and equity commitments of nearly US$1.2 billion.

Ioneer has largely completed the capital-intensive heavy-lifting work required to meet its commitments to Sibanye Stillwater (conditional equity) and the US Department of Energy (conditional debt) and make an informed FID decision later this year.

The company is working with Fluor (NYSE:FLR) and our other consultants to finish the Class II capex and opex estimates, and requisite technical and financial reports required by Sibanye and the DOE.

Infinity Lithium

Infinity Lithium Corporation Ltd (ASX:INF) achieved significant momentum for the San José Lithium Project with increased levels of support through the award of an €18.8 million grant under PERTE VEC IIa from the Spanish Government’s Ministry of Industry, Trade and Tourism.

Read: Infinity Lithium soars on gaining strong endorsement of San José Lithium Project with €18.8 million government grant

The grant was the sixth largest amount awarded under this round of the program and the first allocated to the processing of critical raw materials.

The support is a major endorsement for the project and demonstrates Spain’s commitment to building its own lithium-ion battery value chain, beginning with the development of its own natural resources.

Green Technology Metals

Green Technology Metals Ltd (ASX:GT1, OTC:GTMLF) completed the preliminary economic assessment (PEA) for its vertically integrated lithium business in Ontario, Canada during the quarter, featuring vertically integrated mines, concentrators and a lithium hydroxide conversion facility.

The PEA validates the company's potential to emerge as a large-scale, cost-effective producer of lithium concentrates and chemicals, emphasising environmentally sustainable production of SC5.5% spodumene concentrate and lithium hydroxide.

The combined mine and concentrator development delivers a net present value (NPV) for the project of C$1.189 billion (A$1.335 billion). The project’s compelling projected economics are due to attractive capital and operating costs, short transportation distances, minimal royalties and low corporate income taxes.

Global Lithium Resources

In the December quarter, Global Lithium Resources Ltd (ASX:GL1) achieved a significant milestone with the completion of its 60,000-metre drilling program at the Manna Lithium Project in Western Australia.

The company is already seeing the rewards with high-grade results released during the quarter, underpinning the quality of the project.

Global Lithium awaits the remaining assay results in Q1 CY24 and will announce them to the market in the coming months.

Concurrently, progress on the definitive feasibility study (DFS) for the Manna Lithium Project is advanced and progressing well.

The outcomes of the recent drilling program which will be incorporated into an updated MRE and mine schedule, coupled with the ongoing metallurgical studies, will be integral to the DFS which will be released in 2024.

Dynamic Metals

During the quarter, Dynamic Metals Ltd (ASX:DYM) focused on systematic early-stage lithium exploration at its flagship Widgiemooltha Project in Western Australia, where it has successfully identified several significant anomalies.

Dynamic managing director Karen Wellman sat down recently with Proactive’s Jonathan Jackson to talk about the highlights of the December quarter as well as two new lithium trends at the Franks Far Southeast and Spargos East prospects at Widgiemooltha Project.

The soil anomalies are more than 1 kilometre in strike, between 300 to 600 metres wide and register lithium-in-soil grades of more than 100 parts per million. The company will now turn its attention to infill soil sampling to define its drill targets, with an eye to start drilling later this year.

Anson Resources

Anson Resources Ltd (ASX:ASN, OTCQB:ANSNF) completed the acquisition of the Green Energy Lithium Project from Legacy Lithium Corporation during the December quarter.

The Green Energy Project is strategically located immediately adjacent to Anson’s Paradox Lithium Project in south-eastern Utah, USA and increases the project area by 8% to a total of 231.35 square kilometres.

It hosts 18 historic oil and gas wells – three of which have recorded lithium values – which has enabled Anson to deliver the Paradox Lithium Project’s mineral resources upgrade without the need for further drilling.

Read: Anson Resources delivers 1.5 million tonnes LCE in ‘Major’ lithium resource upgrade at Paradox

The company has lifted the Paradox mineral resource to 1.5 million tonnes of lithium carbonate equivalent (LCE) following the acquisition.

Torque Metals

Torque Metals Ltd (ASX:TOR) completed its due diligence drilling campaign at the New Dawn Lithium Project in Western Australia during the quarter, returning strong results.

Managing director Cristian Moreno said: “This has been a quarter of achievements for Torque, particularly with the positive conclusion of the company’s due diligence assessment of New Dawn.

“We are incredibly pleased with the strong results returned from our DD and RC drill programs at the site, including a cumulative interval of 35 metres with 10 metres at 1.51% Li2O from 51 metres, 15 metres at 1.17% Li2O from 220 metres and 10 metres at 1.15% Li2O from 265 metres, and a peak cumulative grade of 3.99% Li2O.”