(Reuters) - Loews Corp (NYSE:L) said on Monday its second-quarter profit more than doubled as a jump in investment income cushioned a hit from higher catastrophe losses in its insurance unit, CNA Financial.

Markets have staged a comeback this year on rising bets that the Federal Reserve was done with the bulk of its tightening cycle that had taken the economy on the edge of a recession.

Loews reported a higher return on investments, helped by a broader market rally.

Investment income for New York-based Loews jumped to $592 million in the second quarter ended June 30 from $366 million a year earlier.

The company earns most of its revenue from CNA, in which it holds about 90% stake. It also operates a natural gas transportation pipeline business and a chain of hotels.

Catastrophe losses in CNA's property and casualty operations rose to $68 million from $37 million.

The U.S. Midwest and South were hit by violent storms in the quarter that knocked over houses and led to loss of life, adding to a series of weather-related events that have hurt insurers' profitability.

CNA's peer Travelers (NYSE:TRV) Companies, earlier this month, reported about a 98% rise in catastrophe losses due to extreme weather.

Meanwhile, CNA reported an underlying combined ratio of 91.1%, compared with 90.8% a year earlier. A ratio below 100% means the insurer earned more in premiums than it paid out in claims.

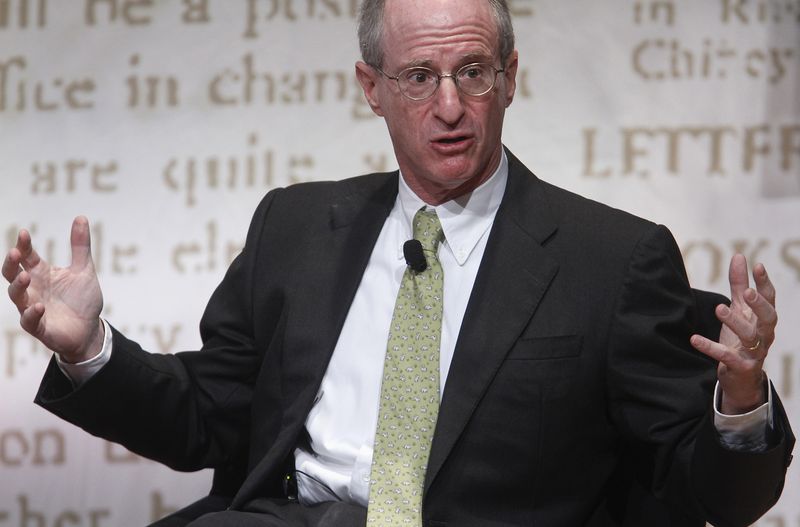

"CNA reported stellar results, despite high industry catastrophe losses," President and CEO James Tisch said in a statement.

The income attributable to Loews for the second quarter was $360 million, or $1.58 per share, compared with $167 million, or 68 cents a year earlier.