Lithium Universe Ltd (ASX:LU7, OTC:ESMAF) is on track to acquire a commercial property in the Bécancour Waterfront Industrial Park in Québec, Canada, as part of its strategy to address the lithium conversion capacity gap in the North American market.

Large site, advantageous infrastructure

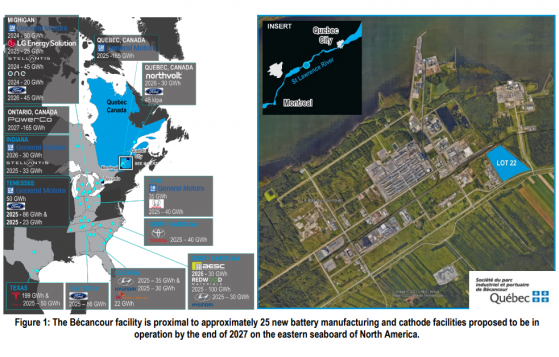

The company has executed an option agreement to pick up the secured 276,423-square-metre site, known as Lot 22, to enhance lithium conversion capacity in response to the burgeoning demand for electric vehicle (EV) batteries.

Lot 22 will become an integral part of the Québec Lithium Processing Hub (QLPH) Strategy, with the potential to host up to three lithium carbonate refineries, each with a capacity of 16,000 tonnes per annum.

It boasts proximity to major cathode factories, including those of General Motors/POSCO and Ford/EcoPro BM, and is within 140 kilometres of Northvolt’s EV battery facility.

It is also close to essential infrastructure, including hydroelectricity, natural gas and spodumene import facilities, alongside road and rail networks.

The site acquisition comes at a critical time for a continent preparing for a substantial increase in battery manufacturing, with an estimated 900GW of battery capacity slated for deployment by 2028.

LU7 chair Iggy Tan said: “This is just another positive step forward for the company as we secure this key landholding in the most attractive emerging battery-focused jurisdiction.

“Québec’s low-cost hydroelectricity, high environmental standards and educated workforce, as well as the location’s logistical advantages, including a deepwater port and easy rail access to the rest of North America, were key factors in the decision.

Ability to expand to meet demand

“One of the reasons we like the site is that it gives us the opportunity to expand. We have the ability to do that if necessary.”

The surge in EV production necessitates a corresponding expansion in lithium processing capabilities, with North America's demand expected to require 800,000 tonnes of lithium carbonate equivalent (LCE) per annum by 2028.

With the strategic advantages offered by the site, Lithium Universe believes it is equipped to play a pivotal role in reducing North America's dependence on foreign lithium converters and refining capacity, thereby enhancing both commercial and national energy security.

Lithium Universe says it will benefit from favourable terms, including a waiver of the option fee until July 2024 and a three-year option term.

The acquisition is contingent upon regulatory and shareholder approvals as well as the successful financing of the lithium refinery project with no immediate fundraising required for the land acquisition.

Read more on Proactive Investors AU