The price of lithium has jumped more than four-fold over the last year, underpinned by a surge in the demand for electric vehicles (EV) worldwide along with increasing pressures on lithium supply.

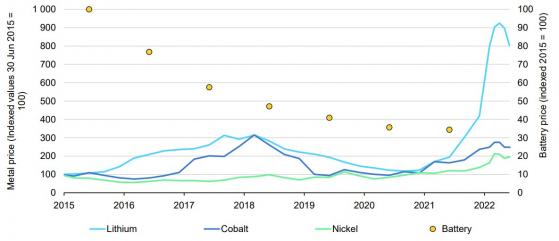

Battery metals prices (2015 to July 2022).

Source: International Energy Agency analysis based on S&P Global.

Lithium demand is expected to rise from ~500,000 tonnes of lithium carbonate equivalent (LCE) in 2021 to about 3-4 million tonnes in 2030, according to a report by McKinsey & Company.

Over the next decade, McKinsey forecasts continued growth of li-ion batteries at an annual compound rate of about 30%.

By 2030, EVs, along with energy-storage systems, e-bikes, electrification of tools, and other battery-intensive applications, could account for 4,000 to 4,500 gigawatt-hours of li-ion demand.

The International Energy Agency (IEA) has highlighted the pressing need for massive investments in mining and processing of key battery raw materials if the highly likely scenario of an intense demand-supply mismatch is to be averted.

In the spotlight: ASX lithium stocks

With lithium demand outstripping supply, ASX lithium explorers, developers and miners have been hard at work attempting to find new sources of supply and generate higher production levels to meet market demand.

We will look at how a number fared in the June 2022 quarter and what’s in the pipeline as the market heats up.

Core Lithium

Core Lithium Ltd's (ASX:CXO) development of the Finniss Lithium Project in the Northern Territory continues to run according to schedule with site activities now focused on the pre-strip needed to uncover ore and the erection of the DMS (dense medium separation) plant.

Last month, Core upgraded the Finniss Lithium Project’s mineral resource estimate and ore reserves by 28% and 43% respectively, extending the mine life of the project to 12 years.

The mineral resource now sits at 18.9 million tonnes at 1.32% lithium oxide, with a measured and indicated category of 13.3 million tonnes at 1.4% lithium oxide – a 61% increase to those classifications.

Core Lithium non-executive chair Greg English recently said: “Fully funded to first production, Finniss remains on track to ship first lithium by the end of this calendar year to herald Core’s arrival as Australia’s next lithium producer.”

Lithium Australia

Lithium Australia NL (ASX:LIT) is focused on its battery recycling business (Envirostream) and LFP (lithium ferro phosphate) cathode powder business (VSPC).

Envirostream has quickly grown a national network of more than 700 accredited B-cycle drop-off locations with its partners supplying EOL (end-of-life) batteries.

During the quarter, Envirostream reported that it had established relationships with electric vehicle (EV) manufacturers in Australia seeking an EOL solution for their batteries.

Battery sorting line (left), conveyor (middle), and sorting bins (right) at Envirostream’s operation in Melbourne.

Lithium Australia’s subsidiary VSPC has selected global engineering and project delivery entity Lycopodium (ASX:LYL) to provide engineering support services for the definitive feasibility study (DFS) for a potential LFP manufacturing facility.

Successful completion of the DFS for an LFP manufacturing facility would signal a major step-up in production capacity for VSPC from its current R&D facility in Brisbane.

Discovery Alaska

Discovery Alaska Limited (ASX:DAF) progressed its lithium-focused activities at the Chulitna Project in Alaska during the June quarter.

The company has confirmed the lithium potential at the Coal Creek prospect after a comprehensive data review and associated works revealed the widespread presence of lithium mineralisation within the historical Coal Creek drill core.

Chulitna Project – Coal Creek Prospect (outcropping granite with lithium mineralisation).

Discovery’s work is the first systematic assessment of a lithium project in Alaska with more than 5,000 metres of historical Coal Creek drill core available for assessment.

The company’s re-analysis work of the historical Coal Creek drill core stored at the Geological Materials Centre in Anchorage is currently in progress.

Lithium Power International

Lithium Power International Ltd (ASX:LPI) made strong progress during the June 2022 quarter, with the company entering agreements to consolidate 100% ownership of Maricunga Lithium Brine Project in Chile by way of a three-party all-scrip merger with its JV partners.

By holding 100% of the project, LPI will be able to rapidly advance the asset by simplifying decision-making and unlocking funding pathways as the company capitalises on the global shift towards the electrification of transport and infrastructure.

Importantly, during the reporting period, LPI also increased its tenement holding in Western Australia, with the largest ground coverage in the Greenbushes Region through the acquisition of CMC Lithium and its Greenbushes Project.

LPI also acquired two new tenements in the mineral-rich Eastern Goldfields of WA.

With plans to demerge the company’s West Australian lithium assets, these acquisitions further bolster the portfolio of Western Lithium (TSX:WLC) Limited, which LPI plans to list on the ASX later this year.

Astro Resources

Astro Resources NL (ASX:ARO) entered the buoyant battery materials sector during the quarter, with the company successfully staking a number of highly-prospective lithium brine and clay claims in the Kibby Basin, Nevada.

The Kibby Basin is adjacent to several large-scale lithium development projects, including ioneer Ltd’s DFS-stage US$1.265 billion after-tax NPV Rhyolite Ridge Project.

Astro has also signed a letter of intent (LOI) to acquire an 80% interest in the world-class Georgina IOCG Exploration Project in the Northern Territory from Greenvale Mining Ltd (ASX:GRV), with highly regarded Greenvale directors and experienced battery minerals executives Neil Biddle and Tony Leibowitz to join the Astro board.

The forward exploration strategy for Georgina is designed to advance further prospects along the exploration pipeline for drill testing.

Work planned for the current year includes exploration drilling, geophysical surveying, and progressing the remaining tenement applications toward grant.

European Lithium

European Lithium Ltd (ASX:EUR) delivered strong valuation metrics for its Wolfsberg Lithium Project in Austria during the quarter.

The company, which aims to be the first local lithium supplier into an integrated European battery supply chain, revealed an accelerated-case NPV6 (net present value) of $862 million, based on the measured and indicated resource of 9.7 million tonnes at 1% lithium hydroxide.

EUR is advancing the project DFS which is expected to be completed in the fourth quarter of 2022.

The company is reviewing increasing inflation rates and unexpected high prices for consumables including energy and chemical reagents for integration into the final DFS.

Lake Resources

Lake Resources NL 's (ASX:LKE) DFS for the Kachi lithium play in Argentina continues to advance with final drafts expected toward the end of 3Q 2022, based on 50,000 tonnes LCE per annum.

Discussions are ongoing with UK Export Finance (UKEF) and Export Development Canada (EDC) to support ~70% of the total finance required for Kachi’s expanded production.

Meanwhile, Lake inked a non-binding deal with Ford during the quarter for the Automobile monolith to pick up roughly 25,000 tonnes of lithium every year from Lake’s Kachi asset as part of a strategic collaboration.

Kachi’s demonstration plant arrived in Argentina and is now on site and being assembled prior to commissioning following the construction of the facility housing the demonstration modules.

Lake is well-funded with a cash balance of A$173 million (US$120 million) as at end of the FY22 financial year.

Anson Resources

Anson Resources Ltd (ASX:ASN) maintained its core focus during the June quarter on resource expansion drilling programs designed to deliver a significant resource upgrade at the Paradox Lithium Project in Utah, US.

This will support a DFS and the development of the project into a substantial lithium-producing asset.

Drilling during the quarter at the Long Canyon No. 2 well has delivered new, high concentrations of lithium and bromine from the Clastic Zones.

The high pressure, porosity and permeability are expected to deliver continual flow at the extraction well over the proposed life of mine at Paradox.

Read more on Proactive Investors AU