Shareholders have overwhelmingly approved the sale of Lithium Energy Ltd (ASX:LEL)’s interest in the Solaroz Lithium Brine Project.

The sale is being conducted under a Share Sale Agreement with CNGR Netherlands New Energy Technology B.V. (CNNET), a subsidiary of CNGR Advanced Material Co. Lithium Energy has agreed to sell its 90% stake in the Argentinian company, Solaroz S.A., which owns the Solaroz Project, for a total consideration of US$63 million (~A$97 million) in cash. This amount includes the assignment of a loan owed by Solaroz S.A. to LEL.

Lithium Energy has received an initial deposit of US$1.8 million (~A$2.8 million). The remaining balance of US$61.2 million (~A$94.1 million) will be paid by CNNET as follows: US$53.7 million (~A$82.6 million) will be paid upon completion of the sale, and US$3 million (~A$4.6 million) will be placed in a joint escrow account for two years.

The escrow amount will serve as security for Lithium Energy's obligations under the sale agreement and will be released to the company after the period ends.

Additionally, a deferred consideration of US$4.5 million (~A$6.9 million) will be paid by CNNET if the Benchmark Lithium Carbonate Price exceeds US$23,000 per ton, averaged over any four months within the 12 months following the completion of the sale.

Lithium Energy executive chairman William Johnson has previously said, "The transaction will remove the company’s funding and development risks associated with the project while delivering the company a very substantial cash balance.

"Post completion, the company will have the capital required to consider investment opportunities in the battery minerals area. The board will also consider a potential distribution to shareholders."

Johnson sat down with Proactive in May to discuss the sale when it first became public:

The company will turn its attention to advancing the Axon Graphite Ltd (proposed ASX code: AXG) initial public offering (IPO), while investigating investment opportunities in the battery mineral projects sector in Australia and overseas.

Once Axon Graphite is listed, LEL will retain a 50 million share cornerstone equity holding comprising between 22.2% to 28.6% of Axon Graphite, depending on the final amount raised under the IPO, with such shareholding likely to be subject to a 2-year escrow period as required under ASX Listing Rules.

LEL recently completed the process of board selection for Axon Graphite, which will encompass the merger of the high-grade natural graphite assets of Lithium Energy and NOVONIX Limited.

The Axon board intends to advance the company’s status from a graphite exploration and evaluation company into a graphite miner and battery anode material (BAM) producer.

Conditions of Solaroz sale

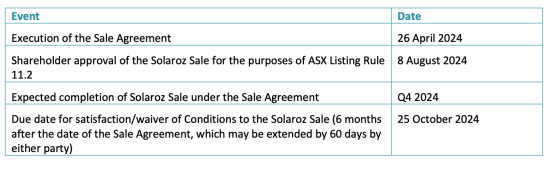

Completion of the Solaroz sale will be finalised once several conditions outlined in the Sale Agreement are satisfied or waived.

These conditions include obtaining shareholder approval from Lithium Energy, which was successfully secured at the General Meeting held earlier today. Additionally, the transaction requires certain regulatory approvals in China and Argentina.

In May 2024, CNNET and CNGR obtained all necessary Chinese overseas direct investment and foreign exchange control approvals concerning the Solaroz sale. However, CNNET's registration as a foreign company in Argentina, necessary for the transfer of shares in Solaroz S.A., is still pending.

The parties are not aware of any other regulatory approvals that need to be met under this condition.

Furthermore, environmental and concession-related approvals, particularly concerning updated Environmental Impact Assessment (EIA) applications for the next phases of exploration and evaluation at the Solaroz Project, are also required.

All these conditions must be met by 25 October 2024, six months from the Sale Agreement date. If necessary, the deadline may be extended by either party for an additional 60 days.

Indicative timetable

Read more on Proactive Investors AU