Lithium Energy Ltd (ASX:LEL) has signed an agreement with NOVONIX Ltd to merge their adjoining Queensland graphite assets into a proposed spin-out company, Axon Graphite Ltd.

The proposed new company, which plans to undertake an IPO, and its consolidated graphite assets will form a distinct vertically integrated mine-to-battery anode material (BAM) product manufacturing company.

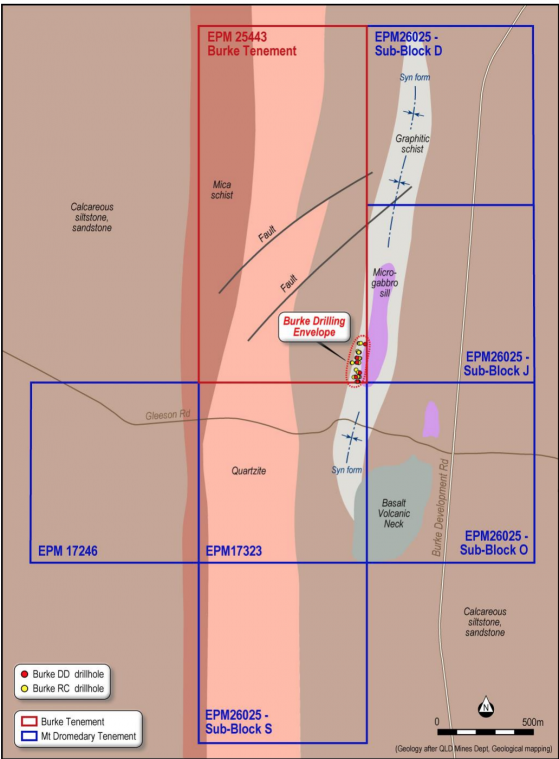

The merger of NOVONIX’s Mt Dromedary Graphite Project and Lithium Energy's directly adjoining Burke Graphite Project is expected to create a substantial, world-class inventory of high-grade natural graphite.

This will comprise:

- Burke Deposit: Total indicated and inferred mineral resource of 9.1 million tonnes at a grade of 14.4% total graphitic carbon (TGC) for 1.31 million tonnes of contained graphite; and

- Mt Dromedary Deposit: Total measured, indicated and inferred graphite mineral resource of 14.3 million tonnes at 13.3% TGC for 1.908 million tonnes of contained graphite (at a 4% cut-off grade).

The company says that the combination of these two adjoining high-grade graphite deposits creates the potential for significant operational synergies and economies of scale in the development of a vertically integrated BAM manufacturing facility in Queensland.

Burke & Mt Dromedary graphite projects: tenements, geology, Burke drill holes and drilling envelope.

Axon Graphite IPO

The new company, Axon Graphite, plans to raise $20 million through an IPO, with a minimum subscription of $15 million and oversubscriptions of up to $5 million (for $25 million in maximum subscriptions) at an issue price of $0.20 per share.

Eligible Lithium Energy and NOVONIX shareholders will be entitled to participate in a (pro-rata) priority offer of Axon Graphite IPO shares.

Assuming a $20 million raising, Lithium Energy and NOVONIX will each hold a 25% cornerstone equity holding in Axon Graphite on successful completion of the IPO.

Axon Graphite would also own Lithium Energy’s Corella Graphite Deposit, which holds an inferred resource of 13.5 million tonnes at 9.5% TGC for 1.3 million tonnes of contained graphite.

Creating a “world-class inventory”

Lithium Energy executive chairman William Johnson said, “The consolidation of the adjacent high-quality Burke and Mr Dromedary graphite deposits will create a world-class inventory of high-grade graphite to support plans to develop an Australian-based, vertically integrated battery anode material (BAM) business.

“We expect significant operational synergies and economies of scale will be gained from the consolidation of these adjacent graphite deposits.

"We are delighted also to have NOVONIX as a partner in Axon Graphite. NOVONIX has established an enviable position within the global battery industry and their experience and industry contacts will be of great value for Axon Graphite moving forward.

“Through a priority offer to Lithium Energy shareholders and Lithium Energy’s retained interest in Axon Graphite (post IPO), shareholders will benefit from significant upside exposure to a dedicated Australian graphite business.”

NOVONIX CEO Dr Chris Burns said, “The growth opportunity in the electric vehicle and energy storage systems battery markets for anode materials and high-grade graphite products is significant over the next decade.

“We believe the combination of the Mt Dromedary and Burke assets will enhance the scale and economics of these resources and provide the focus for the development of a substantial natural graphite mine and business.

“We believe a standalone vehicle provides the opportunity to attract new development capital to enable the development of the resource and production of highly refined grade natural graphite for EVs and ESS. It will also highlight the value of these assets for NOVONIX shareholders.”

Battery Anode Material manufacturing business

Axon Graphite plans to develop a vertically integrated BAM business utilising high-grade graphite from its consolidated graphite deposits as feedstock material to a BAM manufacturing facility in Queensland.

The vertically integrated BAM business envisages mining graphite initially from the combined Mt Dromedary/Burke graphite deposit and producing a +95% TGC graphite flake concentrate at the mine site.

Flake concentrate will be transported to a proposed BAM manufacturing facility for processing, firstly by mechanically shaping and spheronising the flakes and then chemically purifying the spheronised graphite to form the high-quality BAM product, spherical purified graphite (SPG).

This SPG product is proposed to be sold as a battery anode material for use in lithium-ion battery manufacturing or for battery energy storage solutions.

Townsville in North Queensland — an important emerging location for the production of critical materials for battery technologies in Australia — is currently proposed as the location of the BAM facility utilising graphite sourced from the combined deposits.