A binding Framework Agreement between Lithium Energy Ltd (ASX:LEL) and Xi’an Lanshen New Material Technology Co. Ltd paves the way for a demonstration plant capable of producing up to 3,000 tonnes per annum of battery-grade lithium carbonate.

Lanshen will fund the sole cost of the engineering and design, construction, transportation, assembly, commissioning and initial operation of the plant, which will be built at LEL’s 90%-owned Solaroz Lithium Brine Project in Argentina.

Solaroz is next to Allkem’s Lithium Production Facility in the Salar de Olaroz basin in the heart of South America’s world-renowned Lithium Triangle.

Importantly, the plant will include Lanshen’s proprietary sorbent-based direct lithium extraction (DLE) technology, which has already been proven on industrial and commercial scales.

The structure of the agreement for the construction and commissioning of the plant is expected to significantly reduce the upfront capital costs in evaluating Lithium Energy’s DLE production option.

Lanshen is a leading provider of DLE technology and plant manufacturing, with industrial-scale commercial DLE plants in operation. Its major shareholders include China Minmetals and Softbank Capital.

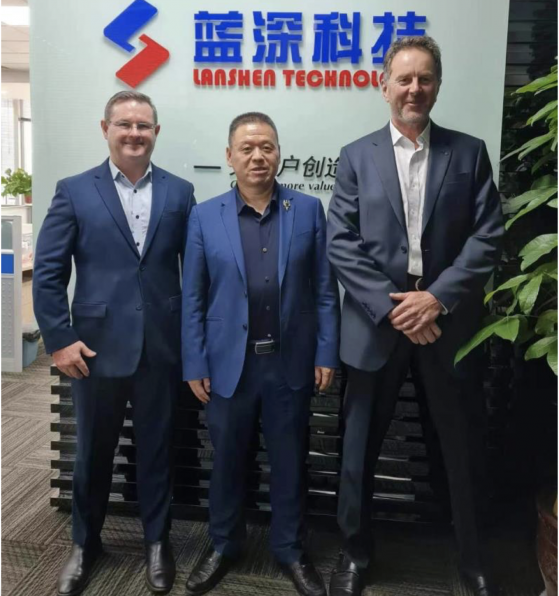

Lanshen chairman Zhijun Feng (centre) with Lithium Energy executive chairman William Johnson (right) and Lithium Energy general manager Projects Graham Fyfe.

Highly favourable agreement

In discussing the agreement, LEL executive chairman William Johnson noted there were several potential significant commercial and environmental benefits.

“During a recent trip to China, the company was highly impressed by the capabilities of Lanshen and their relatively mature sorbent-based technology, which has been proven on industrial and commercial scales,” Johnson noted.

“The ‘try before we buy’ commercial arrangements agreed under the Framework Agreement, through which Lanshen has committed to fully fund the construction and initial operation of the plant, are highly favourable for Lithium Energy.

"The development of this plant will enable the company to fully test the capabilities of the plant before making a purchase decision and will provide valuable information towards the development of the broader Solaroz Project as a whole.”

Lanshen sorbent material produced at Lanshen factory in Xi’an, China.

Terms of the agreement

Pending the successful acquisition of necessary environmental and additional permits, LEL plans to construct the plant on the distinct Mario Angel concession, a discrete 543-hectare area within the larger Solaroz concession that spans roughly 12,000 hectares in total. The Mario Angel concession lies southwest of the main Solaroz concession block.

The company aims to commission the plant during the latter half of 2024.

Drilling operations at the Mario Angel concession (Hole SOZDD001) have reportedly discovered an estimated 235 metres of lithium brine mineralisation across both upper and lower aquifers to date. The average lithium grade is reported to be 446mg/l in the upper aquifer and 501mg/l in the lower aquifer.

At approximately 543 hectares, Mario Angel is a relatively small, standalone concession selected due to its suitability for DLE testing. Importantly, operations and testing at Mario Angel will not interfere with the development of the larger Solaroz concession holdings.

Lithium Energy, in conjunction with Hatch, is undertaking a scoping study to evaluate the potential application of both traditional pond evaporation and DLE technology across the broader Solaroz concession areas, which span around 12,000 hectares in total.

The terms of the agreement with Lanshen include:

- Lanshen will supply, build and initially operate the plant at its own cost, with Lithium Energy being responsible for securing all necessary approvals and permits and establishing the necessary supporting site infrastructure.

- Once the plant is completed, if it passes pre-agreed acceptance criteria then Lithium Energy will buy the plant for either cash consideration, or a percentage interest in the lithium rights associated with the Mario Angel concession.

- The value of the plant (with respect to the potential cash consideration or Mario Angel lithium rights to be contributed), together with detailed plant specifications, technical, engineering and operating parameters (including the final acceptance criteria) will be outlined in a more detailed agreement which is envisaged to be executed before September 2023.

- Should the commissioned plant not meet the agreed acceptance criteria, then Lanshen may be required to remove the plant at its own cost.

- Lanshen and Lithium Energy will now immediately commence works together to complete the plant by November 2024, with initial activities focussing on the plant design and engineering and necessary approvals and permits.

Lanshen DLE test facility in Xian, China.

High priority project

Lanshen chairman Zhijun Feng has labelled the agreement a high priority.

“We treat this project as a high priority amongst our projects in Argentina and others in Chile. We already have a plant of 3,000 tpa under construction in Salar Arizaro, Argentina, as our first sale and construction of our modular DLE plant in Argentina.

"On the basis of our accumulated experiences there, we have this project as a demonstration of our investment and operation in Argentina together with our strategic partner Lithium Energy.

“From the success of the plant at the Solaroz Project, we are interested in the investment and operation of a bigger plant of 20,000 tpa or above, applying our modular plants and our integral capacity together with Lithium Energy.

“We really want to participate in the local development of the industry of lithium in Jujuy Argentina through our strategic cooperation with Lithium Energy.”

How Lanshen’s DLE works

Lanshen’s DLE ‘one-step molecular recognition technology’ for lithium extraction selectively extracts lithium directly from lithium-rich brines by using proprietary lithium adsorbent material.

Lithium ions are then eluted (extracted) with fresh water and lithium is subsequently separated from magnesium, potassium, sodium, calcium, iron, silicon, boron and other deleterious elements.

No chemicals are added in the lithium extraction process, which is considered relatively environmentally friendly compared to other DLE technologies.

Read more on Proactive Investors AU