The recently released annual report of Lithium Australia Ltd (ASX:LIT, OTC:LMMFF) outlines the company’s milestone accomplishments across its Battery Recycling, Lithium Chemicals and Battery Materials businesses in FY24.

LIT made considerable progress in FY24 in transitioning its battery recycling commercial model to deliver operating cash profits, signing landmark recycling agreements and making rapid advances under its joint development agreement with Mineral Resources.

The company is well placed to capitalise on the global trend toward electrification with Its patented technologies ready for commercialisation and its LieNA® lithium chemical progressing via a partnership with Mineral Resources.

Battery Recycling

LIT’s Battery Recycling Division achieved maiden operating cash profits in the final quarter of the year, which the company directly credited to its strategic transition towards an upstream service model, which drove robust revenue growth and enabled a greater proportion of revenue to be received upfront.

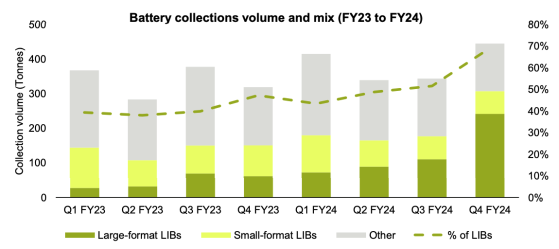

Over the year, the company collected a record 1,542 tonnes of batteries for recycling. Of this, 514 tonnes of large-format lithium-ion batteries (LIBs) were collected — more than doubling the LIBs collected in FY23.

This brings the large-format LIB collection mix to around 33% and points to the success of LIT’s strategic focus on exclusive recycling agreements with leading OEMs and battery manufacturers.

Driven by strong LIB collections growth, the company’s FY24 battery recycling revenue came in at A$6.7 million — a 22% increase on the prior year.

For the year, LIT achieved gross profit of A$2.2 million, up 53% on FY23, and FY24 gross margin of 33% driven by its upstream service model.

Looking ahead, LIT expects continued increases in large-format LIB collections to be “a significant value driver” for the company’s recycling operations.

Recycling agreements signed

During the year, LIT signed landmark supply agreements with LG Energy Solution, Hyundai Glovis and Volvo Group Australia.

LIT also signed a 3-year binding offtake agreement with SungEel HiTech (SungEel), who will purchase a minimum of 60% of annual Mixed Metal Dust (MMD) production from recycling processing.

The parties are now discussing a joint development agreement, which includes SungEel’s investment in our recycling operations to enhance processing capacity.

Battery Materials

Within the Battery Materials division, LIT entered a number of MOUs during the year regarding the potential development of a lithium ferro phosphate (LFP) and lithium manganese ferro phosphate (LMFP) manufacturing plant. The company is focused on two strategic commercialisation pathways:

Lithium chemicals: LieNA® commercialisation

During the year, the company’s LieNA® lithium chemical made commercial progress with LIT entering a joint development agreement (JDA) with Mineral Resources, providing funding for a piloting plant and engineering studies for a demonstration plant.

Since signing the JDA in early FY2024, significant progress has been made, including completion of the final stage of piloting. The remaining activities under the JDA, including product analysis, refining and demonstration plant engineering study, are all on track to be completed by the end of 2024.

Subject to these results, Lithium Australia will form a 50:50 joint venture with Mineral Resources to commercialise the LieNA® technology through a licensing model.

LIT is now focused on accelerating revenue growth through exclusive recycling agreements while aiming to complete LieNA® JDA activities and formalise a joint venture with Mineral Resources. It continues to seek partners for growth across its businesses.

Subsequent to the year-end, LIT executed a placement and launched a share purchase plan to help drive key growth and business development initiatives across the battery recycling and battery materials divisions.

Read more on Proactive Investors AU