Liontown Resources Ltd (ASX:LTR) has hit a new 52-week low, with its shares plunging to just AU$0.77 apiece on Monday. The decline was even steeper earlier in the session, with shares dropping to AU$0.765 before stabilising. This significant dip represents a staggering 53% loss for the company so far this year, despite the Australian stock market performing robustly overall.

The sharp drop in Liontown’s share price has occurred in the absence of any new, market-sensitive announcements from the company. The downturn reflects broader challenges facing the lithium sector, rather than issues specific to Liontown.

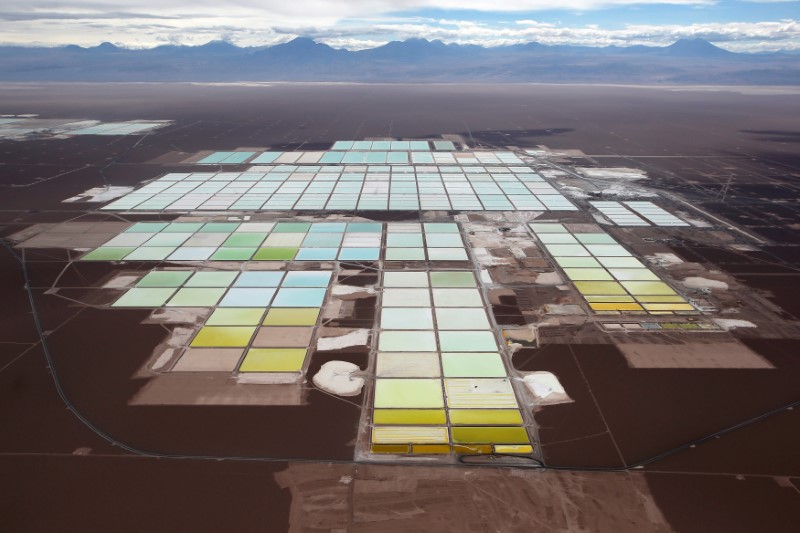

In 2024, the entire lithium market has faced considerable pressure, contributing to the downward trend in Liontown’s share price. Lithium carbonate prices, a key benchmark for the battery metal, have experienced a dramatic decline. From a high of CNY597,500 in October 2022, the price has plummeted to CNY73,500. This represents a more than 87% reduction, highlighting a significant shift in market dynamics.

Several factors have contributed to this slump in lithium prices. A substantial supply glut has flooded the market, outstripping demand and pushing prices downward. At the same time, high input costs have further suppressed market values. The confluence of these factors has created a challenging environment for lithium miners, including Liontown Resources.

The broader implications for the lithium market are considerable. As the prices for lithium carbonate continue to hover at their lowest levels in three years, the profitability and valuation of lithium mining companies are coming under increasing pressure. For Liontown Resources and its peers, navigating this challenging landscape will be crucial as they seek to manage costs and adapt to evolving market conditions.

Despite these challenges, the lithium sector remains a critical component of the global transition to renewable energy. Investors and stakeholders will be closely watching how companies like Liontown adapt to the current market pressures and whether they can position themselves effectively as conditions evolve.

In summary, while Liontown Resources Ltd is currently facing a difficult period marked by a dramatic drop in share value, the broader issues affecting the lithium market are a significant factor in this downturn. As the industry contends with falling prices and supply-demand imbalances, the path forward for lithium miners remains uncertain.