Lindian Resources Ltd (ASX:LIN, OTC:LINIF) is an ASX-listed exploration and mining company headquartered in Perth with a rare earth element (REE) project and four bauxite projects in Malawi, Guinea and Tanzania.

The company’s flagship asset is the Kangankunde Rare Earths Project in Malawi, which LIN is developing to meet battery and critical mineral demand for emerging technologies and established industries.

The basket of magnet rare earth elements present at Kangankunde has applications in permanent magnets, solar panels, rechargeable batteries (including for EVs), wind turbines and medical imaging and manufacturing.

Lindian’s Guinean bauxite projects hold more than 1 billion tonnes of bauxite resource, which is used as a feedstock for aluminium and multiple other purposes including metallurgical and chemical applications.

Kangankunde REE Project

Kangankunde sits just north of the major city of Blantyre in Malawi, a stable mining jurisdiction with a democratically elected government.

Malawi’s deputy secretary to the President and Cabinet and the head of the Presidential Delivery Unit, Dr Janet Banda, recently stated the government was committed to the mining industry’s success.

“It is the commitment of Government, to help the investors in mining and other related sectors key to the development of the mining industry,” Dr Banda said.

“Once done, this will catapult the growth we all have been looking for in the sector. Negotiation is as key to the mining industry as it is to other industries.

“This will also be extensively reviewed in the main delivery lab so that the country is ready to negotiate effectively for the benefit of all.”

Lindian acquired its ownership stake in Kangankunde in 2022 after shareholders agreed to acquire 66% ownership of project holder Rift Valley Resources (RVR) for US$30 million with an option to acquire the remaining percentage for an additional US$10 million before commercial production begins.

Since then, the company achieved a maiden mineral resource in the third quarter of 2023 as well as developing a community plan and securing water licences vital to the project’s operation.

In the second quarter of this year, LIN completed a feasibility study based on its maiden ore reserve.

Long-life, low-cost REE mine

LIN’s feasibility study outlines a strong economic case for Kangankunde, with a 45-year mine life for stage 1 development, and a notable 99% pre-tax internal rate of return (IRR), expected to cost just US$40 million to develop.

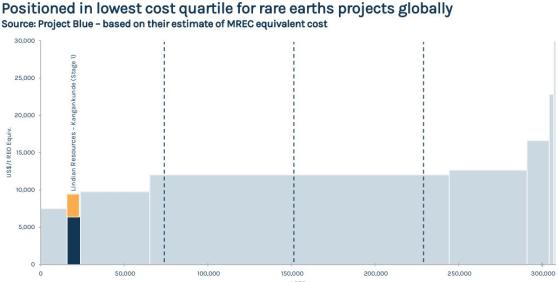

The project’s operating expenditure is also very low at US$2.92 per kilo of rare earth oxide (free on board), meaning Kangankunde sits in the lowest cost quartile.

Finally, Lindian predicts a pre-tax net present value (NPV8) of US$794 million (A$1.189 billion) and estimates it will take just 15 months to reach production once a final investment decision (FID) is made.

The project’s ore reserve comes in at 23 million tonnes at 2.9% total rare earth oxide (TREO) at a 1% cut-off, while its mineral resource estimate boasts 261 million tonnes at 2.1% TREO at a 0.5% cut-off.

Overall, LIN expects to produce about 15,232 tonnes of TREO per year at a concentrate grade of 55% TREO for the first stage of production at Kangankunde, with 1,613 tonnes of that being neodymium-praseodymium (NdPr) production.

Mine design, processing and infrastructure

Kangankunde will feature six open pit mining zones, using conventional mining equipment with low ore loss and a very low strip ratio of 0.2:1.

The early years of production will be supported by 19.5 million tonnes of high-grade feed at a 3.1% TREO grade – LIN is expecting to mine about 613,000 tonnes of total material per year, with 529,000 tonnes of that being ore.

Adding to the cost-effectiveness of the project, the ore haulage stockpiles are just 2 kilometres away and downhill from the deposits themselves.

In terms of processing, Lindian has chosen a predominantly physical process of gravity and magnetic separation, using sulphide flotation on the concentrate stream alone, which will require much lower reagent use than usual.

Processing plant components.

The cleaner process of relying on physical flowsheet operations will also allow LIN to recover water for recirculation without the need for a treatment process.

Concentrate produced from the mine will then be dried to 2% moisture and packed in 1-tonne bags to be transported 110 kilometres by sealed road to the Blantyre area, loaded into 40-foot containers and railed to the Nacala Port in Mozambique for shipping to its final destinations.

Lindian estimates 15 months will be required from securing funding to loading the first product from Kangankunde at port:

REE demand and offtake opportunities

Demand for rare earths, and particularly NdPr, is growing in step with future energy applications including electric vehicles, wind turbines and high-powered permanent magnets.

Project Blue’s February 2024 report predicted NdPr demand will triple in the period to 2050, requiring a similar 3-times increase in supply compared to 2023 levels.

Kankangunde has an additional advantage in the high purity of the mineralisation on the tenure, falling into the top quartile for REO grades with low impurities and ultra-low radioactivity.

Project Blue’s report highlights a strong market outlook for the per kilogram price of NdPr as well:

Lindian is targeting the major markets fairly evenly, expecting to offload about 40% of its product in the Asia region, 20% in the US and Europe respectively, and the remaining 20% to interested parties in other regions.

The company is already making progress in that regard, having secured an offtake agreement covering 40% of production for the first five years with Gerald Metals in the US.

LIN plans to secure a similar deal for another 40% of its REE concentrate, with the final 20% being sold on the spot market to the highest bidder.

Adamas Intel (NASDAQ:INTC), a rare earths and battery metal market intelligence firm, estimates there will be an annual undersupply of NdPr of 90,000 tonnes by 2040, with the market for all magnet rare earth oxides increasing five-fold by 2040, from US$10.8 billion in 2023 to US56.7 billion by 2024.

Read more on Proactive Investors AU