Lindian Resources Ltd (ASX:LIN) has completed a tranche two payment of US$7.5 million, as part of its agreement to acquire the Kangankunde Rare Earths Project in Malawi.

The company has confirmed the payment to the vendors in accordance with the sales agreement with Rift Valley Resource Developments Ltd and its 100% owned exploration and mining assets of Kangankunde.

Lindian’s phase one drilling program at Kangankunde advances with a steady stream of assays to continue towards a maiden mineral resource estimate on track for the June quarter this year.

Notably, Kangankunde’s mining licence and environmental approvals will enable the project to be fast-tracked, with the company remaining well-funded to advance work programs at the project.

What's more, payment for tranche three is due by August 2023 and tranche four, the final instalment, is due in August 2026 or at the date of first commercial production, whichever comes first.

Important milestone

Lindian executive chairman Asimwe Kabunga said: “We are pleased to have completed this second tranche payment – an important milestone for Lindian.

“We remain well-funded in the medium term to deliver significant value from the first phase drill program which is producing outstanding assay results.

“These results, and the fact that Kangankunde has a fully permitted mining licence, is driving increased interest and awareness from domestic and international groups that recognise Kangankunde’s potential as a globally significant, permitted, non-radioactive rare earths project.

“I am most encouraged by the interest being received from participants in the rare earth industry to assist Lindian’s development of a proposed demonstration plant.”

Forward plan

Lindian’s development of a proposed demonstration plant has been escalated with interest from participants in the rare earth industry.

Small-scale metallurgical test work is underway in South Africa with larger-scale testing to begin in Australia shortly with results on track for this quarter.

Lindian CEO Alistair Stephens added: “Lindian is making good progress with its respective mine development works, most notably the phase one drill program, metallurgy work, and initiating early activities for the proposed demonstration plant.

“We will continue reporting a steady stream of assay results from now through to the publishing of our maiden mineral resource estimate in the second quarter, and commencing the all-important metallurgical test work that will confirm recoveries, with preliminary results this quarter.”

About Kangankunde

The Kangankunde Project has been subject to significant historic exploration by Lonrho Plc in the 1970s and the French geoscience Bureau de Récherches Géologiques et Minières (BRGM) in the 1990s.

The project has an underground adit (a horizontal drive with cross-cuts extending at least 300 metres underground) and exploration sampling by trenching and drilling has identified significant non-radioactive monazite mineralisation.

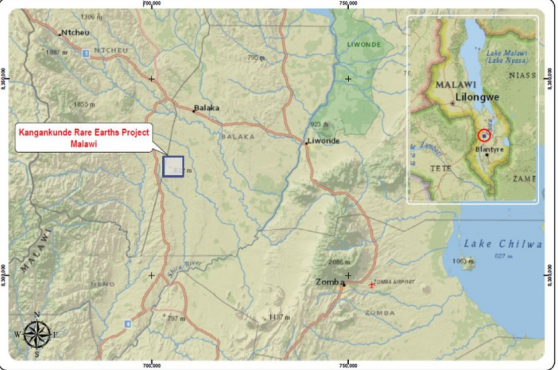

Project location.

Read more on Proactive Investors AU