Legacy Minerals Holdings Ltd (ASX:LGM) is joining forces with the world’s largest gold company, Newmont Corporation, at its Bauloora epithermal gold camp in New South Wales’ Lachlan Fold Belt.

Together with Newmont’s exploration arm, Newmont Exploration, LGM has inked a A$15 million farm-in and joint venture agreement, geared towards discovery and development across Bauloora’s epithermal systems.

Investors have responded strongly with shares as much as 26.48% higher in early ASX trading to $0.215.

Legacy MD Chris Byrne called the partnership an exciting development for both project and team.

“It confirms our belief, through the systematic work completed by our exploration team to date, that [Bauloora] has the potential to host a world-class epithermal system,” he explained.

Give me the elevator pitch

Newmont has committed to spend A$2 million on exploration in the next 24 months — a pledge that includes a regional magnetic survey and drill testing at Bauloora’s Breccia Sinter prospect before the end of 2023.

From there, Newmont can spend A$5 million to earn a 51% interest, so long as it completes 4,00 metres of drilling and splashes the cash in 48 months.

Following the phase one earn-in, it can seed an additional A$10 million and drill another 8,000 metres to upgrade its stake to 75%.

“As these types of systems require systematic work and significant drilling, securing the world’s largest gold mining company as a long-term partner on the project is of huge significance."

“The partnership allows us to leverage Newmont’s global epithermal expertise and sustain the funding for drilling that Bauloora will require," Byrne continued.

Joint venture potential

It’s still early days, but if both parties agree to mine, they can form a mining joint venture.

Legacy can tap Newmont’s financing team for a loan that would carry it through to production, allowing Newmont to earn up to 80%.

Legacy can repay the loan using its share of future mining proceeds and Byrne said the joint venture would deliver significant value for Legacy shareholders by accelerating near-term discovery.

“Importantly, the joint venture also provides a clear pathway to development, with the loan financing option meaning that shareholders of Legacy Minerals would be carried through to commercial production.”

All eyes on Bauloora

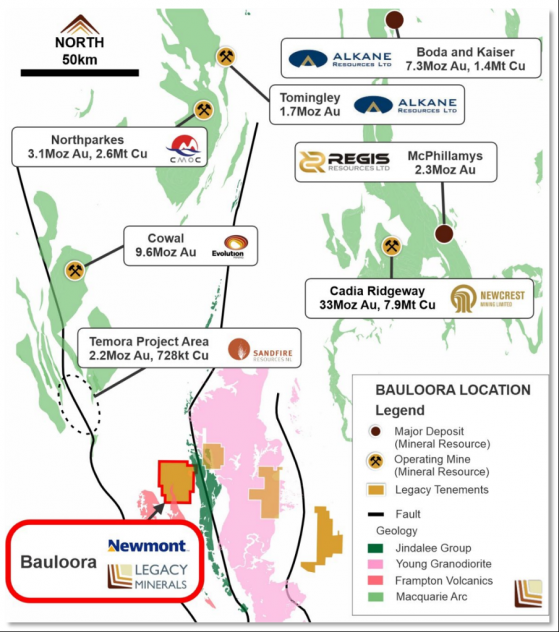

Bauloora, near the town of Cootamundra, is surrounded by famous copper-gold orebodies in central NSW’s Lachlan Fold Belt, but it has made a name for itself as a large, low-sulphidation epithermal project.

Bauloora project regional setting.

Recently, the Legacy team has been hard at work on a systematic exploration program, targeting prospectivity along a 27-square-kilometre epithermal vein field.

A maiden diamond drilling has just wrapped (targeting the Mee Mar epithermal veins) and Legacy is eagerly awaiting the final assays.

Read more on Proactive Investors AU