Latin Resources Ltd (ASX:LRS, OTC:LRSRF) has leveraged almost 40,000 metres of drilling at the Colina lithium deposit – part of the Salinas Lithium Project in Brazil – into a significant resource upgrade, increasing the mineral resource estimate (MRE) at Colina by 241%.

Importantly, some 67% of that new resource sits in the higher confidence measured and indicated category, representing 30.2 million tonnes at 1.4% lithium of the greater 45.2 million tonnes at 1.34% lithium MRE.

The high quality of the MRE bodes well for a positive preliminary economic assessment (PEA) for Colina, which LRS is targeting for the third quarter of 2023 with certification company SGS.

“Well set up” for future success

"We are very excited and proud to announce this significant upgrade to our JORC resource, which is starting to show the true potential of the Colina deposit,” Latin Resources managing director Chris Gale said.

“Tony and the team in Brazil are to be congratulated on another valuable milestone delivered on time and on budget for shareholders.

“The increase in both size and grade reflects our early confidence in the prospective nature of our tenure in Brazil to potentially produce a tier-one lithium deposit.

“This significant upgraded resource, and the potential value add of strengthening lithium prices, will provide solid inputs into our preliminary economic assessment (PEA) which we believe sets us up well for future success.”

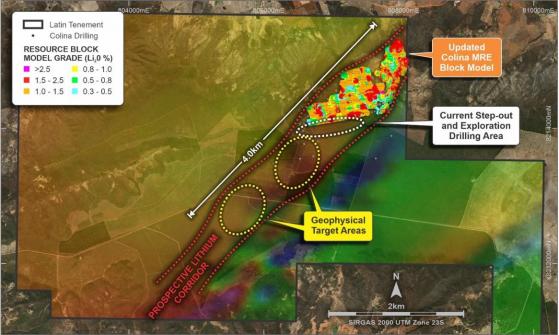

Gale highlighted the potential for further resource extensions to the southwest, as well as multiple regional targets the company intends to drill in its ongoing work at the greater Salinas project.

“Our eight drill rigs will remain busy with this program through to the end of the year and we eagerly await more resource upgrade results from these potential expansion areas,” Gale continued.

“I thank all of our team at Latin and shareholders for their support thus far, we look forward to bringing updates as they are received over the coming months."

“Exceptional result”

“This increase in the Colina mineral resource is an exceptional result for the company, coming off the back of the hard work from our team on the ground in Brazil,” Latin Resources vice president of operations – Americas Tony Greenaway said.

“What is really pleasing is the upgrade of a significant portion of the resource base into the JORC measured and indicated classification.

“This is a direct reflection of the very high levels of confidence in the geological model and resource estimate and provides us with a very strong basis for the upcoming PEA.

“While we are all extremely pleased with the outcome of the resource update; work goes on, with our drill rigs continuing to extend the Colina pegmatites to the southwest, which we expect to translate into additional tonnes in future resource updates, as well as testing some of our new blind geophysical target areas.”

Colina deposit MRE area, highlighting the interpreted prospective lithium corridor and newly identified geophysical drilling target areas.

Read more on Proactive Investors AU