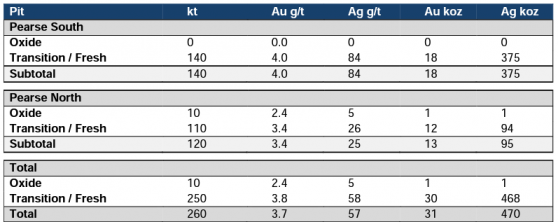

Kingston Resources Ltd (ASX:KSN) has delivered an updated ore reserve estimate for Pearse North and Pearse South open pits within the Mineral Hill Project in the Cobar region of NSW of 260,000 tonnes at 3.7 g/t gold and 57 g/t silver for 31,000 ounces of gold and 470,000 ounces of silver.

The updated reserve is supported by a revised mineral resource estimate (MRE) using all available historical data and drill hole data acquired by the company in 2022.

This marks a significant milestone for the company as it delivers the first component of the life of mine (LOM) plan to restart hard rock mining at Mineral Hill.

Looking ahead, Kingston is undertaking comprehensive geotechnical studies, underground mining evaluations and metallurgical test-work to support the release of Mineral Hill’s full LOM plan for hard rock mining.

Springboard into conventional mining

Kingston managing director Andrew Corbett said: “We are very proud to report the updated ore reserve for Pearse.

“The high-grade mineralisation within the Pearse open pits acts as a springboard to successfully get Mineral Hill back into conventional mining.

“The modelled revenue makes a significant positive impact on Kingston’s cash flow projections.

“We see this as just the first step in our transition back to hard rock mining at Mineral Hill and in delivering value from this outstanding tenement package.”

Ore reserve estimate

A ‘probable ore reserve’ is the economically mineable part of an indicated, and in some circumstances, a measured mineral resource.

The updated reserve marks a significant milestone for Kingston, as the open pits are expected to generate significant cash flow for the company.

The average reserve grade of 3.7 g/t gold is significantly higher than the current tailings resource grade of 1.1 g/t, meaning a significant step up in metal output and revenue when open pit mining commences.

There is also potential to discover additional high-grade, near-surface gold/silver mineralisation within the mining and exploration leases to complement the existing plant feed.

Mineral Hill’s operating process plant as well as the existing permitting and approvals are a major asset for Kingston with incremental mineralisation discovered or acquired having an accelerated path to value realisation.

Pearse South and Pearse North Probable Ore Reserve, March 2023.

Mineral resource estimate

Pearse North and South deposits at Mineral Hill are interpreted to be epithermal shear-hosted gold-silver lodes within the Late Silurian to Early Devonian Mineral Hill Volcanics.

The sulphide mineralisation, comprising predominantly pyrite, arsenopyrite and stibnite, is typically disseminated within quartz-mica (sericite) schist.

Mineralisation geometry was interpreted by creating 3D geological domain models using a 0.3g/t gold lower cut-off for Pearse South and 0.2g/t gold for Pearse North

The mineralisation model for each deposit has been revised using all available historical data and drill hole data acquired by Kingston in 2022

MIneral resource estimate.

Read more on Proactive Investors AU