Kingston Resources Ltd (ASX:KSN) says the Mineral Hill Tailings Project in NSW’s Cobar Basin continues to deliver after it sold 1,775 ounces of gold during May.

The gold bullion changed hands at an average price of A$2,999 an ounce, while the all-in sustaining cost came in at A$1,312 per ounce of gold.

In production news, Mineral Hill Tailings Project generated more than 1,800 ounces over the month of May, chalking up a processing recovery rate of 61%.

Considering last month’s results (and the gold metrics that preceded it), Kingston believes its mining strategy is paying off.

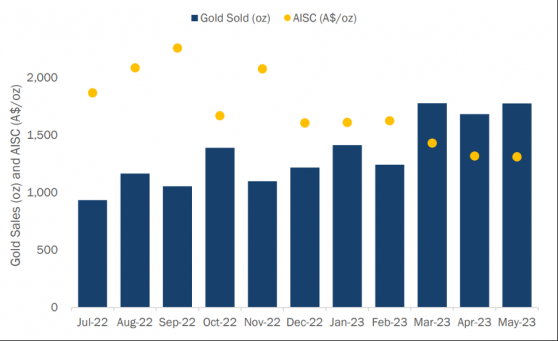

Mineral Hill's monthly AISC and gold sales from the Tailings Project (FY YTD).

Leveraged to new discoveries

Kingston Resources managing director Andrew Corbett said Mineral Hill’s Tailings Project had delivered impressively on production and cash flow during May.

“The team is now turning its focus to the open pit and underground mining opportunities we have at Mineral Hill,” he told the market.

“Drilling continued during the month with the completion of several geotechnical diamond drill holes and the drill rig will now turn to resource expansion and exploration drilling.

“Numerous discoveries have been made throughout Mineral Hill’s history and we are certainly excited by the current drill targets we plan to drill within our mining lease and surrounding exploration licence.”

Last week, Kingston announced it was winding back the clock at Mineral Hill’s Southern Ore Zone (SOZ) underground mine as it prepares for the next stage of development at the NSW project.

The gold and base metals producer is eager to restore the NSW mine to its former glory, kicking off proceedings with safety checks, ventilation reinstallation and power and pumping development.

Kingston hopes to get the drill bit spinning in 2023’s December quarter when it’ll focus on infilling and extending the underground resource at SOZ.

While there’s still a way to go, it’s hoped the revitalised mine will leverage existing development and infrastructure to facilitate a low-cost restart.

Read more on Proactive Investors AU