Kingston Resources Ltd (ASX:KSN) has released a presentation titled '2023: A Year of Transformation & Operational Success Building a Gold and Copper Mining Company', which covers the company key achievements in 2023 while outlining its growth strategy for 2024 and beyond.

Looking ahead, Kingston is focused on executing its clearly defined strategy of leveraging its existing gold-copper asset base while advancing future growth opportunities.

Mineral Hill

Kingston is working to transform the Mineral Hill Project in central New South Wales back into a hard rock mining operation. The company is focused on extending the 5-year mine life producing precious and base metals with plans for underground and open pit mining next year.

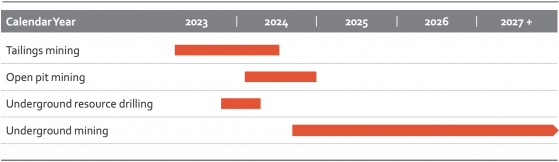

Open pit mining is set to commence in the first quarter of 2024, while underground refurbishment is well advanced, with underground drilling to begin in mid-2024, ahead of underground mining later in 2024.

All approvals and licences to operate are in place, with the mine refurbishment on track and on budget, while all major equipment has been ordered and contractors are in place.

The project demonstrates significant exploration upside, hosting multiple orebodies with potential for extensions and new discoveries.

Alongside work towards the commencement of mining, resource expansion and infill drilling is underway at Mineral Hill. Near-mine exploration is a priority in order to extend the underground mine life.

A new discovery at Mineral Hill of 12.5 metres at 3.41% copper equivalent is near the existing underground development.

The company says that exploration across the wider licence area will also be a focus, while there is also significant regional growth opportunity with abundant obar-style deposits within trucking distance of the Mineral Hill processing plant.

Misma Gold Project

Next year will also involve identifying options for the advancement of the Misima Gold Project in Papua New Guinea.

At Misima, work is continuing to find optimal funding and development options given that the large-scale, long-life, low-cost open pit gold and silver mine presents a high-leverage opportunity on the gold price.

A definitive feasibility study assumes a $1,800 per ounce gold price and 0.7 AUD:USD exchange rate, but applying a gold price scenario of $2,000 per ounce lifts the life of mine net present value (LOM NPV) to $1.3 billion, up from $956 million.

Year of strong operational performance

2023 was a successful and profitable year for Kingston, with Mineral Hill producing gold and silver to generate “excellent” cash flows, while being well-positioned for continued growth.

Highlights include:

- The project has generated operating cash flow of $22.6 million since its acquisition in January 2022.

- Record gold sales of 16,068 ounces from the Tailings Project at Mineral Hill

- Significant progress made on exploration and development initiatives, including multiple phases of drilling and updates to mineral resource and ore reserve estimates

- Received NSW Government's Critical Minerals and High-Tech Metals Activation Fund Stream 1 grant and secured additional funding to support Mineral Hill development and production expansion.

- Delivery of the life of mine (LOM) update, incorporating open pit and underground mining out to +2027.

Read more on Proactive Investors AU