Kingfisher (LON:KGF) Mining Ltd (ASX:KFM) has started preparations on-site at the Mick Well Project's carbonatite targets ahead of diamond drilling expected to begin in early August.

Drilling and works contractors have been engaged and all necessary approvals are in place for the Mick Well co-funded government exploration incentive scheme (EIS) drilling program.

Kingfisher non-executive chairman Warren Hallam said: “A significant amount of work has been undertaken defining a regional-scale REE field with over 20 kilometres of REE mineralised strike being identified and the defining of several large potential carbonatite pipe targets which could be a significant host of REE mineralisation.

“We are excited that initial works are now underway for the commencement of diamond drilling of these targets in early August.

"Kingfisher appreciates DEMIRS support for the co-funded drilling of these carbonatite pipes at Mick Well which attests to the potential for the discovery of another significant rare earth deposit.”

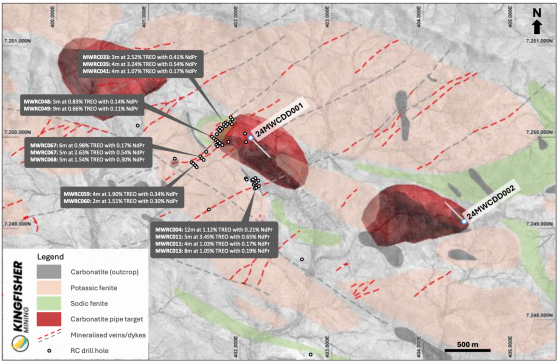

Mick Well mineralisation and proposed government co-funded drill holes. Drill results are shown in grey boxes.

Base metals opportunity

In addition to the drilling plans, Kingfisher is also reviewing the base metal opportunities within its Gascoyne tenure.

The company is evaluating VMS-style base metal mineralisation, including the reprocessing of historical induced polarisation (IP) geophysics survey over the Kingfisher prospect.

It is undertaking a field assessment of copper-bearing structures which outcrop for 2 kilometres and the old Kingfisher copper workings where prior exploration by Pasminco identified high-grade rock chips from spoil piles and limited wide-spaced historical RC drilling has intersected anomalous copper values.

Additionally, rock chips from recent field investigations and sampling of spoils from historic workings returned a number of high-grade copper results with values ranging from 1.73% up to 15.3% copper.

That review identified historical data including a base metal drilling intercept of 10 metres at 1% lead from 27 metres associated with a surface gossan at Mombo Creek. No follow-up ground-based geophysics has been undertaken.

Government co-funded drilling

The Department of Energy, Mines, Industry Regulation and Safety (DEMIRS) has awarded Kingfisher $200,000 co-funding for drilling of the Mick Well carbonatite pipe targets.

Three large carbonatite pipe targets at Mick Well have been identified below the company’s high-grade vein and dyke REE mineralisation discoveries.

These carbonatite pipe targets were generated through three-dimensional modelling of the company’s gravity and magnetics data, with areas with more dense and more magnetic rocks identified from the geophysics.

Each of the target pipes is more than 1,000 metres in diameter and close to surface, with the top of each target less than 50 metres below surface.

The co-funded drilling will target the central and eastern pipes, with additional drilling planned in other locations.

Carbonatite pipe targets at Mick Well, oblique three-dimensional view.

Read more on Proactive Investors AU