Kingfisher (LON:KGF) Mining Ltd (ASX:KFM) has made a deal to sell its entire stake in the Boolaloo Project to Black Cat Syndicate Ltd, which maintains a gold operation nearby.

Training attention on REE and lithium plays

This strategic divestment marks a big step by the company towards refocusing resources and expertise on the exploration and development of its key REE and lithium projects in the Gascoyne region.

Kingfisher now plans to concentrate on its promising Mick Well Rare Earth Elements (REE) and Chalby Chalby Lithium projects.

The deal involves the transfer of 100% interest in the Boolaloo Project, near Black Cat's Paulsens Gold Operation, while allowing Kingfisher to retain exposure to the project’s value through shares and royalties.

Kingfisher will receive two million fully paid ordinary shares in Black Cat, worth $560,000, and a 0.5% net smelter return royalty on gold and copper from Boolaloo tenements.

This agreement not only provides Kingfisher with a stake in a near-term gold producer but also ensures a continuous earnings potential through royalties.

The completion of this transaction signifies a pivotal shift for Kingfisher. It allows the company to direct its exploration expenditure wholly towards its Gascoyne projects.

Kingfisher executive director and CEO James Farrell said: “The sale of the Boolaloo Project, when completed, allows Kingfisher to focus its full effort on the continuing discovery of rare earth elements and lithium through our ongoing exploration in the highly prospective Gascoyne region.

“The transaction provides Kingfisher with an investment in a near-term gold producer as well as royalties over copper and gold produced from the Boolaloo Project.

“We wish Black Cat the best of luck with its future exploration campaigns in the area as it moves towards production at its Paulsens Gold Operation.”

Focus on Gascoyne projects

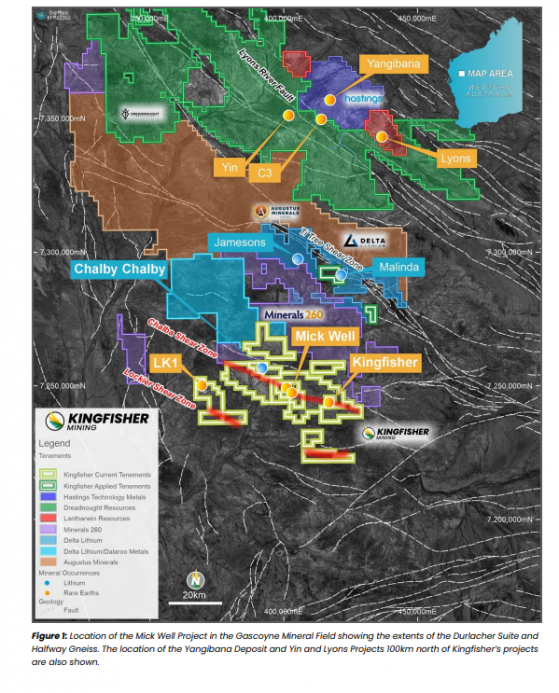

Kingfisher's Gascoyne portfolio, including the Mick Well REE Project and Chalby Chalby Lithium Project, spans more than 969 square kilometres in Western Australia.

These projects are notable for their potential in carbonatite REE mineralisation and lithium-bearing pegmatites.

Recent discoveries in these areas have yielded significant results, bolstering Kingfisher's position in these critical mineral sectors, which are in high demand in various industries, including technology and renewable energy.

Read more on Proactive Investors AU