Kinetiko Energy Ltd (ASX:KKO, OTC:KKOEF) has completed spudding the first two core wells in ER272 near the Secunda refinery in South Africa, with wireline logging results establishing significant sandstone gas intervals in both wells of more than 100 metres.

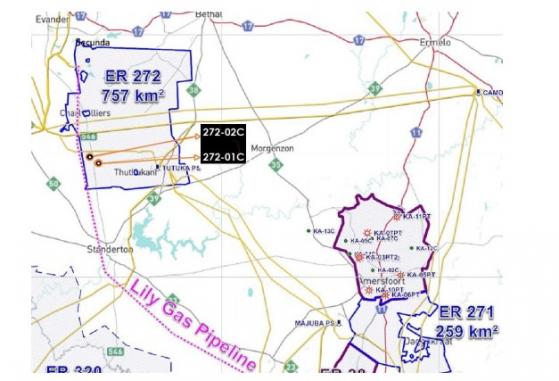

The company spudded core well 272-01C and 272-02C in early May with the wells in close proximity to Sasol’s Secunda refinery (potential gas off-taker) and South Africa’s largest gas pipeline, the Lily pipeline.

Kinetiko isn’t stopping there and has accelerated dual rig exploration with two further core wells expected to be spudded in ER272 this week.

Evolutionary path

The company expects to play a key role in regional supply in a nation hungry for energy.

”It is always very rewarding to enter a new exploration block and have such an unexpectedly high level of success in the initial core holes,” Kinetiko CEO Nick de Blocq said.

“The TD (Terminal Depth) was shallower than what we encountered further south, just as predicted, due to the sloping nature of the Karoo basement structures; so the logged stratigraphy returning over 100 metres of gassy pay in both 272-01C and 272-02C was a most encouraging outcome.

"We are in the process of moving the two core rigs to sites 272-06C and 272-08C due to the logistical expedience of proximity, and we have no reason to expect anything but success from these core holes as well.

“Of course, the strategical placement of the current exploration effort so close to Secunda is obvious.

"Sasol runs one of the world’s biggest and best coal-to-liquids plant at Secunda, and they have stated their need to move towards a gas-to-liquids conversion as they reduce pollution whilst increasing the quantum of their fuels output going forward. We absolutely expect to be a large part of that positive evolution towards greener liquid fuels.”

Gas intersection

The initial logging results from the first two core wells appear promising, indicating a richer concentration of gaseous sandstone compared to other areas previously explored by the company.

This newfound ratio, like those identified in numerous ER271 core wells, demonstrates the potential for further net pay of more than 100 metres. Interestingly, these findings come with a significantly reduced cost per well, largely due to the shallower well depth in ER272.

The first exploration hole in Northern ER272 – Core Well 272-01C – is less than 100 metres from the Lily Gas Pipeline. Results from this well have identified a substantial 101-metre interval of sandstone gas.

Figure 1 below shows where sandstone intervals are indicated by a pink shading. The presence of gas is confirmed through a crossover observed between the neutron porosity curve (depicted by a blue line on the right track) and the density porosity curve (represented by a red line on the right track), as shown in Figure 2 further down.

Locations of core wells 272-01C and 272-02C in proximity to major energy infrastructure.

This promising start in ER272 indicates a strategic direction that could significantly enhance the company's operational efficiency and profitability.

Well 2

The core well 272-02C, the second in ER272's series of gas exploration wells, has provided notable logging results.

These findings indicate an even greater span of sandstone intervals compared to its predecessor, core well 272-01C, measuring a substantial 117 metres. Figure 2 visually demonstrates these results, using pink shading to represent sandstone intervals detected by gas effect.

Core well 272-01C wire line logging results illustrating 101-metre gas pay zone.

Once again, gas presence is confirmed through an identifiable crossover point between the neutron porosity curve, illustrated by a blue line on the right track, and the density porosity curve, shown as a red line on the same track.

As depicted in Figure 3, core well 272-02C's promising results further reinforce the potential of ER272 as a highly valuable asset for gas exploration.

Core well 272-02C wire line logging results illustrating 117-metre gas pay zone.

The company continues to drill more wells as it looks toward a potential boost in production rates.

Read more on Proactive Investors AU