Kin Mining NL (ASX:KIN) has increased its holding in Dacian Gold Limited to 7.34% following further on-market purchases.

The company has been accumulating on-market shares of Dacian since late August 2022 and views the latter’s assets as good value at current prices, while also being a strategic play to bring in Daclan as a bridging source to ore as it advances its long-term strategy.

Dacian is currently the subject of an off-market takeover bid by Genesis Minerals (ASX:GMD) Ltd, which is scheduled to close on November 21, 2022.

Why Dacian?

Kin’s strategic holding in Dacian is to ensure that it can participate in any future consolidation, while also ensuring that available milling capacity is appropriately utilised.

Dacian’s 3.0 million tonnes per annum Mt Morgans treatment plant, located adjacent to its mineral resource of 38.8 million tonnes at 1.8 g/t gold for 2.2 million ounces, is a strategically valuable asset that will play an important role in the inevitable consolidation of the Leonora district.

With consolidation in mind, Kin has welcomed Genesis’ activities, including its bid for majority ownership of Dacian.

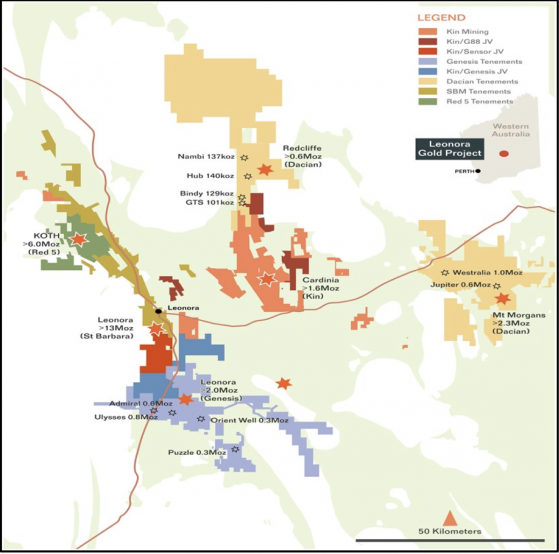

Kin’s 1.4-million-ounce Cardinia Gold Project has significant strategic value in any future consolidation of the Leonora region, which has an oversupply of milling capacity with ~9 million tonnes per annum available and a shortage of immediately available mining inventory.

Kin has several development-ready deposits (with ~100,000 ounces of resources fully permitted, approvals pending for a further ~100,000 ounces and applications to be lodged for a further ~200,000 ounces in Q4 2022). It believes that these deposits have strategic value in the region with the potential to provide near-term mill feed which could assist Dacian as a bridging source of ore while it advances its longer-term strategy.

Dacian recently sought expressions of interest for the provision of ore supply to the Mt Morgans treatment facility, which is just 87 kilometres to the southeast of Kin’s Cardinia mining centre. Kin has previously engaged with Dacian and will continue to do so to examine processing opportunities on acceptable commercial terms for Cardinia ore through the Mt Morgans treatment plant.

Location plan of the Cardinia project relative to the Leonora region.

Evaluating all opportunities

Kin Mining managing director Andrew Munckton said of the company’s increased stake in Daclan, “While Kin continues to build its mineral resources through exploration to support a standalone processing facility, we continue to evaluate all early, low capital cost opportunities to monetise parts of our resource base, if this makes commercial sense.

“Approximately half of our 1.4-million-ounce mineral resource, which is predominantly oxide and transitional material, is best suited to the conventional grind and leach processing technology offered by Mt Morgans and other processing facilities located within our sphere of influence.

"Kin’s fresh sulphide ores are optimally suited to flotation and concentrate fine grinding prior to leaching, however, these sulphide ores still perform acceptably through conventional processing in the absence of a suitable flotation and fine grinding facility.”

The company’s central landholding in Leonora, sizeable mineral resource estimate, recent exploration successes and partial ownership of a key asset through the Dacian share acquisition, could set it up to be a significant player in the Leonora region in the future.

Read more on Proactive Investors AU