Kalamazoo Resources Ltd (ASX:KZR) is set to spin out its Australian lithium projects into a new ASX-listed exploration company, via a demerger and concurrent initial public offering (IPO) of Kali Metals Ltd (proposed ASX code: KM1).

Kalamazoo has entered an agreement with TSX-listed Canadian gold miner Karora Resources Inc. (TSX:KRR) whereby at IPO, Karora will vend into Kali its highly prospective Higginsville Lithium Project in WA.

At listing, Kali will be a leading Australian critical minerals exploration company, having consolidated significant lithium and critical minerals tenure totalling ~3,833 square kilometres and will have an experienced management team and board.

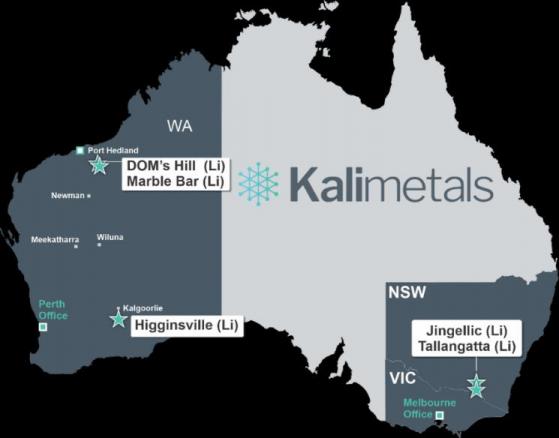

Location of Kali Metals’ portfolio of lithium exploration projects.

The spin-out of Kali will enable Kalamazoo to focus its attention on the ongoing development of its gold assets in the Pilbara, particularly at the Ashburton Gold Project, where a new 16.2 million tonnes at 2.8 g/t gold for 1.44 million ounces resource was announced recently, and across its highly prospective gold projects in Victoria.

Kalamazoo chairman and CEO Luke Reinehr said: “With Kalamazoo's primary focus on gold, we have contemplated spinning out our Pilbara and Lachlan Fold Belt lithium projects for quite some time now.

“When the opportunity arose to join with Karora, into what we consider will be a significant critical minerals exploration company in Australia, the rationale was compelling.

“We are delighted to have reached an agreement with Karora that will see our lithium portfolio combined with its highly prospective tenement package located in a Tier 1 lithium mining jurisdiction.”

Location of Higginsville Lithium Project.

Kali will be led by Graeme Sloan as managing director and Kalamazoo’s chairman/CEO Luke Reinehr as non-executive chairman.

Kali’s extensive exploration portfolio will be adjacent to world-class lithium mines and deposits in the Eastern Yilgarn (1,607 square kilometres) and Pilbara (199 square kilometres) WA, and prospective greenfields lithium exploration projects in the Lachlan Fold Belt (2,027 square kilometres) in NSW and VIC.

Kali is expected to raise $10 million to $12 million at IPO to fund its exploration and drilling plans across the combined Australian lithium portfolio.

Kalamazoo will own 55% of Kali, with Karora owning the remaining 45% prior to IPO.

The IPO will provide Kalamazoo shareholders with an initial 25% in-specie distribution of its Kali shares and a priority entitlement to subscribe for shares in Kali, subject to final shareholder and regulatory approvals.

“Unrivalled portfolio of assets”

Reinehr added: “The spin-out will result in the establishment of Kali as a well-funded ASX-listed lithium explorer, with an unrivalled portfolio of assets located in the hottest hard-rock lithium regions, not just in Australia, but globally.

“The spin-out of Kali will provide our shareholders with ongoing exposure to these expanded assets and strategy via an initial in-specie distribution of its shares in Kali.

“In addition, Kalamazoo shareholders will have the right to subscribe for additional shares, should they wish to participate in Kali’s IPO on a priority entitlement basis.”

Read more on Proactive Investors AU