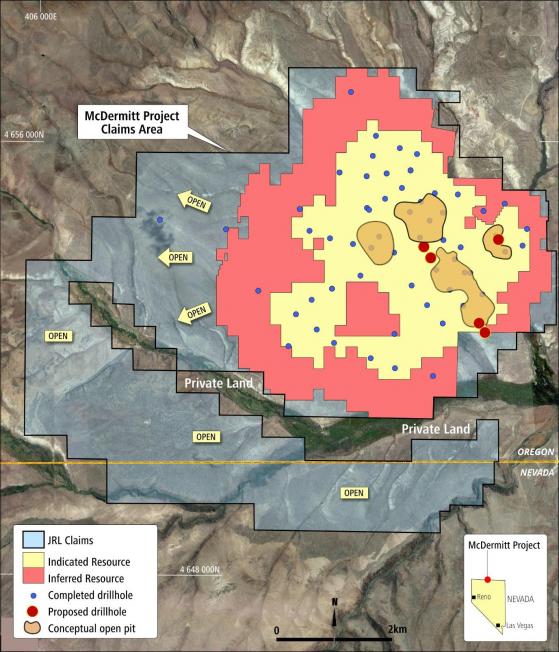

Jindalee Resources Ltd (ASX:JRL) has appointed a drilling contractor ahead of the upcoming infill drilling program at its McDermitt Lithium Project in Oregon, USA, that’s set to commence in the weeks ahead.

McDermitt is the largest lithium deposit in the US and a globally significant resource by contained lithium, at 21.5 million tonnes lithium carbonate equivalent (LCE).

Jindalee has contracted Alford Drilling to undertake the diamond core drilling program, which is designed to provide geotechnical information for the pre-feasibility study (PFS) and confirm data from earlier reverse circulation (RC) drilling.

Drilling is set to commence on November 1 once final approvals are received from the Bureau of Land Management. The proposed drilling program comprises five HQ triple tube core holes collared within, or immediately adjacent to, conceptual Pit Shell (LON:RDSa) 5 (nominal 20 years).

Assays from the drilling are expected in early 2024.

Lithium Americas' Thacker Pass points to upside potential

The McDermitt Lithium Project sits at the northern end of the McDermitt Caldera, about 35 kilometres north of the Thacker Pass deposit, owned by Lithium Americas.

McDermitt has an indicated and inferred mineral resource inventory of 3 billion tonnes at 1,340 parts per million (ppm) lithium for a total of 21.5 million tonnes LCE at 1,000 ppm cut-off grade.

Lithium Americas’ flagship Thacker Pass Project has a 19.1 million tonne resource, is fully permitted and currently under construction.

As announced last week, Lithium Americas is separating out its Argentinian assets as Lithium Americas Argentina. The split saw General Motors (NYSE:GM) purchase US$330M in Lithium Americas shares, taking its total investment to US$650 million or 9.4% of issued capital. GM has an agreement to acquire 100% of lithium carbonate from phase one production (40,000 tpa LCE) at Thacker Pass.

The recent progress at the Thacker Pass Project is very encouraging to Jindalee as it has positive implications for the potential development of McDermitt.

Jindalee recently compared McDermitt and its market valuation — at around $100 million— to Thacker Pass and Lithium Americas’ C$2.51 billion ($2.87 billion) market cap.

@JindaleeL notes a recent corporate action to demerge @LithiumAmericas US & Argentinian #Li assets ????????????????Thacker Pass, located near $JRL's #McDermitt #Lithium Project, is now the flagship asset of LAC.NYSE & hosts a mkt cap of ~USD$1.9B#comparethepair pic.twitter.com/nURmdLY45q

— Jindalee Resources Ltd (ASX:JRL) (@JindaleeL) October 5, 2023