Jensen Huang co-founded Nvidia Corporation in 1993 with a focus: Create technology that will revolutionise the video games market.

Bear in mind that in 1993, the video games industry was essentially kids pumping coins into Street Fighter II at the local arcade, or even younger kids pushing 2D Mario sprites across a blocky TV screen.

Few predicted that gaming would become a US$200bn market a few decades later, eclipsing the music and film industries combined.

Huang must have had a hunch though, as the graphics processing unit (GPU) technology his company invented is today one of the fundamental underpinnings of gaming as we know it – and now the growth engine for artificial intelligence (AI).

It was a huge gamble on Huang’s part, coming from a cushy job as a chip designer at future competitor AMD to try his luck in what was then a sub-billion-dollar total addressable market.

It paid off massively. At the turn of the millennium, Nvidia signed a landmark $500mln-a-year deal to supply the graphics for Microsoft’s revolutionary Xbox console, thus implanting Nvidia as the undeniable leader in graphics processing tech for the exponentially growing gaming industry.

Yet despite the undeniable influence Nvidia has had on the technology sector, and the fact that he basically invented the modern GPU, commander-in-chief Jensen Huang - born in Taiwan as Jen-Hsun Huang - never became the household name that Musk, Zuckerberg and Jobs did. At least not yet.

Perhaps it’s down to the nature of Nvidia as a company.

Despite being one of the great drivers of technological innovation of the past three decades, and despite being among the 10 most valuable companies on Earth, Nvidia is not ubiquitous in everyday life.

Its graphics cards are stuffed inside the guts of powerful gaming rigs, or large-language AI systems, or - much to the group’s disdain - massive cryptocurrency mining farms.

Nvidia’s lime green logo is not shoved in your face whenever you flip your phone or laptop on, or whenever you get stuck in traffic.

Huang, too, lacks the ostentatious sensibilities of fellow Tech Bros, certainly compared to Musk anyway.

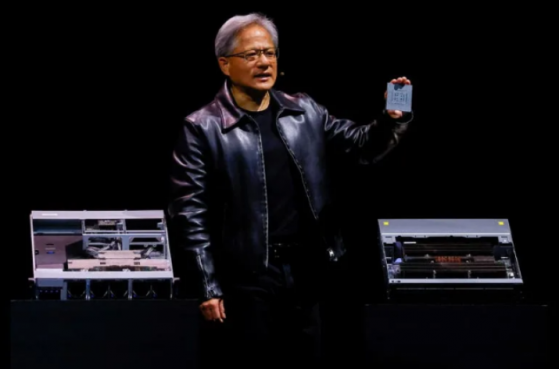

Which is not to say Huang isn’t prone to bouts of hubris, or a fine leather jacket.

The well-Huang look, courtesy of a fine leather jacket – Credit: Yahoo

As he told students at Stanford University, his alma mater, back in 2003, when Nvidia was merely valued in the low-single-digit billions: “My will to survive exceeds almost everybody else's will to kill me.”

He had good reason to feel vindicated.

Nvidia survived the big tech purge of the late ‘90s and proceeded to fend off every single competitor in what was, at the time, an overcrowded GPU market that he essentially created.

It is also not to say that Huang is not prone to massive, bet-the-company risks.

What's the difference between a GPU and CPU?GPUs (or graphics processing units) were first developed as a more powerful alternative to existing CPUs (central processing units).

The first CPUs came about in the mid-20th century, while GPUs were standardised by Nvidia in the late 90s (there were more rudimentary predecessors being developed since the late 80s).

Both process data, but GPUs are significantly more powerful due to their parallel-processing infrastructure. This makes them well-suited for processing large amounts of data simultaneously, a crucial trait for advanced computational needs.

CPUs are typically found in low and mid-range laptops, while GPUs are synonymous with gaming. However, GPUs have found new uses in the AI, machine-learning and cryptocurrency industries due to their ability to handle far more computations than CPUs.

Nvidia’s coup d'état

Coming fresh off Nvidia’s lucrative Xbox deal, Huang began diverting resources away from the gaming industry in the late Noughties to develop a weird programming language called CUDA (or Compute Unified Device Architecture).

With CUDA, Huang was looking to tap into biotech, science and other cutting-edge industries outside of gaming.

Not only was Nvidia pivoting away from gaming, but Huang was diverting huge sums of cash into what, to this day, is an entirely free programming language since launching 2006.

What followed was a troubling period for Nvidia. Amid a global financial crisis and a few earnings misses, the company’s stock plummeted by 80% between December 2007 and December 2008.

Yet, just as gaming proved the right call, Huang’s CUDA pivot was ultimately an act of genius.

As was CUDA’s coup d'état: Yes, it is free to use. But it is also a proprietary language that only works on Nvidia GPUs.

For the technically minded, Acquired podcast’s detailed breakdown of the Nvidia story goes into the technical details of why CUDA was a brilliant move.

From a business standpoint, the importance of Huang’s huge CUDA gamble cannot be overstated, for it sowed the seeds of what would become the next great chapter in the Nvidia story.

From gaming giants to AI superpower

Nvidia today is a decidedly more difficult company to define.

In the 90s it was simple: Nvidia made GPUs.

But in 2023, though Nvidia remains the clear market leader in the GPU industry (with over 80% of market share), the group is becoming synonymous with artificial intelligence and deep learning.

Let’s not forget that OpenAI used some 10,000 Nvidia processing units to train its game-changing ChatGPT large-language model.

But that is only scratching the surface of what Nvidia is currently working on.

Nvidia’s Omniverse 3D modelling technology stack is being used by some of the world’s largest automobile companies to create exact digital replicas of their manufacturing warehouses. That’s just one use case.

Now, it appears that Nvidia wants to predict the future of humanity.

It’s called the Earth-2 initiative. Nvidia calls it “one of the most ambitious efforts in the history of computing”.

Can Nvidia predict the climate future of Earth? -- Credit: Nvidia

“We will dedicate ourselves and our significant resources to direct NVIDIA’s scale and expertise in computational sciences, to join with the world’s climate science community,” Huang said when he announced the Earth-2 initiative in late 2021.

More recently, in June 2023, Huang joined the EVE for Climate Summit to expand the concept: "EVE’s vision to understand future climate impacts at kilometer scale is a grand challenge that demands simultaneous breakthroughs in modeling, computing, and AI."

NVIDIA (NASDAQ:NVDA) is working with the EVE community to provide a path to simulate and visualise the global atmosphere at unprecedented speed and scale, using cutting-edge AI for physics simulation, accelerated scientific computing and advanced data infrastructure.”

Whatever happened to keeping things simple? Back in 2003, speaking to those Stanford students, Huang espoused the virtues of not overcomplicating things.

“Having simpler ideas that you can execute perfectly is sometimes better than having a grandiose idea that your company can't execute on it,” he said 20 years ago. “When you get large as a company and when you're trying to do complicated things, in fact, it is best, it is most prudent to keep it simple.”

Bet the company 2.0

So once again, Huang has put gaming aside to focus on grander ambitions. Can he get away with betting the company yet another time?

It’s certainly working for the moment: The company Huang founded 30 years ago joined the one-trillion-dollar club in June of this year.

Nvidia stock is up 200% this year alone; almost unheard of for a corporation at this scale.

Will the bubble burst, or does Huang know exactly what he is doing? His company bets have paid off in the past, but as everyone in the world of investing knows, past performance is no indication of future returns.

Read more on Proactive Investors AU