(Bloomberg) -- It’s going to be Janet Yellen’s Federal Reserve no matter who is the next chair.

With every headline, financial markets get jolted as investors guess whether President Donald Trump will re-nominate Yellen to the helm of the U.S. central bank or opt for a more hawkish successor such as Stanford University economist John Taylor. Fed chairs matter. If credible, they influence dozens of policies, from regulation to research.

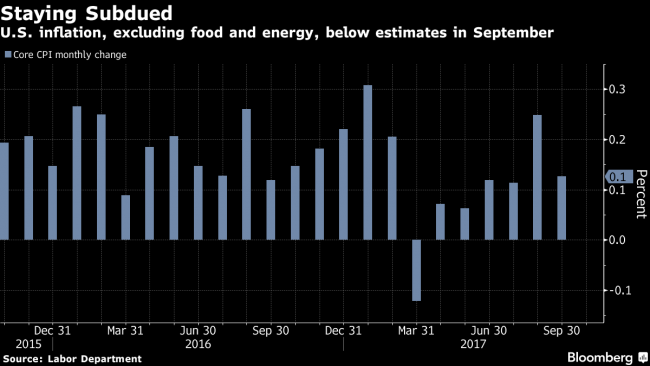

But on monetary policy, Yellen’s strategy of gradual rate hikes, and ultra-slow balance sheet runoff, will be difficult for any newcomer to quickly change. The Fed is guided by the goals Congress set for it, what the data say about those goals, and its forecast of how fast it’s going to achieve them. And right now, it has missed its inflation goal for most of the past five years, with the data showing scant sign of a breakout to galloping growth.

“I don’t think the fundamentals of the economy allow you to change the policy path that much,” said Seth Carpenter, chief U.S. economist for UBS Securities, and a former Fed economist. “The biggest opportunity for change is with respect to balance sheet policy, and even there I find it hard to see how much change” a newcomer can bring.

Trump said this week he’s “very, very close" to announcing his pick for the new Fed chair, who will need Senate confirmation. In a Fox News interview broadcast Sunday, the president specifically mentioned Yellen, Taylor and Fed governor Jerome Powell, without precluding other choices.

Yellen and Powell, who has never dissented since his arrival at the Board in May 2012, would be continuity choices.

Taylor brings a different framework. If he gets the job, there is little doubt that his influence will be large over the longer run. In the near term, however, the biggest change under a Taylor Fed might be in the area of transparency, said Andrew Levin, a former student of Taylor’s and a Dartmouth College professor.

“He would make monetary policy more clear, more transparent, and more accountable to Congress,” Levin added.

Gradual Pace

Under Yellen, the Federal Open Market Committee has raised the benchmark lending rate just four times since December 2015 to a range of 1 percent to 1.25 percent. Officials agreed to take several years to shrink the balance sheet, a process that started this month. They have penciled in one more hike this year, for a total of three, and possibly three more next year.

The policy future is going to look at lot like the recent policy past, said Nathan Sheets, chief economist at PGIM Fixed Income, an asset management arm of Prudential Financial Inc (NYSE:PRU).

“The current FOMC has said that it is going to be moving three times next year,” said Sheets, a former division director at the Fed board. “I would think it would be roughly that -- no matter who is chair.”

The pattern of gradualism has been dictated by several economic conundrums, the most important being that the link from low unemployment to higher inflation seems to be much weaker than in the past. Growth in productivity -- output per hour -- has also been unusually low, and that’s blamed by many economists for holding down wages and growth.

Much of the debate about how Taylor, or any new chair, would approach these problems revolves around an obscure economic concept known as the neutral policy rate -- the theoretical level that keeps supply and demand in balance.

Raise rates too high above neutral, and the economy slows as demand is constrained. Keep rates too far below neutral and demand exceeds supply, pushing up prices and potentially stoking asset bubbles. Problem is, it can’t be directly measured, though officials think it’s low. Fed projections in September imply a real neutral rate of 0.8 percent, after adjusting for inflation, and some estimates place it below zero.

Most importantly, the neutral rate, known by economists as R-star, is an input into Taylor’s eponymous rule on monetary policy. Taylor has resisted tampering with his neutral rate estimate of 2 percent, after inflation, although last year he said there is “a lot of disagreement and uncertainty” around estimates. Using his baseline spits out a Taylor Rule rate recommendation of around 3.75 percent.

“The only reason Taylor is a high-rate person” in the minds of investors “is that he has a dramatically higher R-star estimate than anybody else on the committee,” said former Fed Governor Laurence Meyer, who doesn’t think Taylor can convince the committee that the neutral rate is around 2 percent.

“Not a prayer in the world,” said Meyer, who now runs his own policy analysis firm. “FOMC decisions have become more consensus driven under Bernanke and Yellen. No going back.”

One area where a new chair could influence the committee is on the eventual size of the balance sheet, which will guide how monetary policy operates day-to-day.

Taylor says he wants to go back to a system where the federal funds rate is determined by demand for reserves, implying a small balance sheet. But he could face opposition from William Dudley, president of the New York Fed, which manages the central bank’s portfolio. Dudley favors an abundant reserve model and other officials lean the same way.

As a matter of policy, officials are keeping an open mind on the topic, saying in the minutes of their June meeting that they expect “to learn more” about the underlying demand for reserves as they gradually shrink the balance sheet.