StepN was one of the cryptocurrency sector’s big success stories when it launched in March this year after extensive beta testing.

Users quickly flocked to the Solana-based move-to-earn platform (M2E) by the thousands, enticed by the ability to earn actual money simply by exercising.

Co-founded in 2021 by Australian duo Jerry Huang and Yawn Rong, and supported with funding from Sequoia, Folius Ventures, Binance and others, developer Find Satoshi Labs took the existing play-to-earn concept seen in Axie Infinity and added a fitness spin.

By buying or renting a ‘sneaker NFT’, StepN users can earn rewards in the GMT cryptocurrency depending on how many real-world miles they clock up while running.

More expensive NFTs with better attributes generate higher rewards, with GMT’s tokenomics designed to facilitate payment of these rewards.

For a while StepN was the talk of the town: Come May, An average sneaker NFT set you back more than US$1,000, and GMT token surged over 2,000% in value in the first two months of trading.

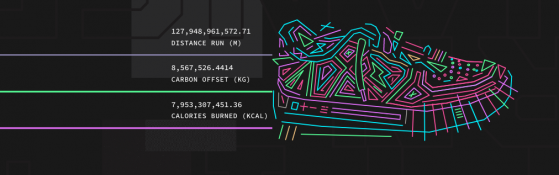

Nearly 128bn miles have been clocked up across all StepN users – Source: StepN.com

StepN became one of, if not the top trending decentralised applications (dApps) on Solana.

Cut to today, and the average sneaker NFT goes for only US$51, while GMT token has dropped nearly 90% in six months.

Is StepN just taking a breather, or is the world just not ready for an NFT-based, move-to-earn cryptocurrency dApp?

StepN’s macro stitch up

It would be unfair to put these crushing valuations purely at the feet of StepN.

This year has been one of the worst in the history of cryptocurrency, with some two trillion dollars wiped off global market capitalisation, multibillion-dollar coins crashing and burning, and large-scale crypto companies like Celsius and Voyager Digital (CSE:VYGR, OTCQX:VYGVF) filing for bankruptcy.

Not a single major digital asset has increased in value since the start of the year, and certainly not Solana (SOL), of which StepN’s NFTs are denominated.

In fact, having dipped 83% so far, SOL has underperformed considerably against ether, bitcoin, Cardano (ADA) and most other large-cap coins.

Combine that with the fact that NFT trading volumes have absolutely collapsed across the board, and there is no doubt that StepN is facing some incredibly adverse conditions.

The NFT market has crashed since January highs – Source: Dune Analytics @abhi_0x

It’s not like Find Satoshi Labs is ignorant of these issues.

In an open letter to the StepN community, the developers attempted to strike a reasonable tone while acknowledging the struggles they are facing.

“We’ve been reflecting on the past year,” went the letter, before offering some fairly vague promises of “focusing on the road ahead” and “working around the clock to build something new for our international community” all the while conceding that “much of the Web3 community at large has suffered over the past few months”.

StepN: A fancy Ponzi scheme?

A sophisticated website, doxxed team and collaborations with Japanese sports brand Asics has not fended off accusations that StepN more or less acts as a colourful Ponzi scheme.

The company addressed these claims in an April blog post and even a Vice article.

StepN is “way more sustainable” than the competition because of a tax on each side of the NFT transactions (i.e. when bought and sold), so users are rewarded even when someone exits, reckons the company.

While that is not wholly convincing, I would not label StepN a Ponzi scheme, at least not an intentional one.

When I spoke with chief operating officer Shiti Manghani earlier this year, she stressed that she does not want new users to simply become “liquidity for older players”, something Axie Infinity has been accused of.

Rather, “we want all people, both new and old, to earn and profit as well as keeping the focus on fitness and health”.

But Manghani also conceded that maintaining the value of GMT is a balancing act, and rampant growth “could potentially drag the token down to zero; people could cash out and burn”.

Herein lies the core issue: Play-to-earn games, by their very nature, rely on new users to maintain value for existing users. Sound familiar?

Good intentions or not, StepN has yet to prove the exception to the rule.

Proactive has asked StepN for a comment on the project’s progress.

Read more on Proactive Investors AU