Ioneer Ltd (ASX:INR, OTC:GSCCF)’s Rhyolite Ridge Lithium-Boron Project in Nevada is proving its pivotal role in the future electrification of transportation in the US, with a 145% increase in tonnage for the South Basin mineral resource estimate (MRE) to 360 million tonnes.

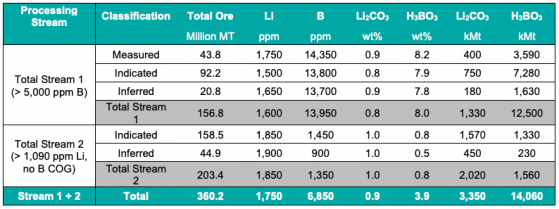

The JORC-compliant MRE contains 3.4 million tonnes of lithium carbonate equivalent (LCE), an increase of 168% and 14.1 million tonnes of boric acid equivalent (BAE), up 18%.

Notably, the MRE, which replaces the April 2020 mineral resource and ore reserves estimate for South Basin, includes high-boron lithium mineralisation and low-boron lithium mineralisation for the first time.

This provides the option for future growth opportunities, including increasing lithium production with or without increasing boron production.

About 80% of the MRE is classified as measured and indicated, with 44% classified as high-boron lithium mineralisation and 56% as low-boron lithium mineralisation.

Summary of South Basin March 2023 mineral resource estimate.

Open for increase

The MRE covers the project boundary currently being permitted under the Mine Plan of Operation, with all mineralised units remaining open to the north, south and east.

About 60% of the South Basin remains to be drilled, providing significant further resource growth potential.

The company is planning extension drilling, initially to the south, immediately upon receipt of final permitting.

Map showing South Basin (green), MRE area (grey) and location of east-west cross-section (black).

“Fantastic start”

Ioneer executive chairman James Calaway said: “We are extremely pleased with the significant increase in the South Basin mineral resource estimate.

"It highlights Rhyolite Ridge’s optionality and multi-generational scale potential to provide a secure, sustainable and reliable domestic source of lithium for the growing electric vehicle battery supply chain.”

Ioneer managing director Bernard Rowe added: “To date, we have focused heavily on progressing our development plan for Rhyolite Ridge.

“With binding offtakes in place, debt and equity commitments of nearly US$1.2 billion and the project in the final stage of permitting, we can now begin demonstrating the broader scale potential at Rhyolite Ridge.

“The updated mineral resource base for the South Basin is a fantastic start and we look forward to building on this further with significant growth potential through South Basin extensions as well as increased exploration efforts on the mineralised and much larger North Basin.”

About Ioneer

Ioneer holds 50% interest in and manages the Rhyolite Ridge Lithium-Boron Project, the only known lithium-boron deposit in North America and one of only two known such deposits in the world.

Sibanye-Stillwater holds the remaining 50% interest, subject to certain conditions being met under a September 2021 agreement.

In January this year, Ioneer received a conditional commitment from the US Department of Energy Loan Programs Office for up to US$700 million of debt financing.

The company also signed separate off-take agreements with Ford Motor Company (NYSE:F) and PPES, a joint venture between Toyota and Panasonic, in 2022 and Korea’s EcoPro Innovation in 2021.

Read more on Proactive Investors AU