A June quarter highlight for Iondrive Ltd (ASX:ION) was the progress made toward completing a pre-feasibility study (PFS) for its lithium-ion battery recycling technology, which remains on track for October 2024.

Battery recycling: PFS progressing

The PFS aims to de-risk the project’s commercialisation path while its timing seeks to build on Iondrive’s early mover advantage for its recycling technology, which provides a unique environmental value proposition compared to incumbent recycling processes in a rapidly growing battery recycling market.

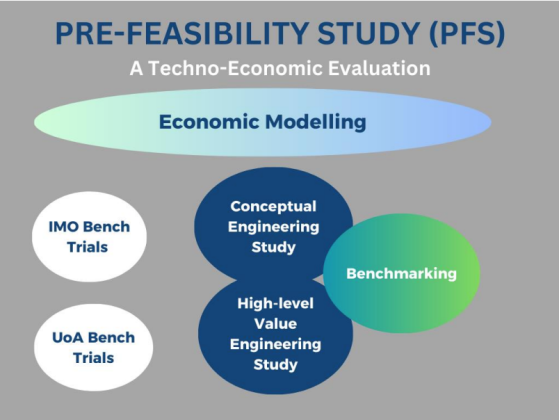

During the quarter, the PFS was advanced in a number of ways. This included completing the first phase of large-scale bench trials at the University of Adelaide.

Results from these trials included scalability of the high metal recoveries; and solvent losses of less than 2% with the potential to re-use the solvent (as the largest input cost, this is critical for economic viability).

Results of the second phase of large-scale bench trials, independent verification by IMO in Perth, are now being finalised and should be announced next week.

Overview of ION's PFS activities.

Additionally, during the quarter Iondrive partnered with Wood for the Conceptual Engineering Design of a 10,000 tonnes per annum commercial black mass processing plant, which is now underway.

The Wood study will help in commercialising Iondrive's battery recycling technology by defining the process, quantifying project economics and supporting the design of a scalable and efficient commercial plant.

Iondrive also commenced a benchmarking study with the Production Engineering of E-Mobility Components (PEM) department at RWTH Aachen University and initiated an engineering study with Koch Modular Process Systems. Both studies focus on optimising the economics of the process.

The quarter also featured discussions with potential collaboration partners, particularly in the EU, where the European Green Deal and new Batteries Regulation are generating a sense of urgency for sustainable battery recycling.

Exploration activities

Iondrive’s exploration activities in South Korea remain focused on those under an earn-in and joint venture agreement with KoBold Metals Company, on Iondrive's Samgeun, Seobyeok, Danyang, Seosan and Cheongpyeong lithium exploration projects.

As per the agreement, KoBold may earn a 75% interest in the five exploration projects through a two-stage earn-in arrangement of A$7 million over five years.

First assay results were reported during the quarter, featuring encouraging results from rock-chip samples from reconnaissance exploration conducted with KoBold at Samgeun, Seobyeok and Danyang.

Fieldwork recommenced in March after the winter period, with a comprehensive exploration program completed at the end of June across all of the lithium joint venture projects.

An updated statement of works (SOW) outlines the scope and cost of an exploration program through to September 2024, comprising some 270-person days of fieldwork.

Iondrive notes that it is in discussions with a number of interested parties regarding potential joint venture and/or cash sale of its other exploration assets, including rare earth elements (REE) and its gold-silver-copper projects.

Quarterly cashflows

Iondrive reported total net cash inflows of $400,000 for the quarter, consisting net cash outflows from operating activities of $618,000 and $158,000 inflow from KoBold for exploration costs reimbursement; inflows of $46,000 related to the disposal of surplus exploration equipment; and cash inflows of $992,000 from tranche 1 of the placement.

These cash flow movements resulted in a cash balance of $2.759 million at the quarter end.

The company also expects to lodge a Research & Development Tax Incentive claim in the September quarter in excess of $500,000, continued funding of the South Korean exploration operations by KoBold and $933,000 proceeds from the expected completion of tranche 2 of the placement.

Read more on Proactive Investors AU