Boston-based MFS investment management portfolio manager and global investment strategist Robert Almeida says: “We’re careening toward the point where fundamentals drive valuations rather than discount rates or maneuvers by policymakers. Central banks cannot fix businesses that are broken.”

To combat this, investors need to ask the right questions around the terminal value of companies.

Are these the right questions?

Following the inflation ambush in 2022, elevated inflation prints have fallen, as has the volatility of inflation, which has whipsawed investors.

In late April, I wrote about how the then-recent inflation readings were higher than market expectations, which was not a surprise to those who buy groceries or pay utility bills.

A similar pattern has played out in the last few weeks, but this time in the other direction, with direct and indirect inflation figures surprising to the downside. As a result, talk of US Federal Reserve rate cuts has been revived.

I am not dismissing the growing probability the market is assigning to a rate cut in September or the months after. But as the title of this piece suggests, I think investors may be asking the wrong questions.

Are 'When will the first rate cut be?' and 'How many times will the Fed cut in 2024?' the right questions? Do the answers really matter? In 2028, when you’re digesting a five-year attribution analysis of a portfolio, will the timing of that first-rate cut be a factor?

Better questions to consider

Perhaps a more relevant question could be why might the central bank need to loosen monetary policy?

More importantly, if prices of goods and services are falling, whose revenue is being negatively impacted? Are their costs falling too? What will this mean for corporate profits compared with what has been discounted in stock prices?

So, while the market is happily applying a higher multiple to risk assets because of a potentially lower discount rate, it’s ignoring what mounting weakness may tell us about company fundamentals, and that’s what matters most to asset values.

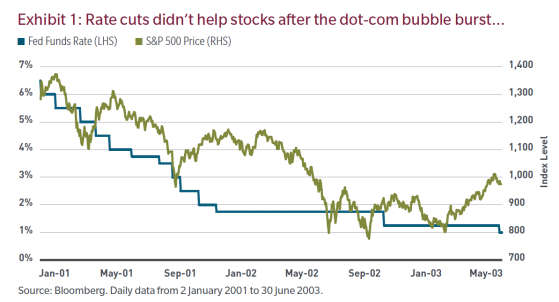

Let’s look at what happened during the interest rate cutting cycle that followed the end of the technology boom in the 1990s.

In early 2001, fed funds peaked at 6%. Caught by surprise by a sharp growth slowdown, the Fed cut rates aggressively over the next 18 months to 1%. While the equity market troughed before the Fed’s penultimate cut, as profits had already bottomed and were poised to improve on the back of massive cuts to costs, the S&P 500 index fell almost 40%.

A pushback to this is that valuations aren’t as elevated today as they were then. Which is correct, and why I’m not suggesting we’re facing a drawdown of that magnitude. I’m merely pointing out that central bank interest rate cuts are not a near-term panacea for disappointing operating results.

So, while valuations are not at 1990s extremes — which were the highest in US history — analysts’ expectations are for high, single-digit profit growth. Anything that comes in below that will prove disappointing to investors who have alternatives beyond the equity market.

We can also look at what happened during the rate-cutting cycle following the mid-2000s expansion and housing bubble, since stock valuations were not expensive heading into that recession.

As the chart below shows, fed funds peaked at 4.25% in early 2008 and then collapsed to 0% before the year was finished. At the same time, the S&P 500 was nearly cut in half.

What matters

Ever since 2022, inflation and central bank policy has been fresh on everyone’s minds. Or, arguably, even longer, dating back to the days of zero interest rate policy and quantitative easing, which produced a 5,000-year low in borrowing costs.

Recency bias, along with other cognitive biases, can be dangerous. In our brains, the biases can sometimes usurp, or at the least dilute, what is material, which in the case of investing, are fundamentals and future cash flows.

The right answers to the right questions, I think, rhymes with terminal value. What does the company do? How are they managing rising labor costs against falling prices for their goods?

While artificial intelligence may bring efficiencies and savings, does it open the door to competitors with fresh entrants coming to market faster with equal or better products? Does AI introduce obsolescence risk to their business? How much debt do they need to roll in the next few years, and at what cost? Is that in equity analysts’ models?

I believe we’re careening toward the point where fundamentals drive valuations rather than discount rates or manoeuvres by policymakers.

Central banks cannot fix businesses that are broken.

Robert M. Almeida Jr. is an investment officer and global investment strategist for MFS Investment Management® (MFS®), offering insight and perspective on cyclical and secular trends impacting investors. He also serves as a member of the portfolio management teams for multiasset income and alternative strategies. Rob joined MFS in 1999 and served as an institutional portfolio manager for the Fixed Income Department from 2007 through 2009. He joined the US Growth Equity team in 2009 and became a portfolio manager in 2014. He added additional portfolio management responsibilities in 2018 and assumed his current strategist title in 2019.

Read more on Proactive Investors AU