International Graphite Ltd (ASX:IG6) has presented a compelling development pathway for its Collie Graphite Battery Anode Material (BAM) Facility by releasing a scoping study showing the production of high-grade battery anode materials to generate significant financial returns.

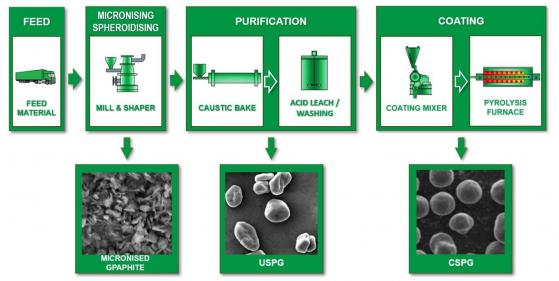

The flowsheet involves graphite micronising, spheroidising and non-HF chemical purification, to produce uncoated spheroidised purified graphite (USPG), then carbon coating to produce coated spheroidised purified graphite (CSPG).

Simplified overall flowsheet.

International Graphite managing director and CEO Andrew Worland said: “Our expert graphite metallurgists and engineers have applied their collective expertise in graphite metallurgy, process design, flowsheet development, estimation and markets, to present a compelling development pathway for the Collie Graphite BAM Facility.

“The economics are outstanding and there are many opportunities to improve the cost structure with further test work.

“The financial modelling of the Scoping Study applies long term forecast pricing for CSPG.

“Current and forecast natural graphite supply is well below the levels required to meet global decarbonisation goals from the uses of the lithium-ion battery.

“The plant has been designed as two parallel lines and could be implemented in stages, including developing a USPG facility in the first instance before expanding into coating.”

Net present value of US$626 million

Worland added: “The total capital cost to produce CSPG is estimated at approximately US$222M and its operations are forecast to deliver a pre-tax – pre finance NPV10 of approximately US$626M and IRR of approximately 41%.”

“As an initial step, the total capital cost to produce USPG is estimated at approximately US$87M and its operations are forecast to deliver a pre-tax – pre finance NPV10 of approximately US$290M and IRR of approximately 48%.”

Summary of key findings.

Key attributes of the Collie Graphite BAM Facility scoping study:

- Capable of processing up to 40kt/y (thousands of tonnes per year) of graphite concentrates.

- CSPG facilities:

- Producing up to 18.6kt/y of CSPG and 17kt/y of micronised by-products.

- Total capital cost estimate to produce CSPG - US$222M including contingency (AUD$317M).

- Annualised operating cost including cost of concentrate feed net of micronised byproduct credits (assuming sales pricing of US$500-800/t by-product) approximately: US$3,175/t CSPG produced.

- Pre-tax, pre-finance NPV10 (pre-tax discount rate 10%) and IRR approximately: US$626M (AUD$894M) / 41%.

- Annual average revenue: US$172M and EBITDA: US$100M.

- USPG facilities only:

- Producing up to 20kt/y of USPG and 17kt/y of micronised by-products.

- Total capital cost estimate to produce USPG - US$87M including contingency (AUD$124M).

- Annualised operating cost including cost of concentrate feed net of micronised byproduct credits (assuming sales pricing of US$500-800/t by-product) approximately: US$2,029/t USPG produced.

- Pre-tax, pre-finance NPV10 and IRR approximately: US$290M (AUD$412M) / 48%.

- Annual average revenue approximately: US$95M and EBITDA: US$43M

The next stage of technical development for the Collie Graphite BAM Facility includes:

- Site selection and infrastructure development at Collie.

- Ongoing test work to further develop and optimise the BAM flowsheet.

- Reviewing staged BAM development options.

- Progressing BAM sales and marketing agreements with customers.

- Completing an integrated definitive feasibility study for the development and operation of the Springdale Graphite Project and Collie Graphite BAM Facility targeting Q3 2024, with various development updates on that path.

- BAM product qualification processes.

“Whilst the financial forecasts for the Scoping Study are based on the purchase of graphite concentrates from third party sources, it is the intention to integrate our 100% owned Springdale Graphite Project with the development of the Collie Graphite BAM Facility.

“When we have advanced Springdale to a sufficient level of detail to allow forecasts to be published, we will be able to update the Scoping Study accordingly.

“Springdale is located only 450km by road from Collie and we are seeking to build a streamlined and efficient ‘mine to market’ supply chain in the world’s most reputable and attractive jurisdiction for minerals investment.

“Australia’s reputation for excellence in mining and minerals processing and our rigorous ESG commitment will provide the highest standard BAM for the world’s lithium-ion battery makers.”

Read more on Proactive Investors AU