International Graphite Ltd (ASX:IG6) has achieved an impressive resource upgrade at the Springdale Graphite Project in Western Australia, which has now been revealed to be the second-largest graphite deposit in Australia.

An extensive drilling campaign over 2023 led to a 3.4-times upgrade to the Springdale mineral resource estimate, growing from 15.3 million tonnes at 6.0% total graphitic carbon (TGC) to 49.3 million tonnes at 6.5% TGC.

That resource also holds a higher-grade component of 28 million tonnes at 8.7% TGC, with 7.9 million tonnes at 9.3% TGC in the higher confidence indicated category and the remaining 20.1 million tonnes at 8.5% TGC categorised as inferred.

Resource upgrade surpasses expectations

“Not only have we significantly increased the size of the mineral resource, 27% of it (by contained graphite) is now at an Indicated category which provides a strong foundation for future technical and economic studies,” International Graphite founder and executive chair Phil Hearse said.

“This is a huge achievement for the business and an important milestone as we drive to establish ourselves as one of the first vertically integrated producers of battery anode graphite.

“These results show that Springdale has the mineral resource base to underpin our mine-to-market vision for decades to come.”

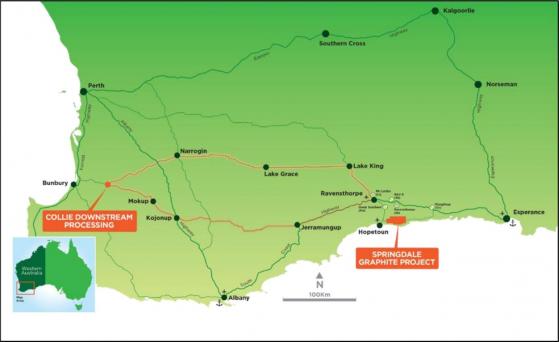

IG6 is developing an integrated battery metal value chain in Western Australia, with a processing facility under development at its site in Collie, where the company intends to produce battery anode material from its own Springdale graphite.

Graphite is one of the largest components of electric vehicle batteries by weight – accounting for on average 50-100 kilograms or about twice the amount of lithium – and considered a critical mineral by Australia, Japan, India, the US and the EU.

Ideally suited for battery applications

“We set out to upgrade the existing mineral resource and expand it,” IG6 managing director and CEO Andrew Worland said. “To expand it by almost three-and-a-half times, improve the overall grade and have over a quarter now classified as indicated, is testament to a well-planned and executed program by our technical team.

“We have only scratched the surface at Springdale. So far, exploration has been limited to approximately 10% of the Springdale tenement areas. More than 80% of the aeromagnetic anomalies on a portion of our tenure have yet to be tested.

“It is notable that 10% of the new mineral resource estimate stems from an exciting new graphite discovery at Mason Bay, two kilometres east of Springdale. Further drilling will seek to expand this resource.

“Across our tenements, there is significant potential for further mineral resource growth to be defined if we follow the same exploration model.

“Graphite mineralisation at Springdale is fine flake and ideally suited to a streamlined flowsheet producing a single concentrate feedstock for downstream processing and the lithium-ion battery market.

“Our team is now working to optimise the mine development pathway, planning further infill and exploration drilling and integrating Springdale with the company’s planned Graphite Battery Anode Facilities in Collie, Western Australia.”

Location of Springdale Graphite Project

Graphite supply dearth

IG6 is on track to be well positioned in the battery metals industry, considering most analysts are predicting a graphite shortage within the next few years as demand skyrockets from EV batteries.

Analysis by Benchmark Mineral Intelligence suggests that graphite will have the largest supply vs demand dearth of all critical minerals, with demand likely to grow by a factor of eight between 2020 and 2030, and 25 times by 2040.

That translates into a predicted supply shortfall of 30% for graphite, compared to 11% for lithium, 26% for nickel and 6% for cobalt.

This is particularly relevant as EVs generally need three times as much graphite to make a single graphite anode unit, a much higher conversion input than most other minerals.

Overall, if IG6 can realise its ambitions, Springdale is shaping up to be a nationally – if not globally – significant resource.

Read more on Proactive Investors AU