According to Morningstar Inc. data. 13 thematic funds focused exclusively on battery technologies and metals have been created in the past year. There are now 28 funds globally in this thematic from which investors can choose.

One of the goals for investors looking at the sector is to gain exposure to battery metal prices without the risk attached to individual mining projects, although they themselves can be beneficial if you choose the right project.

Another goal is to ally the battery thematic with ESG principles. Whether that be through an ETF or via investment in specific mining projects will be based on an investor’s risk profile.

In this article:

- Surging investor interest in battery metals

- A copper shortage looms

- The shortfall and prices

- Battery metals in the sustainability equation

- The copper shortage and the MCB

- Embracing the change

The battery thematic is currently one of the hottest among investors as they bet on a price supercycle created by the world’s shift towards electric vehicles and renewable energy.

The surge in investor interest is also due to government pledges to reach net zero emissions of greenhouse gases by the middle of the century.

That pledge alone will radically increase demand of battery metals.

“It’s a gold rush on steroids,” managing director of Benchmark Mineral Intelligence Simon Moores said.

Benchmark tracks the battery supply chain and has its finger on the pulse of this particular thematic.

“You’ve got the emergence of this green revolution where you have to build infrastructure from scratch. It’s not just China this time, it’s North America at the same time as China, and Europe at the same time as China,” Moores continued.

Former Xstrata boss Mick Davis founded battery metals investment firm Vision Blue Resources (VBR) in 2021.

Davis is attempting to seize the opportunity created by an ever-increasing need for battery metals, including vanadium, lithium, graphite, nickel, and cobalt.

He says supply of those materials was not keeping pace with demand growth and that the need for battery metals would “dwarf anything the mining industry has ever seen before, including the commodity impact of China’s industrialisation in the last 20 years.”

Analysts at Goldman Sachs (NYSE:NYSE:GS) and JP Morgan are also calling out a supercycle of rising commodity prices, like what occurred at the beginning of the 2000s, when China’s economic growth took off.

“Demand has caught up with supply and will be running ahead of supply for a long period of time now,” chief executive of Lithium Americas Jon Evans said.

Lithium expert Joe Lowry believes there are Chinese lithium suppliers already running short of lithium resources and that this is likely to hinder the growth of electric vehicles, similar to the current shortage in semiconductors.

“There will be a two- to three-, or four-year period when things are really messy,” Lowry said. “The capital raisings have put lithium on the road to catching up [with demand], but they’re going to have to play catch-up for a number of years.”

The green industrial revolution will be powered by battery metals.

And while the talk around graphite and lithium has dominated airwaves in the last few years, less glamorous metals such as nickel copper and cobalt are set to dominate the battery metals space.

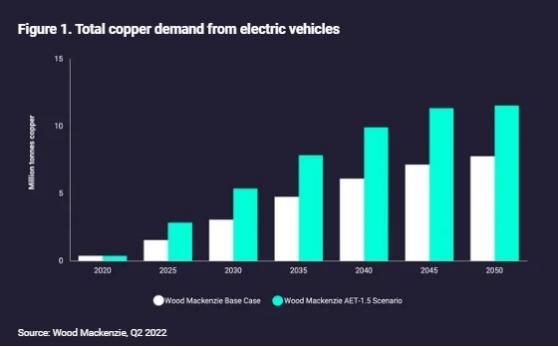

For instance, Wood Mackenzie reports EV passenger cars will need to account for more than 35% of total vehicle sales by 2025, rising to just under 70% over the subsequent decade.

The data and analytics company states, “This higher market penetration of copper-intensive EVs will fuel additional total copper consumption. Under our AET-1.5 scenario, EV demand for copper will be 40% more than our base-case climate trajectory by 2040. Overall, demand in the EV segment will grow by 9.6 Mt over the next 20 years”.

With that growth trajectory in mind, the question is where will supply come from?

The additional volume of copper needed means that 9.7 Mt of new mine supply will be required over the next decade from projects that have yet to be sanctioned – more on that later.

Without those projects, the volume of copper shrinks to just 2.5 Mt – not nearly enough to cover even medium-term requirements.

A copper shortage looms

The decarbonisation message has certainly caught fire. However, the growing momentum is creating supply issues and by 2025 demand for key battery metals could start to exceed supply.

It’s why companies such as Celsius Resources Ltd, a battery metals exploration and development company listed in the UK and Australia with world class copper assets in the Philippines and Cobalt assets in Namibia, are scrambling to fast-track exploration and potentially down the track, move into production.

Celsius is one of those companies that could potentially offer new mine supply.

CEO Peter Hume is aware of the supply challenges ahead and how Celsius may play a role in shifting the demand supply imbalance.

“If I look at all the reports that are out there in the market and look at the EV projection figures, it is suggested that there will be around 27 million EVs sold by 2030. On top of that, you have to meet the infrastructure demand to cater for that many vehicles on the road. That scenario alone points to a huge shortfall within the next five to 10 years,” Hume said.

For companies in the battery metals space, there is enormous opportunity to plug holes.

For instance, it is likely that demand for more power transmission will also put further strain on copper supply. There’s also infrastructure such as charging stations to consider. Bloomberg suggests 12 million charge points will be needed globally, with each requiring 10 kilograms of copper.

“The 2050 climate objectives will not be achieved without a significant ramp-up in copper production in the near and medium term, which will be very challenging,” the S&P Global Future of Copper report warns.

Right now, there aren’t enough copper mines to deal with the 2.5 times more copper required in a battery electric vehicle than for a standard internal combustion engine vehicle.

Remember there are 27 million EVs expected to be sold by 2030. And that’s just the EV market. So called battery metals are used for so much more than cars. Think computers, aeronautics, the TVs you watch… The list of uses for copper, cobalt nickel, graphite and lithium are almost endless.

Wood Mackenzie suggests “close to 80% of copper’s use is related to its property as an electrical conductor. Consequently, future growth in global electricity demand as economies develop will also drive growth in copper consumption. However, the use of copper for EVs and renewable power generation is significantly more intensive than in their fossil-fuelled equivalents. Together with the related build-out of electrical networks, this compounds future expected demand for the metal”.

Copper will thus play a critical role in achieving net zero and meeting increased demand.

Wood Mackenzie suggests that to meet zero-carbon targets, the mining industry needs to deliver new projects at a pace and financing that we are yet to see. If this can be achieved, the data analyst company says it would result in:

- the need for 9.7 Mt of mine supply over the next decade from projects that have yet to be sanctioned. To date, a shortfall of this magnitude has never been overcome within a decade. This supply gap contrasts with 6.5 Mt under our (Wood Mackenzie) base-case climate trajectory.

- more than US$23 billion of investment a year in new projects, 64% higher than the average annual spend over the last 30 years

- a growing market deficit, exacerbated by the sharp increase in refined demand growth. This will underpin a copper price rally to more than US$11,000/t (about US$5.00/lb) within five years, in contrast to US$7,010/t (US$3.18/lb) over the same period in the base case.

Erik Heimlich, head of base metals supply at CRU, said the global copper industry will have to spend $100 billion or more to build mines that could close an annual supply deficit of 4.7 million tonnes by 2030.

He said the supply gap for the next decade is estimated at six million tons per year and that the world would require eight projects the size of BHP’s (ASX: BHP (ASX:BHP)) Escondida in Chile, the world’s largest copper mine, to be built over the next eight years.

“Historically, the completion rates of these projects have been low. A large share of the greenfield possible projects in 2012 remain under-developed so there are questions about the ability to respond to the supply gap in an efficient and timely manner,” he said.

The shortfall and prices

Given the looming shortage, prices could continue to spike.

Financial Services company Fitch Solutions believes that by 2031, copper prices could reach $US11,500/t “as a long-term structural deficit emerges” due to the “very strong” long-term demand outlook.

Fitch notes a “significant pipeline” of new projects set to bring additional copper to market, particularly in Chile, Peru, Australia and Canada.

In the short term, Fitch expects copper prices edge higher to $US9100/t in 2024 and $US9400/t in 2025.

“Our Autos team forecasts global EV (electric vehicle) sales to increase 279 per cent from 2021 to 2031, and reaching 24.7 million units per year by the end of the forecast period,” Fitch states.

This means that from around 2026, improvements in supply will be “increasingly outpaced by demand growth from the global transition to a green economy”.

The current copper price is $8,874.

Battery metals in the sustainability equation

Celsius CEO Peter Hume knows a thing or two about the battery metals thematic and how copper and cobalt can play a pivotal role in the demand supply conundrum.

Celsius has a second project: a 95% interest in the highly prospective Opuwo Cobalt Project in northern Namibia.

Cobalt is an essential part of lithium-ion batteries that give electric vehicles the range and durability needed by consumers. The majority of modern electric vehicles use these battery chemistries in lithium-nickel-manganese-cobalt-oxide (NMC) batteries which have a cathode containing 10-20% cobalt.

Tesla (NASDAQ:TSLA) uses 30 pounds of cobalt and 200 pounds of copper in a battery.

Thus copper and cobalt’s place in the battery metals sustainability mix shouldn’t be understated.

While investors are turning towards a more ESG-focused approach and their attention is on the clean-tech, battery metals sectors, the game is still to turn a profit.

That’s why the rise of companies such as Tesla have become so newsworthy.

Tesla has an increasing appetite for battery metals, but it is a company that is demanding supply chain traceability to root out metals such as cobalt that are linked to child labour in the Democratic Republic of Congo and lithium linked to droughts in Chile.

Institutional investors have taken note.

The Financial Post writes: S&P Global Ratings has fielded “increasing interest” from natural resource investors in sustainability-focused risk analysis of mining companies”, Lynn Maxwell, who leads its commercial operations in Europe, the Middle East and Africa, said.

Of course, to get the metals mining is required.

“It’s a re-education frankly. I think the world has become disconnected from where a lot of these products come from,” he said. “We’re not going to get these battery metals if we don’t have mining,” chief executive of London-based Digbee Ltd Jamie Strauss said.

Celsius is balancing its sustainable mining obligations with its search for copper and cobalt to feed into the supply shortfall equation.

“Our flagship MCB project and the framework and principles we are building around that are critical to future success. We've been doing this type of work for some years without calling it ESG. However, now there's a framework that we can operate under and be recognised for what we are doing in relation to the environment, social and in the implementation of management practices,” Hume says.

The Maalinao-Caigutan-Biyog (MCB Project) is Celsius’ world-class copper-gold project in the Philippines.

It is the sort of project in which investors can see growth upside, while meeting ESG goals.

The Philippines provides a reflection of how a country in turmoil can turn its fortunes around sustainably through mining.

It is exactly the kind of environment investors are looking for as they turn away from miners in regions with political and social turmoil.

On working closely with the Filipino government, Celsius non-executive chairman and MMCI chairman and president Julito R Sarmiento recently stated, “Our principles and visions are aligned, which is a powerful step towards developing and operating the MCB Project in a responsible and sustainable manner benefiting both our shareholders and local stakeholders.

“It has always been our commitment, particularly to the Balatoc Tribal Community, that central to the mine development is cultural respect, social development, and environmental protection. Sodor Inc. shares the same commitment and is thus a perfect partner in developing the MCB Project.”

The Philippines provides an interesting case study in how to balance ESG priorities with mining realities.

“It's no secret that the mining industry in the Philippines was in turmoil and the impact mining companies were having on the environment was taking a big toll. So, the government put a moratorium in place while it got its house in order in relation to making sure that the necessary protections and controls were in place when mining recommenced. That allowed the government to monitor the implementation of responsible mining.

“The moratorium was lifted last year at the end of the Duterte administration, which paved the way for the new mining approach here in the Philippines. The government has identified mining as one of the key economic recovery tools in its toolbox to assist with the economic recovery of the country post COVID. So, it’s very critical that the government identifies the ways in which responsible mining is carried out.”

In ensuring mining is carried out responsibly, The Philippines government is setting itself up for future prosperity, while ensuring environmental sustainability.

Hume caught up with Proactive recently to discuss the company’s competitive advantage in the battery metals space, its ESG accountability and what that means for the growth potential of its MCB Copper Gold Project.

Celsius is certainly positioning itself to help meet growing demand as supply shortages loom.

The copper shortage and the MCB

Use of copper goes well beyond the EV market, but with the rise of EVs a major shortage looms that will affect other industries.

“The chronic gap between worldwide copper supply and demand projected to begin in the middle of this decade will have serious consequences across the global economy and will affect the timing of Net-Zero Emissions by 2050,” the Future of Copper report warns.

The report states copper scarcity could destabilise international security.

While conservationists would question the need for more mines to come online, the reality is mines such as Celsius Resources’ MCB Project in the Philippines are likely to become critical to supply and therefore critical to decarbonisation ambitions.

Notably, in comparison with 37 other pre-production global copper project peers, MCB sits in the upper third quartile in terms of both its copper grade of 0.85% and copper equivalent grade of 1.13% at current prices.

That’s a distinct advantage over its peers.

The benefits of a project such as the MCB are multi-dimensional. Investors can take comfort in the company’s ESG principles and its close relationship with the locals, but they may also capitalise on the company helping out with supply shortages in future.

Hume puts its relationship with stakeholders in the country into perspective.

“We've made several commitments as part of the development of our project to the tribal communities, to other stakeholders, the national government, the local government and municipal government. We don't make those commitments lightly. When you make those sorts of commitments, then people hold you accountable and measurable against those commitments, which is very important.”

Hume says Celsius has 100% support from the indigenous people in the region and highlights the importance of the mechanisms and new standards that have been put in place.

He iterates the fact Celsius is always looking for new procedures to implement that create additional environmental and social controls.

In the end, the community benefits, but it is also an approach that attracts investors.

Embracing the change

In 2021, global electric vehicle sales hit 6.6 million – more than double the 3 million in sales in 2020.

Despite infrastructure issues, Australians are embracing the EV revolution with EVs now outselling hybrids.

February sales data published by the Federal Chamber of Automotive Industries (FCAI) industry body shows electric vehicles claimed 6.8% (or 5932 cars) of all new vehicles sold. This compares with 6.6%, or 5716 sales for hybrids.

Tesla is currently the big winner: three in five electric vehicles sold in Australia so far this year have worn Tesla badges.

Meanwhile, EV-Volumes data shared by Jose Pontes, show around 812,487 new passenger plug-in electric cars were registered globally in February – around 49% more than a year ago and about 14% of the total market.

As JP Morgan states: “The shift to sustainable investing is so powerful because it’s being driven by demand from the bottom up. Quite simply, investors – from individual savers through to large institutions – are directing an ever-increasing proportion of their portfolios towards sustainable strategies as they look to use their capital to help create a more sustainable world.

“Investors are starting to give more consideration to the sectors, countries and regions that have the resilience and competitiveness to thrive as the world moves towards a low carbon future.

“Countries that are able to take advantage of the advances in technology needed to reach net zero carbon emissions will be best positioned to flourish in this environment.”

Institutional investors are looking hard at these factors and looking harder at companies that not only meet their ethical standards, but that can also provide long-term security during commodity shortfalls.

Battery metals, including copper and cobalt, will play a crucial role in the 21st century global economy and investors are getting on board.

Read more on Proactive Investors AU