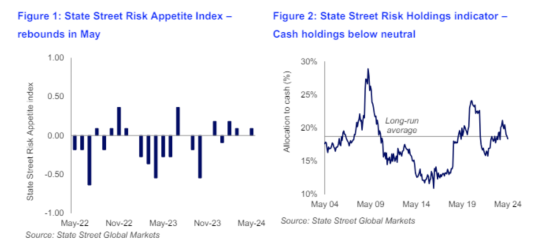

Institutional investors increased their risk exposure in May, as shown by the State Street Risk Appetite Index rising to 0.09.

This indicates a modest preference for risk among investors.

“Institutional investors on balance still saw the glass as half full in May. The aggregate allocation to equities at the expense of cash points to a clear desire to maintain risk budgets,” State Street Global Markets head of macro strategy Michael Metcalfe said.

“Within this moderate risk on environment long-term investors began to reassess their USD overweight once again and rediscovered their appetite for higher-yielding FX and fixed income instruments.

“At the same time, however, there is also clear hesitation on cyclically exposed assets both in equities and commodity exposures. There was also significant dispersion in risk preference across emerging markets, where demand for Chinese equities continues to be robust, but investors lightened their holdings of Indian equities ahead of the election.”

Breaking down the numbers

State Street Holdings Indicators revealed a 33-basis point increase in long-term investor allocations to equities, now at 53.7%, while cash holdings dropped by 0.4 percentage points to 18.4%, the lowest in ten months.

“The trends in State Street’s holdings indicators were encouraging in May. Despite mixed macro news investors allowed their allocation to equities to drift higher alongside market price movements.

"The aggregate allocation to equities is now at its highest level since June 2008. This month the move into equities was entirely funded by allowing a further fall in cash allocations, which have slipped to a ten-month low and are now below their long-run average,” Metcalfe said.

“The early indication here is that despite ongoing uncertainties surrounding the outlook, investors are willing to run cash allocations at below average levels to take advantage of the return opportunities in either fixed income or equity markets.

"As vulnerable as equities look with such a high allocation, the changes in allocations in May were nevertheless encouraging.”

In other words, fixed income allocations remained stable after a significant rise the previous month and investors, despite uncertainties, reduced cash allocations below average levels to capitalise on opportunities in equity and fixed income markets.

The Institutional Investor Indicators, developed by State Street Associates, measure investor confidence through the analysis of buying and selling patterns.

The indicators include the Risk Appetite Index, which reflects investor behaviour across multiple risk dimensions.

State Street Corporation (NYSE:STT), a leading provider of financial services to institutional investors, manages US$43.9 trillion in assets under custody and administration.

Read more on Proactive Investors AU