Impact Minerals Limited (ASX:IPT) is trading higher on taking the first step in its ESG journey by disclosing ESG metrics, employing the World Economic Forum (WEF) Stakeholder Capitalism ESG framework.

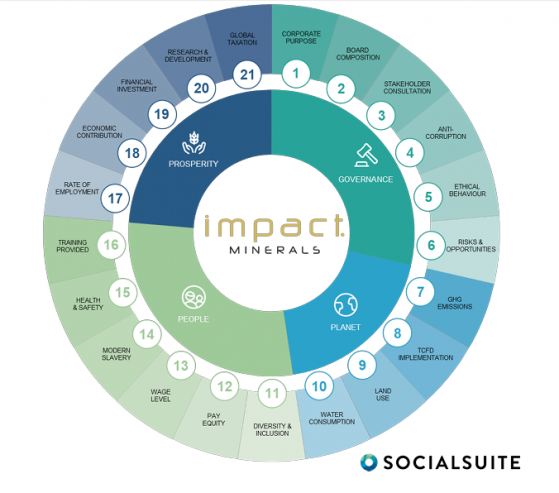

The WEF framework is a set of common metrics for sustainable value creation captured in 21 core ESG disclosures.

To assist with the ESG initiatives, Impact has also engaged the Socialsuite technology platform, ESG Go, to monitor and report its progress.

Impact Minerals plans to release a baseline ESG disclosure report and has committed to setting quarterly ESG actions to further its sustainability goals.

The markets have welcomed the news with shares trading as high as $0.013, up 8.33% from previous close.

The World Economic Forum (WEF) Framework for ESG Reporting.

Tangible first step

Impact managing director Dr Mike Jones said: "Impact Minerals is committed to building legitimate Environmental, Social, and Governance (ESG) credentials and we are now commencing ESG reporting as a tangible first step on our ESG journey.

“This is of increasing importance to us and all of our stakeholders as we move along the path towards production from our Lake Hope High Purity alumina project here in Western Australia over the next few years.

“We believe the Lake Hope project is already demonstrating strong ESG credentials, given the material is free digging, and can be trucked off-site for processing at an established industrial site, leaving a very small environmental footprint compared to conventional mining.

“In addition, we have already received heritage clearance for the area to be mined from the Ngadju Peoples with whom we have an excellent relationship.

“The ESG framework we have adopted, which will be applied throughout our entire project portfolio, will enable us to better identify material risks going forward, leading to better-informed decisions and business outcomes.

“Our commitment to ESG will also create a consistent and measurable approach that helps us contribute to the betterment of our communities both locally and globally.

“We have adopted Socialsuite’s 'ESG Go' as a best-in-class solution to start ESG reporting within a structured, standardised, and globally recognised solution that makes WEF framework accessible and operational.

“We look forward to sharing our ESG journey and reporting on our progress against the WEF framework."

Most appropriate ESG disclosure framework

Impact sees the WEF Stakeholder Capitalism Metrics as the most appropriate ESG disclosure framework to start its ESG journey.

The Stakeholder Capitalism framework leverages a variety of existing frameworks and is intentionally built to be a stepping stone to begin building capacity and capability in ESG reporting.

It enables Impact to report on core ESG matters of governance, anti-corruption practices, ethical behaviour, human rights, carbon emissions, land use, ecological sensitivity, water consumption, diversity and inclusion, pay equality and tax payments.

By including ESG metrics in mainstream reporting and integrating them into governance, business strategy, and performance management processes, Impact sets out to demonstrate that it diligently considers all pertinent risks and opportunities in running its business.