Melbourne-based biopharma company Immuron Ltd (NASDAQ:IMRN, ASX:IMC) is steadily bringing to market its treatments of gastrointestinal diseases, with increased US penetration and record sales.

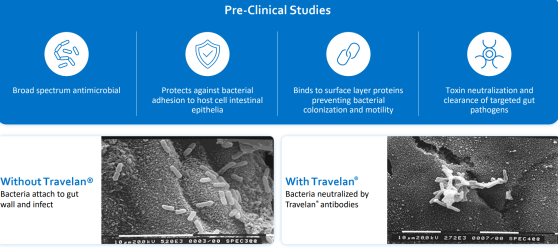

The biotech has developed a proprietary platform technology using polyclonal antibodies derived from hyperimmune bovine colostrum, offering a suite of orally delivered immunotherapeutics targeting a wide array of infectious diseases.

Travelan® on the market

Immuron's flagship product, Travelan®, is designed to prevent traveller’s diarrhoea, a common affliction caused by pathogenic bacteria.

Travelan® has demonstrated remarkable efficacy, with clinical studies showing up to 90% reduction in the incidence and severity of diarrhoea among volunteers.

The product is available as a dietary supplement in the US, listed on the Australian Register for Therapeutic Goods, and licensed as a natural health product in Canada.

Travelan® is an orally administered passive immunotherapy that binds to diarrhoea-causing bacteria, preventing colonisation and associated pathology.

Traveller’s diarrhoea

The traveller’s diarrhoea treatment market is experiencing notable growth, with an estimated compound annual growth rate (CAGR) of around 7%.

According to the IMC Company Report (Travelan Market Analysis 2019) and the Centers for Disease Control and Prevention (CDC) Yellow Book, the affliction affects between 30% and 70% of travellers.

The resurgence of travel post-COVID-19 lockdowns has driven this growth, and Immuron has timed its expansion into new markets to meet this demand.

The company is preparing for expansion in the US, launching its products on major platforms Amazon.com (NASDAQ:AMZN) and Walmart (NYSE:WMT).com in the 2024 financial year.

With plans to increase its product penetration in 2025, the market potential is estimated at US$83 million based on annual US travel numbers and a 15% penetration rate.

The European Union market potential is similarly estimated at €50 million.

Immuron plans to add marketed products in the 2025 financial year, further positioning itself to capitalise on the growing demand for traveller’s diarrhoea treatments and CDI (Clostridioides difficile infection) solutions.

In the pipeline

The company's pipeline includes four clinical programs, notably the IMM-124E (Travelan®) Phase 2 CHIM trial, which has shown significant protective efficacy against Enterotoxigenic Escherichia coli (ETEC)-induced diarrhoea.

Topline results indicated a 36.4% protective efficacy against moderate to severe diarrhoea and a 66.7% efficacy against severe diarrhoea, with a significant reduction in the need for early antibiotic treatment and intravenous fluids among participants.

Additionally, Travelan® is undergoing a Phase 4 field study with the Uniformed Services University (USU), with 75% of the target 866 participants recruited.

In collaboration with the Naval Medical Research Center (NMRC), Immuron is conducting a Phase 2 trial for CampETEC, targeting Campylobacter and enterotoxigenic Escherichia coli.

The inpatient phase of this trial was completed in December 2023, with anticipated topline results expected in August 2024.

Advancements in CDI treatment

Immuron's IMM-529 is being developed as an adjunctive therapy for recurrent Clostridioides difficile infection (CDI).

This product targets three essential virulence components of C. difficile: Toxin B, spores, and vegetative cells, showing promising results in pre-clinical models.

IMM-529 demonstrated prevention of primary disease with 80% efficacy, protection of disease recurrence with 67% efficacy, and treatment of primary disease with 78.6% efficacy.

Collaborating with Dr. Dena Lyras and her team at Monash University, Immuron is advancing towards clinical trials, with a pre-IND submission filed with the FDA in July 2024.

The market for Clostridioides difficile infections (CDIs) is projected to grow to almost US$1.7 billion by 2026, according to GlobalData.

Financial growth

Immuron has reported robust financial performance, with sales of A$3.6 million from July 2023 to March 2024, marking a 154% increase over the prior comparative period.

In Australia, sales reached A$2.8 million, a 234% increase, while US sales were A$0.8 million, up 35%. The company's products are now available on Walmart.com, and further market penetration is planned for FY25.

The commercialisation strategy of Immuron Ltd (NASDAQ:IMRN, ASX:IMC) has borne fruit in 2024, with a global sales income of A$4.9 million, a 174% increase compared to the prior comparative period (PCP).

The company’s core offering is an orally administered passive immunotherapy, reducing the likelihood of contracting traveller’s diarrhoea (TD).

In the June quarter alone, Immuron generated A$1.3 million in Travelan® sales, up 253% on the PCP and 6% on last quarter’s sales.

In Australia, sales growth was particularly strong, reaching A$3.7 million, a 223% increase compared to PCP during the year, with A$1 million in the June quarter alone, representing a 200% gain to PCP and 11% compared to last quarter.

Sales in the US hit a new annual record, capturing A$1.1 million, a 74% increase over the previous year.

The June quarter saw US$300,000 in sales, marking a 546% increase compared to the same quarter last year, despite a 1% fall compared to the March quarter.

This financial year marked Immuron’s second year of operations in Canada, where the company secured A$100,000 in revenue.

Although modest, this represents a staggering 6,637% increase compared to the previous financial year, demonstrating a strong sales ramp poised for continued growth next year.

Read more on Proactive Investors AU