The International Mining and Resources Conference, IMARC 2022, saw more than 7,800 delegates from at least 110 countries come together to collaborate on mining, investment and innovation for the first time since the pandemic closed our borders in 2020.

Attended by 504 speakers in the form of Federal and State ministers, international government representatives, key stakeholders and leaders of industry, IMARC 2022 represented the mining industry’s commitment to addressing the biggest challenges facing the sector, from both within and without.

“Being back in person this year is an exciting opportunity for IMARC; to provide a global platform for buyers and sellers to come together and have a stage to highlight what makes mining good and address what could take the industry forward,” said IMARC conference director Sherene Asansyous.

“Our ‘Talk It Forward’ dialogues especially covered key themes on mining commitment to ESG, engagement, trust and strengthening social value, addressing mining’s legacies, redesigning the mining workforce culture and its ‘DE&I’ [Diversity, Equity, and Inclusion] makeup.”

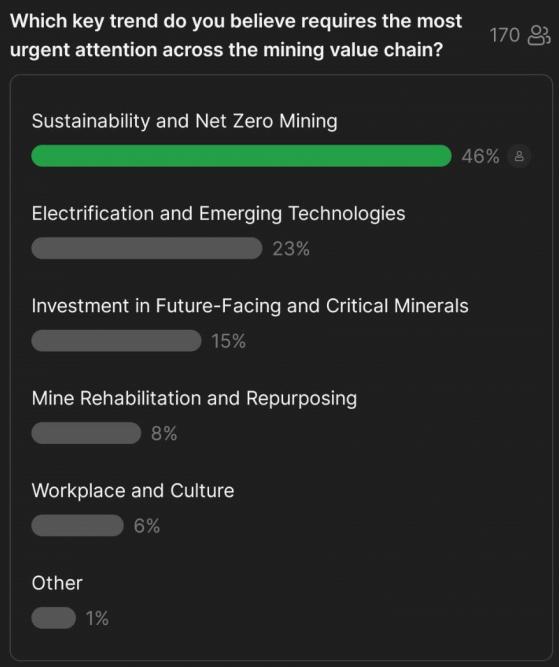

Asansyous set the tone for the event with a single question polled to the 170-strong audience: “What key trend do you believe requires the most urgent attention across the mining value chain?”

The results speak for themselves.

Responsible mining at centre of energy transition

Net-zero, carbon emissions and renewable energy were strong themes throughout the many panels, keynote addresses and long-form interviews on offer during the conference, with delegates emphasising the enormous opportunity offered by the energy transition.

The mining industry’s reputation and its role in decarbonisation were hot topics in keynote addresses and panels alike.

MMG's executive general manager of corporate relations Troy Hey highlighted the negative space the mining industry tends to occupy in media and popular consciousness, and the unique opportunity decarbonisation offers the sector.

“The just transition to a low carbon economy is probably the greatest reputational repositioning opportunity the industry has had,” he said.

“You don't just move to renewables tomorrow and they don't come without more significant mining, and they don't come without coal, oil, gas and others playing a transition role. But in the end, this industry will drive that decarbonised future.”

IMARC’s ‘Talk It Forward’ panel underscored just how far ESG initiatives have come over the years and the opportunities these pathways offer companies.

“In general, it [ESG] has been a really positive thing for the industry and for companies because it's lifted the conversation to the boardroom level,” said Newcrest group manager of sustainability and social performance Tzila Katzel.

“I think it's definitely motivating and driving change in companies, which is a good thing. And I think that companies are looking at it as really a kind of transformational process.”

Fellow panellist Michael Nossal, chair of major mining company IGO Ltd, echoed her sentiment.

“I think it's been a really useful kind of framework or catchphrase or acronym to group together all the parts of the business that aren't necessarily just related to how we reduce costs and increase revenues,” he said.

“We should be able to have an integrated conversation where the value of both the ESG components and the business components are reflected together and make up the full story of the company,” Katzel agreed.

Australia as a renewable energy powerhouse

Australia is a country blessed with abundant potential for renewable power generation. Sunny skies, windy coasts and rugged mountain ranges represent enormous amounts of potential energy to be captured.

The continent also holds some of the largest endowments of critical minerals in the world, ranking in the top five for lithium, cobalt, manganese, iron ore, vanadium, copper and nickel.

The opportunity hasn’t gone unnoticed.

“While coal remains a critical part of the mining sector here in New South Wales, we see the growth in the metals sector as our next significant opportunity,” said Deputy Premier and Minister for Regional NSW Paul Toole.

“By investing in the next wave of innovative low-emission technologies, the government will work to strengthen the entire value chain, from exploration to advanced manufacturing.

“I want New South Wales to be the number one investment destination for mining and advanced manufacturing.”

Federal Minister for Resources Madeleine King acknowledged that net-zero cannot be achieved without the resources sector and that more mining will be needed to effect decarbonisation on a societal level.

“Once again, Australia finds itself in an enviable position and – thanks to the good fortune of the continent’s geology – Australia boasts some of the richest deposits of critical mineral reserves in the world,” Minister King said.

“This presents us with an unmissable opportunity but also a remarkable responsibility.

“We must bring forward a new wave of investment in our resources sector, and further demonstrate how Australia is not only reducing emissions at home, but it's also a crucial player in the global effort to reach net zero emissions.”

Government delegates from Saudi Arabia, Canada, Mongolia, Peru, Sudan and India among many others highlighted just how important Australian resources have already become to the global energy transition.

“We are especially keen to learn from and collaborate with our counterparts here in Australia, who have established one of the world's most advanced mining ecosystems,” His Excellency Bandar Bin Ibrahim AlKorayef, Minister in the Kingdom of Saudi Arabia’s Ministry of Industry and Mineral Resources, said in his keynote address.

“Saudi Arabia stands ready and open to work more closely with all of you and other leading mineral and metal jurisdictions, as we set new standards for a sustainable and ESG-compliant mining industry.

“Let us use this year's IMARC to promote stronger relationships. Together we can future-proof mining, and related industry and value chains.”

Junior explorers make their mark

Not to be outdone by the giants of mining, ASX-listed small and medium caps made an impressive showing at IMARC, cornering the Mines and Money presentations and drawing plenty of interest from prospective investors.

Lean, nimble and driven, Australia’s junior explorers are positioning themselves as leaders in the critical minerals effort, moving to corner the vital materials needed for the decarbonisation revolution.

“Magnetite Mines (ASX:MGT) is sitting on a 6-billion-tonne magnetite deposit that is going to be necessary to produce high-grade iron ore, for decarbonising steel markets,” Magnetite Mines (ASX:MGT) Ltd CEO Tom Dobson said.

“The amount of steel demand in the world has doubled every 20 years since 1950. The steel-making world is going to be transitioning over the next 20 years to non-coal-based steelmaking.

“Of course, as a result of that, high-grade iron ore is needed. And therefore, magnetite’s having its day in the sunshine. So that's really the differentiator for us.”

Steel has become a central focus in decarbonisation efforts, necessary as it is to any large-scale construction effort.

“The more vanadium used in steel, the less steel you need for a building. The building is stronger, you need less cement, you generate less carbon dioxide,” Australian Vanadium Ltd (ASX:AVL) managing director Vincent Algar explained.

“Vanadium is a true green ingredient in steel. The impact is huge. The published use shows that China has already saved 1% of the steel it would have used with vanadium. That’s a big number.

“And then obviously on the battery side of vanadium, the grid level, or grid-scale, vanadium redox flow battery can have a huge impact in storing renewables and truly shifting them.”

Not to be outdone, the small cap precious metals sector also made an appearance, showcasing their efficiency and high vale-to-share-price ratios.

“When investors put money into your company as an explorer, they want to see that drill rigs are turning and you’re making discoveries,” said Nexus Minerals Ltd (ASX:NXM) managing director Andy Tudor.

“We’re well funded, we have just under $10 million in the bank, rigs turning right now, I think that’s an opportunity for investors.”

Further emphasising the potential upside of these smaller explorers, the gold spot price has been steadily rising so far this month – currently sitting at about US$1,700.

“Our company attracts investors that see we are hugely undervalued,” Mako Gold Ltd (ASX:MKG) managing director Peter Ledwidge said.

“Every CEO says that, but we’re basically $15 per ounce of gold at this valuation.

“The smart investors see that and want to get in here and now.”

While the mining industry still has a lot of work to do in order to shift public perception, if IMARC 2022 is any indicator, the will and the momentum are there, and Australia truly could become a critical mineral and renewable energy powerhouse within the next handful of years.

Read more on Proactive Investors AU