Thousands of historical wells have observed natural hydrogen, but previously explorers had no incentive to commercialise this resource.

The urgency to decarbonise has now created the ideal conditions to develop this new industry, targeting an inexpensive, sustainable and dispatchable source of hydrogen.

Natural hydrogen is generated through naturally occurring, geological processes in the subsurface, and its current exploration is analogous to early years of the oil and gas industry, 150 years ago.

A successful natural hydrogen well has the potential to produce for decades and at a significantly lower cost than other forms of manufactured hydrogen. And while it’s still early days, the natural hydrogen industry is positioned to move fast given it is a primary source of scalable and 24/7 dispatchable supply.

In short, natural hydrogen could revolutionise the energy industry.

HyTerra: Natural hydrogen exploration and production

Focused on the early discovery and development of natural hydrogen, HyTerra Ltd (ASX:HYT) has established a major presence in potentially one of the world's most prolific natural hydrogen provinces in the American Midwest.

HyTerra was the first ASX-listed company with a focus on building a profitable natural hydrogen business that will play a role in creating a better future for customers and societies.

The company is working to develop material production and a dispatchable supply that offers replenishing and affordable hydrogen close to customers, and it intends to demonstrate the Midwest as a platform for early cash flow and growth that can be replicated elsewhere.

The projects

HyTerra's Project Geneva in Nebraska and Project Nemaha in Kansas are situated respectively on the western and eastern margins of the Mid-Continent Rift System, an iron-rich band of rocks underlying the Salina Basin widely considered to be the source of multiple historic hydrogen occurrences.

Project Geneva, Nebraska

HyTerra has a 15% working interest — and the right to earn up to 51% — in a joint development agreement with operator Natural Hydrogen Energy LLC at Project Geneva in Nebraska.

This venture presents a first-mover advantage with the project including the world's first wildcat well specifically targeting natural hydrogen.

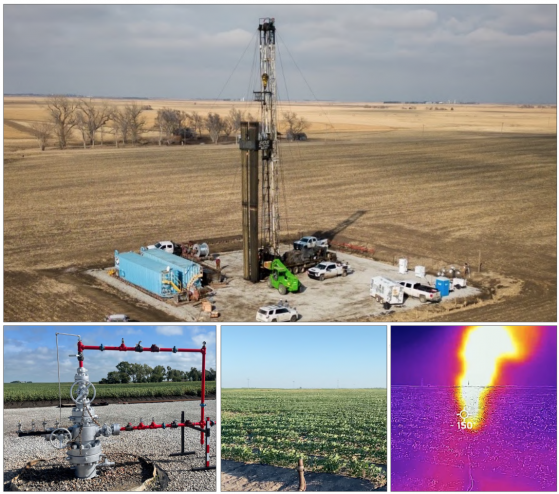

The well, Hoarty NE3, is on the margin of mid-continental rift and was drilled to a depth of 11,200ft (3,400 metres). Elevated hydrogen was detected during drilling, gas was flared during swab testing and flow testing operations commenced in the first quarter of 2023.

This project delivers modern data and first-hand experience in the development of natural hydrogen systems.

Project Geneva.

Nemaha Ridge, Kansas

In addition to its Project Geneva working interest, HyTerra is building a portfolio of owned and operated lease holdings on the Nemaha Ridge, where it has identified multiple targets covering a diverse range of geological plays for natural hydrogen and helium exploration.

The prospective area is supported by at least 10 historical recorded occurrences of natural hydrogen, of up to 92% H2, close to industries, infrastructure and end-users.

Nemaha Ridge presents a unique combination of critical success factors as the most prominent structural high in the region and is a focal point for hydrogen migration. The hydrogen here is considered to be sourced from rocks within the Midcontinent Rift, from which it migrates via faults to the crest of the ridge.

The company’s 100% owned and operated Nemaha Ridge leases comprise four prospects which have been defined by structural mapping and are fault bounded closures on the western side of the Nemaha Ridge in Eastern Kansas.

The play is set up by the Scott #1 well which tested between 42.6% and 56% hydrogen in high-quality laboratory tests. The Heins #1 and Sue Duroche #2 wells also had significant hydrogen gas percentages in laboratory analysis.

There are also 11 wells with sufficient well log data to petrophysically analyse the reservoirs. The prospects — from northeast to southwest — are Zeandale, Eastern Geary, Central Geary and Morris North.

Helium opportunity

In addition to being prospective for hydrogen, the Nemaha Ridge is cored by Precambrian granites which are capable of generating helium. The elements required for a helium system are present and there are documented occurrences of helium within the play area and further along the Nemaha Ridge.

Resource assessment

A maiden independent prospective resource assessment of the Nemaha Ridge leases was completed by Sproule Incorporated after an extensive review of geophysical, geological and wells data in the area.

HyTerra executive director Benjamin Mee said: "This independent assessment of both prospective hydrogen and helium resources strengthens our confidence in our portfolio as a platform to potentially support the decarbonising of several mature industrial sectors and transport in the Mid-West USA, and elsewhere. We will use this resource assessment to rank our drilling targets."

The resources:

- P50 Net Hydrogen Prospective Resource: 100.2 BCF (237,543 tonnes) with a minimum (P90) of 47.1 BCF (111,738 tonnes) and a maximum (P10) of 238.4 BCF (565,390 tonnes)

- P50 volume of Helium Prospective Resources: 0.47 BCF with a P90 volume of 0.04 BCF and a P10 volume of 1.63 BCF

The prospective resource areas are surrounded by mature industrial production facilities and interconnected railroads and highways.

HyTerra anticipates the prospective resources to increase as leasing of acreage in the play continues, while the assessment will assist in ranking existing drilling prospects and will underpin a drilling program at Project Nemaha.

Read more on Proactive Investors AU