Seychelles-based cryptocurrency exchange Huobi Global has confirmed plans to axe 20% of its workforce.

Tron blockchain founder Justin Sun, who acts as an advisor to Huobi Global, last week denied rumours of mass layoffs, reported the South China Morning Post, but today’s statements tell another story.

“With the current state of the bear market, a very lean team will be maintained going forward. The personnel optimisation aims to implement the brand strategy, optimize the structure, improve efficiency and return to the top three,” a Huobi spokesperson today told Cointelegraph.

“The planned layoff ratio is about 20%, but it is not implemented now,” added the spokesperson.

According to a Huobi insider, key executives are also exiting the company, including chief financial officer Lily Zheng.

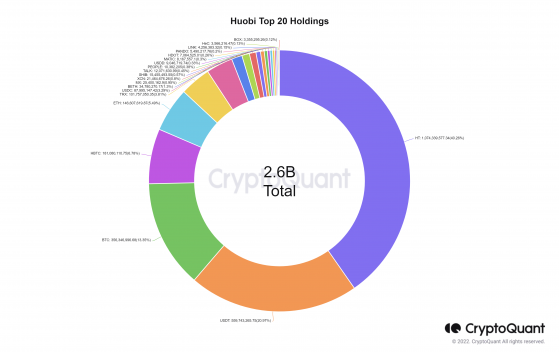

There have also been concerns about the quality of Huobi's reserves. CryptoQuant’s proof-of-reserves data shows that 40% of the exchange’s reserves are denominated in Huobi’s own HT token.

Apart from HT, Huobi’s reserves comprise Tether’s USDT stablecoin, bitcoin (BTC), and a range of altcoins – Source: CryptoQuant

If accurate, it could be a PR headache for Huobi, considering the stark similarities its reserves have to FTX prior to collapse.

The fact that FTX was primarily propped up by self-issued FTT tokens is considered one of the main reasons for the formerly second-largest cryptocurrency exchange’s collapse in November.

Adding to concerns, HT token reacted poorly to the news of layoffs, having dipped 9.5% in the past week, bringing its market value down to its lowest point since November 20, 2022.

Huobi Global has been approached for a comment.

Genesis cuts more staff

Crypto lender Genesis Global Capital, a subsidiary of Digital Currency Group, which also owns Grayscale, has cut 30% of its workforce in a second round of layoffs in less than six months.

Genesis suffered steep losses from loans it supplied to collapsed hedge funds Alameda Research and Three Arrows Capital (3AC), both of which filed for bankruptcy last year.

"As we continue to navigate unprecedented industry challenges, Genesis has made the difficult decision to reduce our headcount globally," a spokeswoman for the company confirmed to the Wall Street Journal on Thursday.

Genesis is working with its advisers “to preserve client assets and move the business forward”, she added.

Concerns over Chapter 11 bankruptcy protection are mounting for Genesis and the option shouldn’t be ruled out, said people familiar with the matter.

If Genesis goes ahead with bankruptcy protection, it could spell terrible news for the US$900mln (£754mln) worth of outstanding customer funds locked up in the platform.

Why all the layoffs?

2022 was a record year for layoffs in the cryptocurrency sector.

Large institutions including Nasdaq-listed crypto exchange Coinbase (NASDAQ:COIN) Global Inc. and digital asset investment firm Galaxy Digital were strongarmed into reducing their headcounts amid a severe market rout that saw two trillion dollars wiped from the crypto markets.

The incestuous relationship between major firms in the crypto sector should also be acknowledged.

Terraform Labs’ collapse in May of 2022 precipitated the collapse of hedge fund Three Arrows Capital, which had US$670mln worth of exposure to Terraform Labs.

Voyager Digital (CSE:VYGR, OTCQX:VYGVF) suffered a similar fate when 3AC defaulted on US$640mln worth of loans.

When contagion spread to FTX, Solana plummeted in value due to its involvement with founder Sam Bankman-Fried.

The point of the matter is, when a sector’s main players are so heavily indebted and overleveraged with each other, market contagion is almost impossible to stem.

Unfortunately, layoffs inevitable ensue.