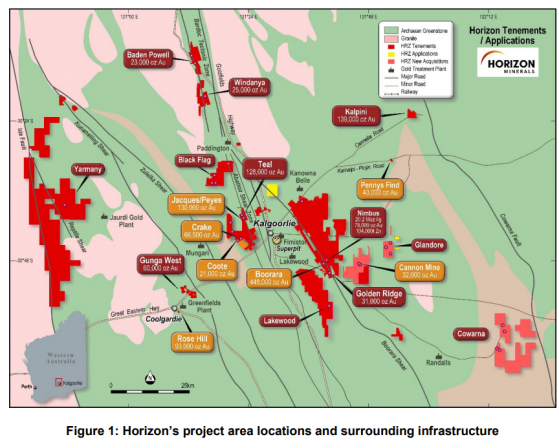

Horizon Minerals Ltd (ASX:HRZ) has kicked off extensional drilling at the Penny’s Find gold mine, some 50 kilometres northeast of Kalgoorlie, in the heart of the West Australian goldfields.

Sequence of mines

The company’s strategy is to produce gold from a sequence of underground mines and growing resources and reserves from its core assets including Cannon, Penny’s Find, Binduli and Rose Hill.

The development of Penny’s Find has been planned to follow the proposed Cannon gold mine development scheduled for the second half of the year.

Around 2,400 metres of reverse circulation (RC) and diamond tails are planned to extend the known resource at depth, and to follow up on the new lode system along strike to the north and at depth to further increase the resource base.

Results are expected in the current quarter, with an updated mineral resource estimate (MRE) slated for the September quarter.

The company will also work on updated mine optimisation and design studies, scheduled for completion in the second half of the year.

Plans to grow resource

The current MRE stands at 270,000 tonnes grading 4.99g/t gold for 43,000 ounces with 81% in the indicated category.

Horizon acquired the remaining 50% of the project in December 2021 and completed an additional 21 drill holes including 2,103 metres of RC and 2,765 metres of diamond to a maximum depth of 282 metres.

The drilling identified significant mineralisation and discovered a new lode system to the north of the existing resource, with results including:

- 5 metres @ 5.27g/t gold from 180.3 metres;

- 3.7 metres @ 7.46g/t gold from 215.3 metres;

- 2.7 metres @ 8.64g/t gold from 171.4 metres and 1.7 metres @ 17.91g/t gold from 178.9 metres;

- 1.9 metres @ 13.95g/t gold from 251 metres;

- 0.9 metres @ 23.56g/t gold from 216.7 metres;

- 2 metres @ 8.47g/t gold from 227 metres; and

- 2.5 metres @ 7.45g/t gold from 226 metres.

“The latest drilling at Penny’s Find has demonstrated the growth potential of this high-grade mineralised system to the north and at depth,” incoming CEO Mr Grant Haywood said.

“As we focus on the development of the Cannon mine in 2023, the follow up drilling at Penny’s Find will enable updated resources and reserve studies to be completed so we can have the mine ready to develop in sequence for continuous gold production at a time of record A$ gold prices.

“We look forward to keeping you updated with regular news flow on drilling results, resource and reserve work and the Cannon development timeline.”

All mineralisation remains open along strike and at depth, which highlights the potential for growth through further drilling.

Read more on Proactive Investors AU