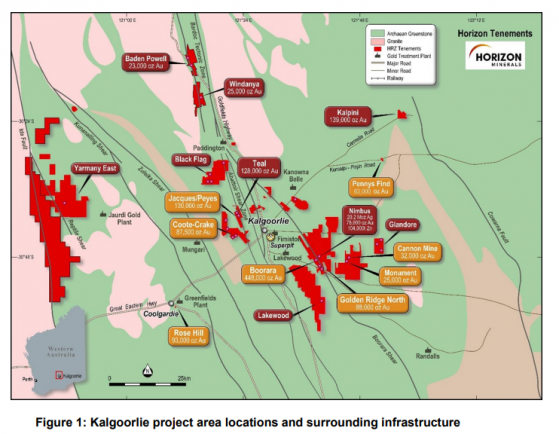

Horizon Minerals Ltd (ASX:HRZ) has a pleasing end-of-year wrap on its Pennys Find gold mine, 50 kilometres northeast of Kalgoorlie in WA's prolific Goldfields region.

Ongoing resource expansion

The company, which fully owns and operates the mine, announced the latest findings from its ongoing resource expansion and classification program.

The 2022 independent mineral resource estimate for Pennys Find highlighted a significant 270,000 tonnes grading 4.99g/t gold, amounting to 43,000 ounces, with 81% categorised as indicated.

In 2023, Horizon Minerals undertook a comprehensive drilling program, executing 10 reverse circulation (RC) and diamond tail drill holes over 3,298.4 metres.

This initiative aimed to both expand the resource depth and enhance the classification of the ore from inferred to indicated.

The Pennys Find project has been a focal point for Horizon since it acquired the remaining 50% interest from Labyrinth Resources Ltd in December 2021.

Lucrative opportunity

The site presents a lucrative opportunity for early underground development and production, with potential arrangements for toll milling and contractor partnerships.

The geological makeup of the Pennys Find area is particularly notable, featuring high-grade gold mineralisation in quartz veins, situated between sedimentary footwall layers and a basalt hanging wall.

Previous open cut mining efforts by Empire Resources yielded 18,300 ounces at an impressive grade of 4.47 g/t gold.

Furthermore, metallurgical testing has shown that the mineralisation is free milling, with a high gravity recoverable gold component, leading to over 90% gold recovery.

The 2023 drilling program has yielded significant results, with notable intercepts including 1.45 metres at 2.61g/t gold and 3.2 metres at 4.19g/t gold.

These results indicate the presence of substantial gold deposits, particularly in the northern extents of the site. The diamond core analysis has also provided valuable geotechnical and structural data.

Looking ahead, Horizon Minerals plans to integrate the updated resource data into a feasibility study for mine design and financial analysis, with a maiden ore reserve for Pennys Find expected to be announced.

The study's results, anticipated in the June quarter of 2024, will play a crucial role in the financial investment decision for the project's further development. This update marks a significant step forward in Horizon Minerals' strategy to expand and optimise its mining operations in the region.

Chief executive officer Grant Haywood said: “It is pleasing to see the resource growth at Pennys Find on the back of the 2023 drill programs, including extensions at depth and to the north of the existing resource, which still remains open.

“We look forward to completing the underground mining study and economic review in the June 2024 quarter for a development decision to be made shortly thereafter.”

Read more on Proactive Investors AU