It’s likely that the crypto markets won’t be getting a Santa rally in their stocking this year.

Quite the opposite in fact: At US$810bn, global market capitalisation across all digital assets is down around 2.6% on a month-on-month basis.

Traders seem to have thrown their hands up in the air and written 2022 off, as trading volumes across the major cryptocurrencies remain highly compressed.

Additionally, digital asset investment products continue to see major outflows, CoinShares data shows.

In the latest weekly summary, bitcoin (BTC) investment products got hit by US$17.5mln in outflows, as a possible warning that more downside could be on the cards.

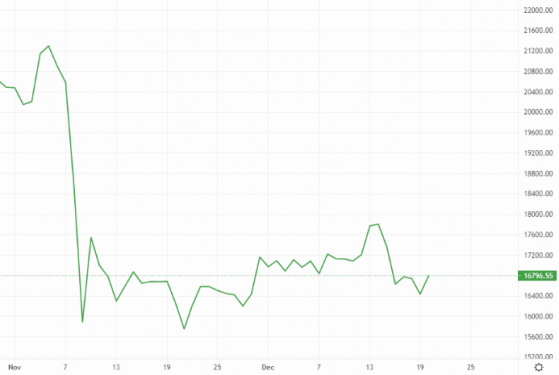

In fairness, BTC/USDT saw a 2% jump this morning, but at US$16,800 the pair could hardly be classified as bullish, especially when you consider the pair’s discount to the 20-day moving average.

If bitcoin continues to experience more downside, the BTC/USDT pair could fall back to US$16,000 before buyers are willing to step in for support.

Downside or upside to come for bitcoin (BTC)? – Source: currency.com

Ethereum (ETH) added 3.5% in the ETH/USDT pair today, having closed 130 basis points (bps) lower on Monday. The pair was changing hands at US$1,210 at the time of writing. Further downside could see ETH dip as far as US$1,150.

Among the altcoins, Binance’s BNB token has managed to add 0.2% in the past 24 hours amid a hostile environment for the digital asset exchange.

Yet despite consistent allegations – largely from faceless online commentators – that its financial security isn’t all it’s cracked up to be, the exchange continues to operate in the usual fashion.

Ripple (XRP) and Litecoin LTC) are also in the green, while Polygon (MATIC) has remained virtually unchanged.

One of the day’s best performers was ImmutableX (IMX), a scaling solution for the Ethereum blockchain.

IMX is close to 10% higher week on week, with a market value of US$336mln.

Read more on Proactive Investors AU