Australia may be late to the party on nuclear energy as a clean energy source – if it gets there at all – but there’s a global push for energy solutions that can’t be ignored and one ASX company is leading the way to production in Mauritania.

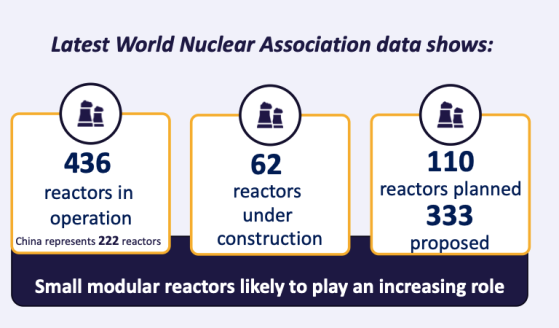

Nuclear energy is essential for global economic decarbonisation. However, according to the World Nuclear Association, there will be a supply deficit of between 119 million and 242 million pounds per annum by 2040.

The growing deficit has been kind to the spot price of uranium, which is up over 90% in the past 12 months.

To combat the deficit, the World Nuclear Association believes small modular reactors will play an increasing role.

Around the world, nuclear is expected to work hand in hand with renewable to create a decarbonisation solution that could bring down escalating electricity prices.

International Energy Agency (IEA) executive director Faith Birol said: “The power sector currently produces more CO2 emissions than any other in the world economy, so it is encouraging that the rapid growth of renewables and a steady expansion of nuclear power are together on course to match all the increase in global electricity demand over the next three years.”

Meanwhile, French nuclear reactors are making a comeback after producing their lowest output in 30 years in 2022. Japan has restarted reactors cautiously putting aside the post-Fukishima fear. Further to this China, India and South Korea have ramped up commercial operations of reactors.

In the past decade, China has added more than 34 gigawatts (GW) of nuclear power capacity, bringing the country's number of operating nuclear reactors to 55, with a total net capacity of 53.2 GW as of April 2024. Additionally, 23 reactors are currently under construction in China.

In contrast, the United States, which has the largest nuclear fleet with 94 reactors, took nearly 40 years to achieve the same nuclear power capacity that China added in just 10 years.

According to the IEA, global nuclear generation will be nearly 10% higher in 2026 compared with 2023 and nuclear power generation could reach an all-time high in 2025. Nuclear power generation is projected to increase by 3.5% in 2025, surpassing 2,900 terawatt hours of electricity worldwide. For 2024, the agency forecasts a growth rate of 1.6%, amounting to approximately 2,800 terawatt hours.

Australia behind the 8 ball but ASX companies in the mix

Near-term uranium producer Aura Energy has focused on clean energy since 2006.

Its primary focus is near-term production at the Tiris Uranium Project in Mauritania, with a secondary focus on the Häggån Polymetallic Project in Sweden, which has a globally significant 2.5 billion tonnes deposit that contains more than 800 million pounds of uranium.

Just recently the Mauritanian Government signed off on the last outstanding permit for the Tiris Uranium Project.

This crucial approval, issued by the National Authority for Radiation Protection, Safety and Nuclear Security (ARSN), allows AEE to start development and production.

The project requires a US$230 million investment, with Aura Energy already engaging with banks and strategic investors. Of interest to them is the recent 55% increase in the mine resource to 91 million pounds of contained resources offers significant potential for future expansion beyond the initially planned 2 million pounds of uranium per year.

So let’s dig deeper into Aura’s key project.

Tiris stands out

Tiris stands out as a near-term uranium producer with impressive economic metrics. The project boasts a post-tax Net Present Value (NPV) of US$388 million and an Internal Rate of Return (IRR) of 36%, coupled with a quick payback period of just 2.5 years.

Mining at Tiris is straightforward and low-risk, involving shallow, free-digging operations that do not require blasting, crushing or grinding. This simplicity is matched by the project's high-grade leach feed, which averages around 2,000 parts per million (ppm) of uranium oxide (U3O8).

Furthermore, the resource at Tiris shows significant growth potential, extending beyond the current estimate of 91.3 million pounds of U3O8. The production capacity is notable as well, with an expected annual output of approximately 2 million pounds of U3O8 over a 17-year period, with room for expansion.

The project also enjoys a regional-scale position within a newly emerging uranium province, indicating its strategic importance and potential for future development.

Essentially this is a low-cost, long-life, near-term uranium production project with exceptional growth opportunities.

The company expects to be in production by 2026/27, with a Final Investment Decision (FID) slated for 2025.

Growing interest

Aura has attracted significant interest from highly credentialled debt providers and strategic investors who recognise the substantial future value of its projects. The company stated that its funding process aimed to secure the optimal financing package, reduce risks associated with the development of its Tiris Uranium Project, optimise equity requirements and maximise shareholder value.

Orimco, which has extensive experience in arranging bespoke debt programs for West African resource projects, brings valuable exposure to a wide range of commodities, projects, and locations, including Mauritania.

Macquarie Group will assist in managing the strategic process. Its role will complement that of Aura's debt adviser, Orimco, with the objective of achieving an integrated funding solution for the Tiris project.

Producing in Mauritania

Northern Mauritania has become a new uranium province.

Tiris is in the Tiris Zemmour region of Mauritania, 680 kilometres from Zouerat and 1,400 kilometres from the capital city, Nouakchott.

The Eastern Tiris Resources areas can be seen below:

Aura has taken a strategic position in this emerging province with 13,000 square kilometres of new tenement applications submitted.

There is significant resource growth potential both on leases and within new applications. The company has undertaken a conventional truck and shovel operation, it has multiple open pits giving it flexibility to access ore and backfills directly into the pits, meaning there is no significant waste dumps.

As for beneficiation, the company is using a simple, proven method that allows an ongoing grade advantage:

Häggån Polymetallic Project

Also up its sleeve is the Häggån Polymetallic Project, which provides Aura with diversification in the future-facing minerals space.

This is a globally significant project, with bonus uranium potential, particularly after Sweden’s Climate Minister, Romina Pourmokhtari created an inquiry to abolish the current ban on uranium mining.

The project offers long life, optionality and scalability. The scoping study shows positive metrics including:

While Tiris provides the company with its main focus, Häggån provides a strong secondary project with excellent upside.

A company with leverage

Aura Energy is committed to supporting global efforts to decarbonise energy production. The company recognises the increasing demand for low-carbon baseload power amidst supply constraints, necessitating affordable energy solutions and security. Two key projects, Tiris and Häggån, are central to this mission.

Together, the Tiris and Häggån boast a combined mineral resource of 891 million pounds of U3O8.

Aura Energy holds a strategic position in an emerging uranium province, providing excellent leverage to the uranium price.

Read more on Proactive Investors AU