Highfield Resources Ltd (ASX:HFR) has raised A$13 million at an issue price of A$0.62 per share, which represents a 10.1% discount to the last closing price of A$0.69 per share.

The company, which is focused on the construction of its flagship low-cost, low capex Muga Potash Project in Spain, received firm commitments from institutional, sophisticated and professional investors, with the oversubscribed placement gaining strong support from new and existing shareholders, including high-quality institutional investors based domestically and offshore.

Funds will be used to fund continued early work construction activities at the Muga Project, finalise debt funding arrangements and put HFR in a strong position to progress negotiations with strategic investors.

Highfield Resources CEO Ignacio Salazar said: “We are pleased to announce the completion of the placement which was well supported by existing and new institutional investors. We welcome all new shareholders to the company and thank existing shareholders for their ongoing support.

"Representing approximately 6% of our market cap, this placement is minimally dilutive, while providing the company with a strong position to continue to move Muga forward, finalise the project financing and negotiate with strategic investors.”

About the Muga Potash Project

Muga has shallow mineralisation and no aquifers above it, which removes the need to build a shaft.

There is quality and readily accessible infrastructure already in place in the region, and importantly, Muga lies at the heart of a European agricultural region which has a clear deficit in potash supply.

In addition to its secure southern European location, the company believes recent events in Russia and Belarus have increased the awareness of the strategic value of the Muga Mine for Spain and the European Union.

After receiving the construction licence for the mine gate and declines in June 2022, HFR started construction at the Muga mine site at the end of June 2022.

About the placement

HFR will issue 21.6 million new shares, allotted in a single tranche on Friday, December 16, 2022.

The placement price of A$0.62 per share represents a discount of:

- 10.1% to Highfield’s last closing price of A$0.69 per share on December 7, 2022;

- 13.2% to Highfield’s 5-day VWAP of A$0.714 per share; and

- 15.0% to Highfield’s 10-day VWAP of A$0.729 per share.

Participants will also be allocated one unlisted free attaching option for every two new shares received in the offer, with a A$0.93 exercise price and an exercise date 18 months from issue.

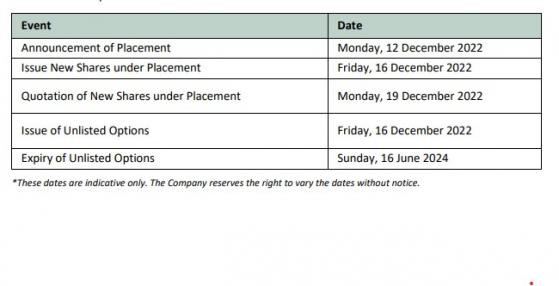

Indicative timetable

Read more on Proactive Investors AU