Helix Resources Ltd (ASX:HLX) has unearthed new high-grade copper hits ahead of a resource update at the Canbelego joint venture project in central New South Wales.

Together with exploration partner Aeris Resources Ltd (ASX:AIS), which holds a 30% stake in the battery metal camp, Helix is advancing a comprehensive reverse circulation (RC) and diamond drilling campaign, designed to add ounces to a shallow, historical resource estimate.

Recent exploration over the Upper Canbelego Main Lode intersected as much as 1.44% copper from 158 metres while drilling at the Lower Main Lode hit up to 10.95% from 605.5 metres. The Western Lode is also a point of interest thanks to a 1.83% copper reading.

With fresh results at hand, Helix and Aeris plan to pause their drilling campaign once the current hole is complete, paving the way for a mineral resource estimate in 2023’s June quarter.

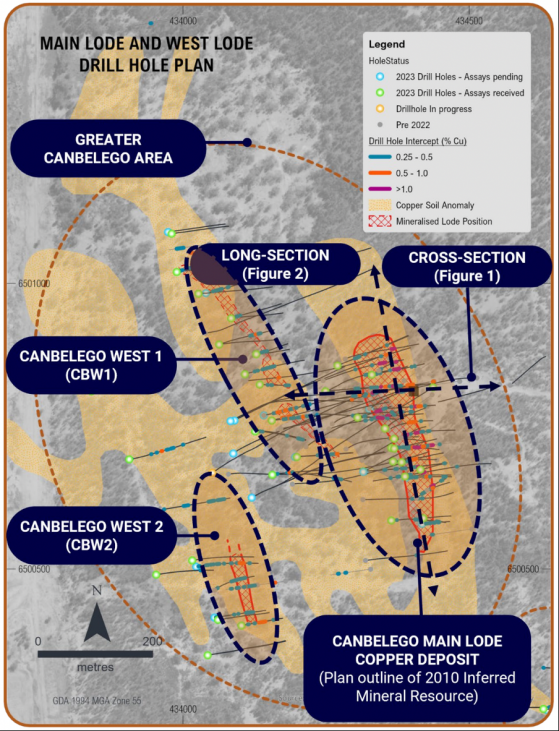

Copper lodes at Canbelego.

Modernising historical resource

Helix managing director Mike Rosenstreich said aggressive drilling at Canbelego had been a priority over the last 18 months.

“To date, we have completed more than 8,300 metres of diamond core and approximately 6,400 metres of RC drilling, comprising more than 70 drill holes,” he outlined.

“This was the first work at Canbelego since 2013, and the current inferred mineral resource estimate of 1.5 million tonnes at 1.2% copper was completed more than 12 years ago.

“With recent significant drilling now completed, it is now the right time to take stock with an updated mineral resource.”

Technical consulting group MEC Mining has been engaged to update the resource estimate, with an initial data review and site visit already completed.

Of course, the release is heavily dependent on assay turnaround times, but Helix says waiting periods are improving, paving the way for a June quarter release.

Exploring Canbelego

Helix and Aeris have boots on the ground at Canbelego as part of a 70-30 joint venture, in which Helix owns a majority stake and is the project manager.

Both parties are looking for upside along the Rochford Trend — a structure that could host ‘Cobar-style’ copper deposits similar to the large-scale, high-grade CSA copper mine.

Recent drilling activity covered three areas of interest: Canbelego’s Upper, Lower and Western lodes. Some of the highlights from each prospect include:

Upper Canbelego Main Lode:

- 11 metres at 0.66% copper from 155 metres, including 4 metres at 1.44% copper from 158 metres; and

- 8 metres at 2.83% from 169 metres, including 5 metres at 4.23% from 172 metres.

Lower Canbelego Main Lode:

- 3.1 metres at 2.19% from 373 metres, including 1.1 metres at 4.73% from 375 metres; and

- 5 metres at 3.59% from 603 metres, including 1.5 metres at 10.95% from 605.5 metres.

Western Lode:

- 8 metres at 1.25% from 330 metres, including 4 metres at 1.83% from 330 metres.

The latest assays point to copper extensions in some highly conductive shoot targets, with copper sulphides intersected some 150 metres up-plunge of earlier intersections.

“Our work has identified high-grade copper zones both within the outline of the shallow 2010 resource estimate and high-grade shoots continuing for at least 300 to 400 metres below the base of that resource outline,” Rosenstreich explained.

The MD said he was looking forward to providing investors with an updated resource in the coming months.

“I am confident that we should realise a more robust estimate in terms of the resource classification and increased contained copper tonnes given the clear extensions to the mineralisation which have been identified and the higher-grade copper zones delineated,” he concluded.

Read more on Proactive Investors AU