Helix Resources Ltd (ASX:HLX) has outlined “excellent potential” to deliver copper results and drive shareholder value, banking on its rigorous exploration program spanning across the company’s highly prospective exploration package in rich mineral belts in New South Wales, according to Independent Investment Research

The tenements cover units of the Cobar Basin and Girilambone Group, which are highly prospective for Cobar-style structurally controlled and Besshi-style volcanic-associated massive sulphide (VAMS) mineralisation, with copper being the main target metal.

Following the recent delivery of an updated Mineral Resource Estimate (MRE) for the Canbelego Copper Deposit and improved ground access following the end of unseasonable weather, Helix is now concentrating activities on defining and testing additional priority targets over its 2,879 square-kilometre highly prospective exploration tenement package.

In the future landscape, market fundamentals appear favourable for copper, positioning Helix in a strong position to contribute to the country’s decarbonisation efforts.

Read: Helix Resources steps up regional quest for more copper in central NSW

Key strengths

According to the analyst, the key strengths of Helix are:

- Highly prospective holdings in a proven mineral district: The western areas of Paleozoic geology in New South Wales are highly productive for base and precious metals – this includes the Early to Middle Ordovician Girilambone Group and Silurian to Devonian Cobar Basin, geological provinces where Helix is exploring.

- Region continues to deliver: The prospectivity has been confirmed by a string of discoveries over recent years - persistence pays off.

- Under-explored: Significant areas of Helix’s tenement package are under-explored, with only limited early-stage work being completed away from the main prospects.

- Experienced people: Company personnel have significant experience in the resources sector, with a history of exploration success and delivering value to shareholders.

- Well-developed infrastructure: All company projects are located in areas of well-developed transport and utility infrastructure, and with readily available experienced labour and services.

- Strong outlook for copper: Market fundamentals look good for copper going forward, with it being one of the necessary metals for the “decarbonising” economy.

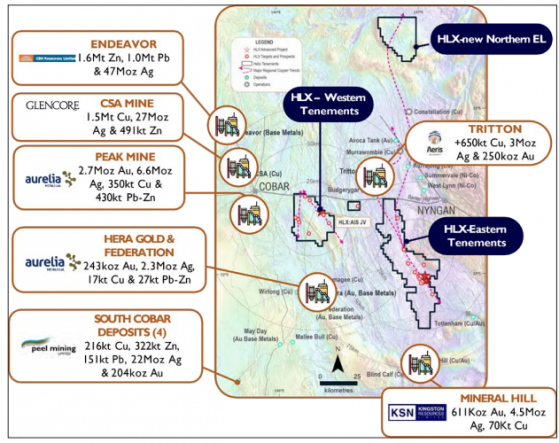

Helix’s main focus is on copper exploration in the Cobar region of Central Western New South Wales, where it holds 2,879 square kilometres of tenure.

The exploration tenements are situated in three groups over highly prospective ground in a region that hosts several operating bases and precious metal mines, as well as several more recent discoveries.

Work by the company has already delineated numerous prospects, as well as the Canbelego copper deposit.

Although the focus is on copper, there are areas of proven gold mineralisation that require further work, including Battery Tank, and to a lesser extent Muriel Tank.

Tenement location and regional deposits

Forward plan

With A$5.89 million in the bank and no debt, Helix is well funded to pursue the planned exploration activities, which will now concentrate largely on regional work, and the initial drill testing of targets defined from this work.

Other work will include the ongoing review and integration of historic exploration data over all areas, including the northern tenement.

In addition, Helix has a comprehensive exploration plan for the Aeris JV tenement (Canbelego) for FY24 - Aeris has elected not to contribute, and hence Helix will solely fund activities and dilute Aeris.

Activities will be targeted at adding additional tonnes to the current resource base, including through further drilling of the known mineralisation, and testing other targets on the property.

Helix also plans to undertake a high-level preliminary economic assessment of the deposit, with this including early-stage metallurgical test work on the different mineralisation types, as well as assessing different treatment options given the existing plants in the region.

Read more on Proactive Investors AU