Helix Resources Ltd (ASX:HLX) has taken significant strides forward in its exploration strategy banking on a robust updated mineral resource estimate (MRE) for the Canbelego Copper Deposit, standing at 1.83 million tonnes, containing 1.74% copper, as highlighted in the research report by Independent Investment Research.

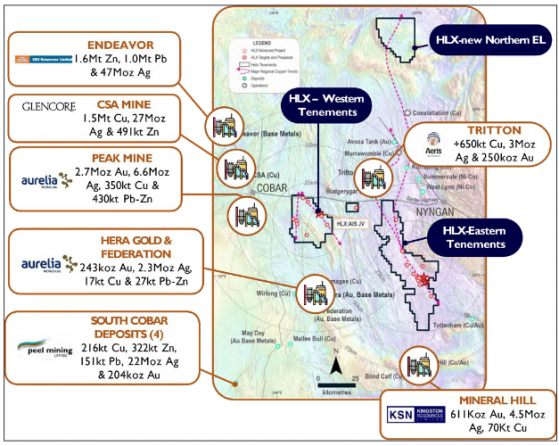

With improved ground accessibility post unseasonable weather, the company is channelling its resources towards identifying and rigorously testing additional priority targets across its vast exploration tenement in Central West NSW, spanning an impressive 2,879 square kilometres.

The regions under exploration, particularly the Cobar Basin and Girilambone Group, are highly prospective for Cobar-style structurally controlled and Besshi-style volcanic associated massive sulphide (VAMS) mineralisation, with a primary focus on copper.

Comprehensive – Scientific – Extensive

Led by a team of veteran explorers, Helix's approach is comprehensive, scientifically rigorous, and poised to cover over 150 kilometres of prospective mineralised trends within the largely underexplored tenement package.

The team has employed advanced techniques such as EM geophysical surveying and geochemical sampling.

These efforts have led to the identification of numerous high-priority prospects that necessitate further investigation, including drilling.

This region houses several major deposits, including the acclaimed CSA mine and the Tritton operations managed by Aeris Resources.

Tenement location and regional deposits

Beyond Copper

Beyond its concentrated efforts on copper, Helix has also set sights on laterite-hosted Nickel-cobalt -PGE mineralisation.

This includes the recently procured Homeville deposit, which boasts 17.9 million tonnes at a grading of 0.89% nickel and 0.06% cobalt, marking it as one of Australia's highest-grade deposits.

In line with this diversification, Helix, contingent upon market conditions, is considering the launch of a Special Purpose Vehicle (SPV), Ionick Metals Limited , dedicated to nickel-cobalt projects, while Helix will stay focused on copper-gold ventures.

The rewards, as seen from recent discoveries like Mallee Bull, Dominion, Federation, and Constellation, underline the immense potential Central West NSW holds.

The presence of six processing mills in the vicinity suggests a potential for consolidation through mergers and acquisitions.

Helix/Ionick project profiles

Forward plan

Helix has a clear vision for the upcoming fiscal year, intending to expand its resource inventory and delve deeper into development potential.

This includes extensive regional work and testing targets informed by prior explorations.

An interesting development is the decision by Aeris not to partake in the forthcoming program, leading to its equity dilution from the current 30% stake in the Canbelego tenement.

In a nutshell, Helix is positioned with a prime exploration package in a mineral-rich belt. The resources identified so far equate to 32,000 t of copper, and there's a prevailing sentiment that with continued methodical exploration.

Read more on Proactive Investors AU